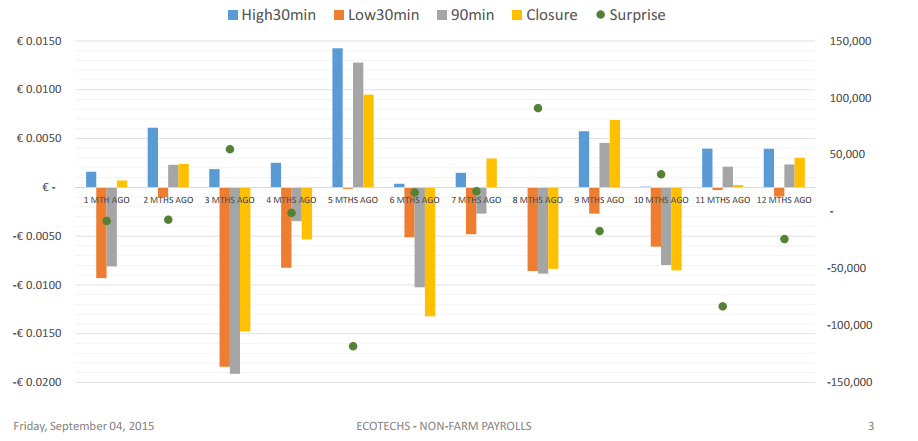

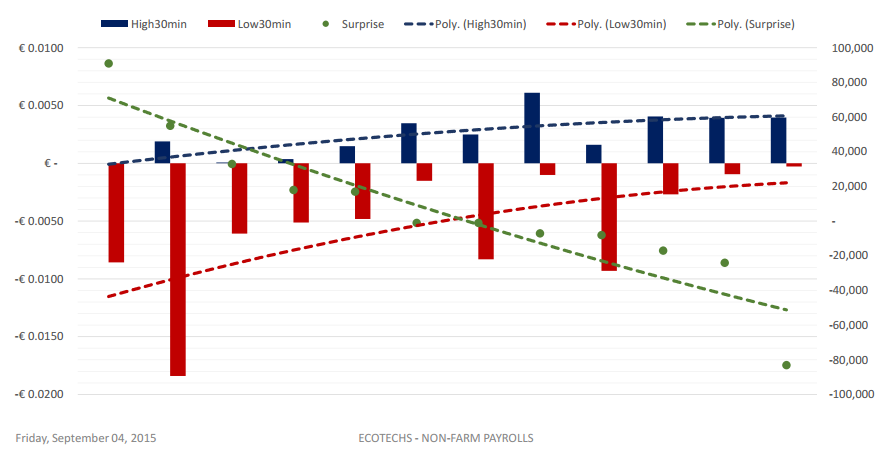

Graph 2 sets out the surprise element and EURUSD impact over the first 30 minutes – both as High and Low – in pips terms from the EURUSD price at the time of NFP release.

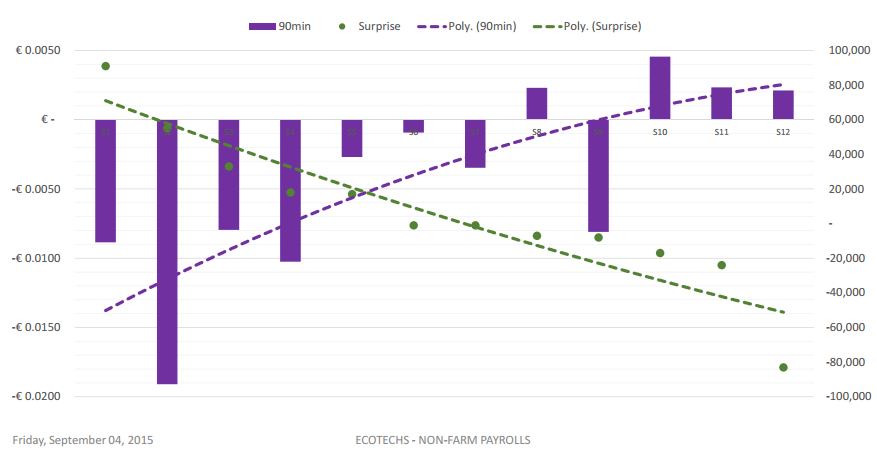

Graph 3 sets out the surprise element and EURUSD impact over the first 90 minutes – as a net move – in pips terms from the EURUSD price at the time of NFP release.

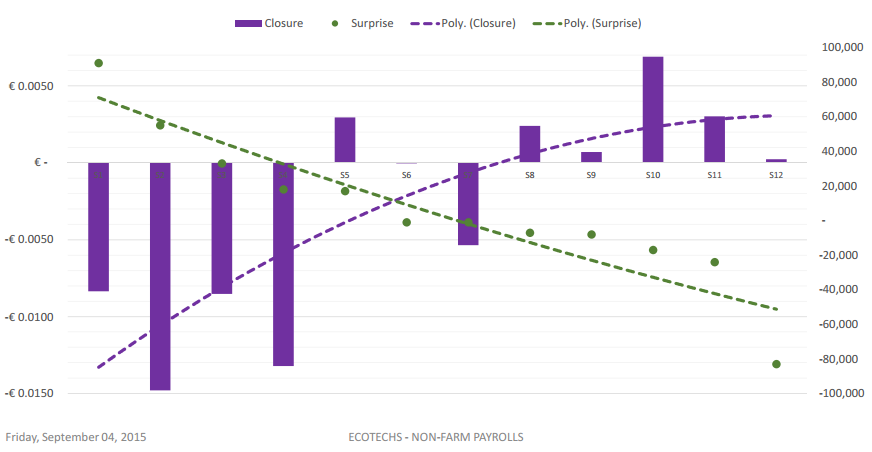

Graph 4 sets out the surprise element and EURUSD impact by the end of the day – as a net move – in pips terms from the EURUSD price at the time of NFP release.

Surprise is defined as the difference between the Actual release and Consensus Estimate.

Trading US Non-Farm Payrolls

From the last 12 observations there were more releases with a positive surprise element than a negative and the surprise element was also in general higher when positive than negative.The overall picture illustrate what one would expect – that a positive surprise element is EURUSD negative and a negative surprise element is EURUSD positive.

What the observations also show is that the EURUSD impact to the downside was bigger from a positive surprise element than the EURUSD impact to the upside from a negative surprise element. I would not necessarily put too much weight to this conclusion as it is only based on 12 observation.

There is rather little to gain from trading the NFP release after the first 30 minutes as the net impact as per 90 minutes tend to be not wider than either the High or Low seen over the first 30 minutes.

These 12 observations also show that there is little to gain from trading or holding on to EURUSD positions entered into upon release and until the end of the day, as these observations show that the price tend to correct a bit from the High or Low seen over the first 30 minutes. That having been said – by extending the number of observations to our full data base (going back to the start of 2010), there are releases throughout that period where the EURUSD impact seen at the end of the day has been wider than that seen over the first 30 minutes. As such - the release had a sustainable impact on EURUSD. This was particularly the case during the period when a series of disappointing NFP releases were replaced with a series of positive releases.

As there are more employment data released at the same time, those can also influence the observations for EURUSD impact.

Trading US Non- Trading US Non-Farm Payrolls September 4th, 2015

Without such orders in place and with clear direction for EURUSD from a big surprise element, it is a matter of getting in early on the move. I measure this in pips terms and not in time.Over the first 30 minutes I do as follows:

1. Should the surprise element be < +/- 25K, I seldom do anything as I would expect EURUSD not to move more than 40 pips. It might do but the number of observations in our research material tell me that this is not with a high enough probability.

2. Should the surprise element be +/- 25K to +/- 50K, I would want to enter within the first 25 pips of the move and exit for 40-70 pips.

3. Should the surprise element be +/- 50K to +/- 100K, I would want to enter within the first 30 pips of the move and exit for 70-100 pips.

4. Should the surprise element be more than + 100K, then I likely trade as under 3) as I see parts of the figure to be a correction to the month before. Should – on the other hand – the surprise element be more than 100K down, then the whole question about USD interest rate increases this year is up for question. We could get more of massive USD long positions being unfolded and the impact on EURUSD could be much more. I would then likely reflect a couple of seconds, try to get in within the first 35-40 pips of the move and sit with this position for a wider impact over sessions to come.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.