The risk appetite rebound which started during yesterday US session could be extended into the Asian session with lower USD/CNY exchange rate fix at 6.563, after yesterday closing at 6.5756, after Dec Chinese Trade Balance has shown $60.9b surplus, while the market was waiting for $53b, after $54.1b in November.

Shanghai composite could have a higher place above 3000 trading currently near 3050, while Nikkei 225 could gain back more than 450 points with USDJPY ability to maintain a place above 118, after massive falling in the beginning of the week to 116.67.

The investors have been encouraged by final rebound of WTI from trading near $30 to be trading current below but close to $31, with lower demand for safe haven sent the gold lower to be trading close to $1085 per ounce.

The cable could attract the Forex market attention by rebounding to 1.4450 level, after falling to 1.435 undermined by monthly retreating of Nov UK industrial productions by 0.7% and also monthly decreasing of UK manufacturing productions in November by 0.4%.

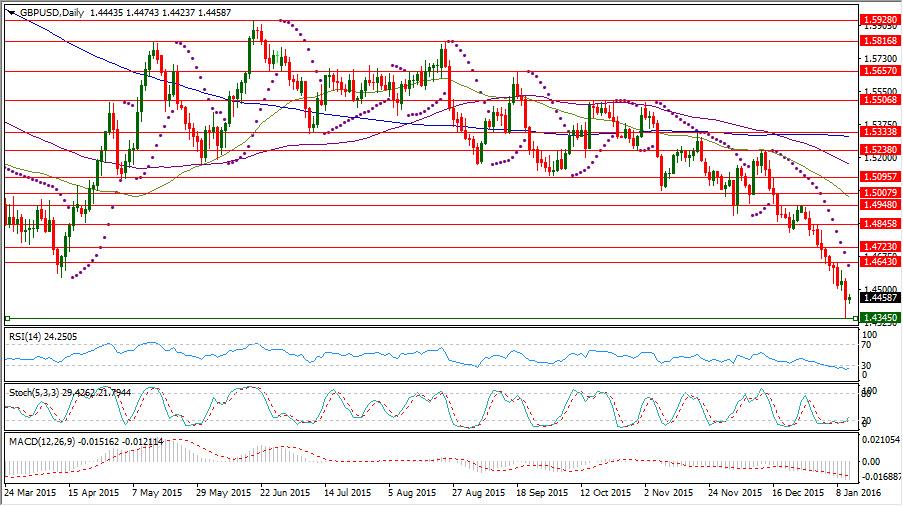

Instrument in Focus: GBPUSD

The cable falling yesterday below 1.45 could gather more interests in selling stopping buying loss to lead it to reach 1.4350, before rebounding keeping June 2010 supporting level at 1.4345 unbroken until now.

After rebounding for trading now near 1.445, The cable daily RSI is referring to continued existence in its oversold area below 30 reading now 24.261, while its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in the neutral region coming up from its oversold area below 20 reading 29.426 and also its signal line which is reading now 21.794.

After forming a series of lower highs and also lower lows, GBPUSD could have extended downside wave from 1.5238 to break its major supporting level at 1.4564 which could hold since last Apr. 13 until last Thursday to watch following this serious break more interests in selling this pair.

Important levels: Daily SMA50 @ 1.4986, Daily SMA100 @ 1.5161 and Daily SMA200 @ 1.5311

S&R:

S1: 1.4345

S2: 1.4257

S3: 1.4228

R1: 1.4643

R2: 1.4723

R3: 1.4845

GBPUSD Daily Chart:

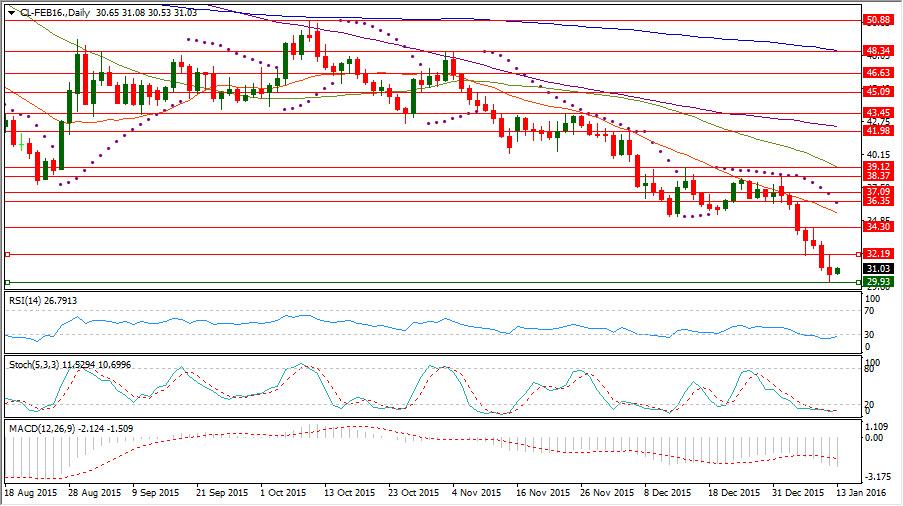

Commodities: CL FEB 16

CL FEB 16 could rebound for trading now close to $31 from yesterday new recorded 12 years low at $29.93 but this rebound could not even drive it out of the parameters oversold area to the neutral area.

CL FEB 16 daily RSI is still referring to existence in its oversold area below 30 reading now 26.791 and also its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having its main line in the oversold region below 20 reading now 11.529 with its signal line which is referring to this same area reading 10.699.

While the market is waiting now for US EIA Oil stockpile of the week ending on Jan. 8, after falling of US EIA Oil stockpile of the week ending on Jan. 1 by 5.085 could not deliver helping hand to the oil prices which shrugged off also the rising tension between Iran and Saudi Arabia which led to forming merely lower high at $38.37 to fall again below its daily SMA20 on doubts about the Chinese economic activity and weaker than expected US manufacturing performance by the end of last year.

Important levels: Daily SMA20 @ $35.43, Daily SMA50 @ $39.11, Daily SMA100 @ $42.39 and Daily SMA200 @ $48.44.

S&R:

S1: $29.93

S2: $29.66

S3: $48.47

R1: $32.19

R2: $34.30

R3: $36.35

CL FEB 16 Daily chart:

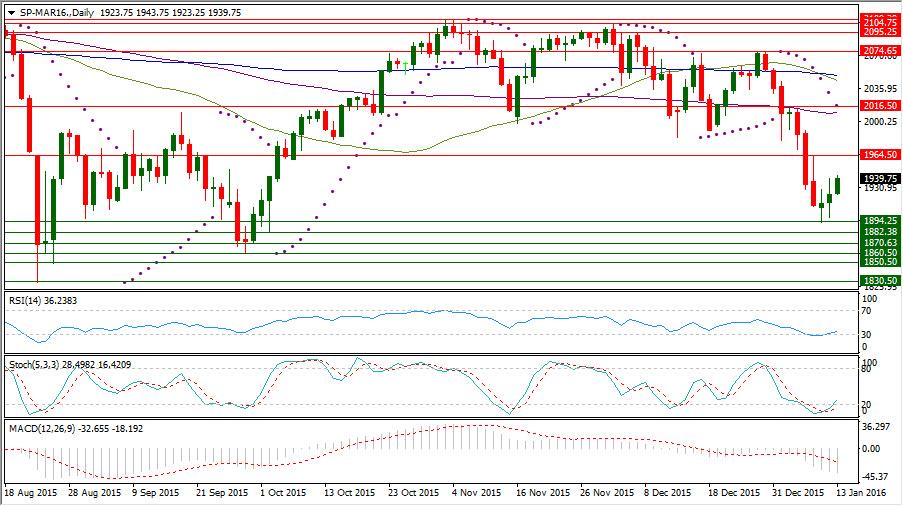

Hot instrument: SP-MAR16

SP-MAR16 could barely fulfill serious need to fix its oversold stance by the rebounding from 1894.25 which could be extended yesterday to 1940 level.

SP-Mar16 daily RSI is referring to existence now in the neutral area coming from its oversold area below 30 reading 36.238 and also its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in the neutral area reading 28.498, while its signal line is still lagged in the oversold region below 20 reading now 16.420.

SP-MAR16 future rate has shrugged off last Friday Dec US labor report bullish release which led to forming only a new lower high at 1964.50, before falling again.

SP-Mar16 has previously formed a lower high at 2074.65 on Dec. 30, after facing difficulty several times to keep a place above 2100 to be exposed to downside extension, after failing to return above its daily SMA100 forming resistance at 2016.50.

Important levels: Daily SMA50 @ 2044.07, Daily SMA100 @ 2010.14 and Daily SMA200 @ 2050.01

S&R:

S1: 1894.25

S2: 1882.38

S3: 1870.63

R1: 1964.50

R2: 2016.50

R3: 2074.65

SP-MAR16 Daily chart:

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.