FTSE - a tale of two trend lines

The FTSE has been one of the better performing indices in the latest run up but having broken key resistance at 6130-50 last week it failed to hold above this area. Monday will see two important trend lines come together around the 6115-20 area. One marks the lower highs from the past two weeks and the other is the steep up trend from the most recent lows. If we break below this area on Monday and hold then shorts will be favoured with support on the way down at 6065 and 6045-50. A further break below here will target the gap close at 6000.I would only want to be long if we see a daily close above the 6150 area, and even then stops should be tight at 6120.

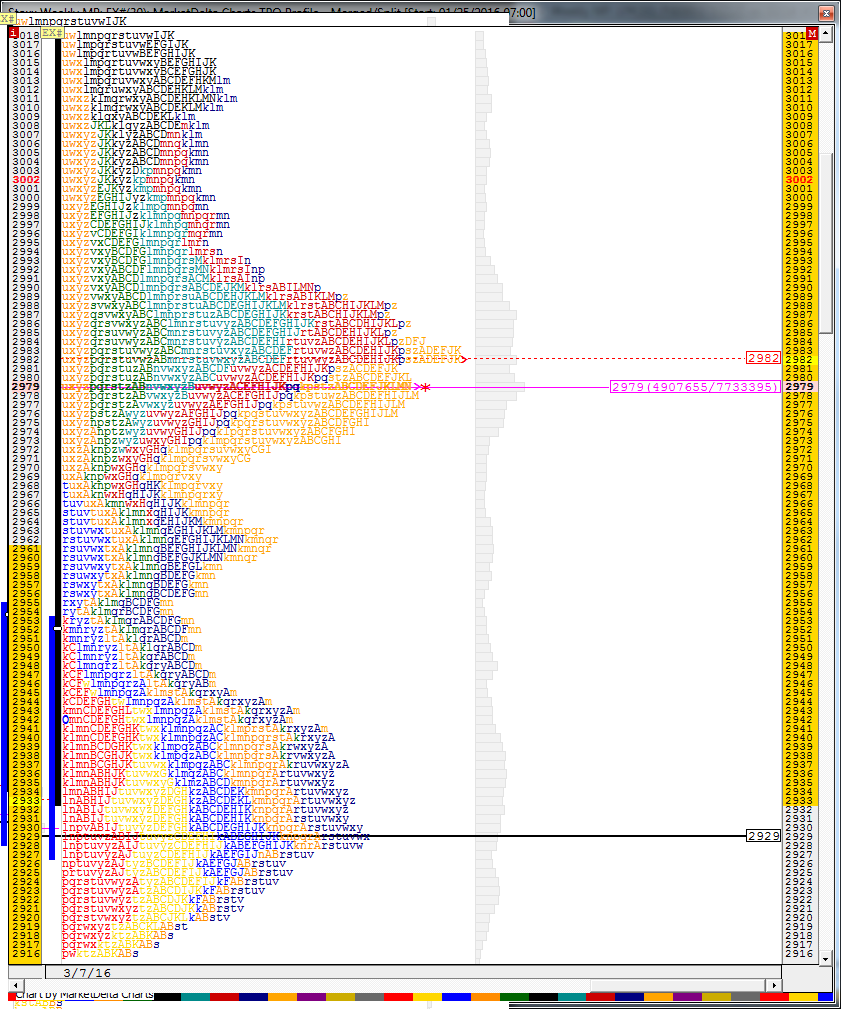

Eurostoxx in acceptance zone

This Stoxx chart shows the last two weeks of trading merged together. You can see it closed right on the VPOC of this balance zone which is right in the most accepted area. For a bullish bias I think we need to see prices trade back above 2995. Then I would expect another run towards the most recent highs. If we stay below this area though I wouldn't be surprised to see lower prices this week with the LVN/midpoint at 2952/5 the key target below. Once through here 2929 becomes the next key objective. Some filling out of this range may be required this week before the market decides where the next big move is going.

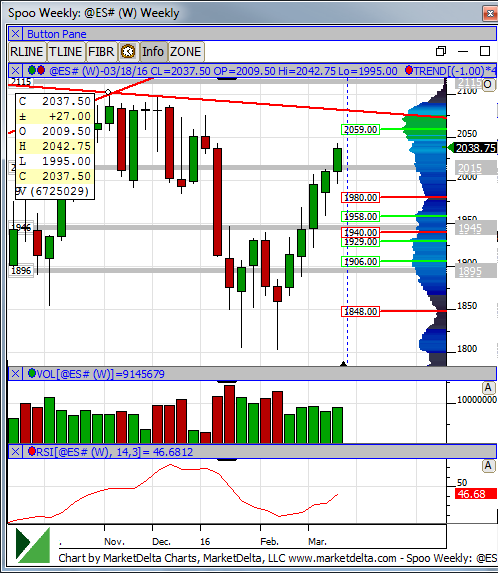

Spoo weekly still 1 time framing

The weekly Spoo chart underlines just how strong this most recent rally has been from the lows and we are now into the 5th week of 1 time framing. For now important overhead resistance lies at the trend line around 2070. Until that is broken and we get a close above there I would have to err on the side of caution for longs now as this move seems to be getting a little long in the tooth. So long as we remain above 2000 this week may be a range play but any break below here and we should see plenty of weak longs start to run for the hills with 1955 the key target below.

.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.