Crude

The front-month contract on Brent settled little changed yesterday even though the oil price was seen in sight of 55 USD/bbl during the most of the session. Later in the evening, comments of a spokeswoman of the US State Dept indicated that the odds that a deal between world powers and Iran on its nuclear programme would be reached were about 50:50. The deadline for a conclusion of talks is today.

As we already pointed out last week, we think that the talks pose more downside risk for oil price than is the upside risk stemming from Saudi Arabia’s air strikes in Yemen. Let us recall that if the agreement was reached, the oil market would have to cope with as much as 1 million barrels per day of oil than now (more realistic estimates however talk about a half of that volume). The probability that the sanctions will be lifted all at once is, however, low. More likely scenario therefore is a gradual removal of import bans in case the deal was reached.

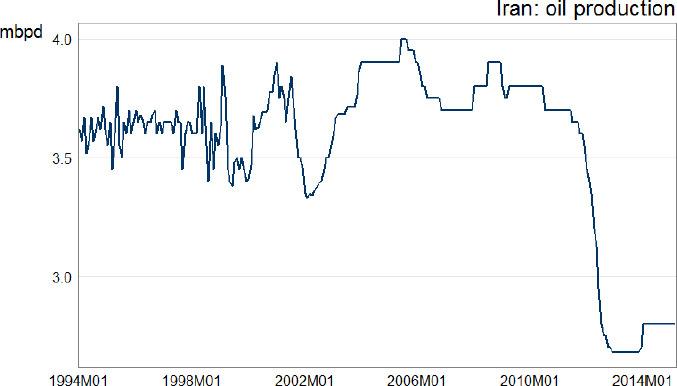

In any case, due to the western sanctions on imports of oil from Iran, the country’s production fell deep below 3 million barrels per day (see the chart below).

Metals

Despite briefly trading above 1300 USD/toz in the end of January, the price of gold is set to decline in the third consecutive quarter. The decline was supported by low global inflation as well as by a sharp appreciation of the US dollar in the first quarter (+ 8.5% against the basket of currencies) which has been driven by expectations of rising official interest rates in the US. Renewed worries about Greek economy and a launch of quantitative easing by the ECB however spurred the gold price in terms of euro which has been the highest in about two years.

Chart of the day:

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.