The Bond Charts that Matter

Bund Yields HoldingLower

Last week the Bunds postedan inside candle on the yield chart and are slowly creeping back down to the13.4bp mark from 2 weeks ago that we made in a sharp euphoric move as risk offsentiment grasped the markets. The key area to keep an eye on if we breach thislevel is the all-time low yield in Bunds at the 4.9bp mark. To the upside, wehave found resistance at the 29.4bp mark which is a key area ahead of theall-important 42.4 bp level that we breached at the end of last month.

Portuguese BondsTrading Within Inside Week

A very key market to keepan eye out for risk-sentiment is the Portuguese bond market which took a veryswift and aggressive shoot up in yields (down in price) during the bout ofvolatility 2 weeks ago. During this move we actually went through the inverseHead and Shoulders target to the upside and last week we left an insidecandle with low in yield at 3.127% and high at 3.559%. A breach of thelevel to the upside with continuation could spark some more risk off sentimentand widening of core-periphery spreads.

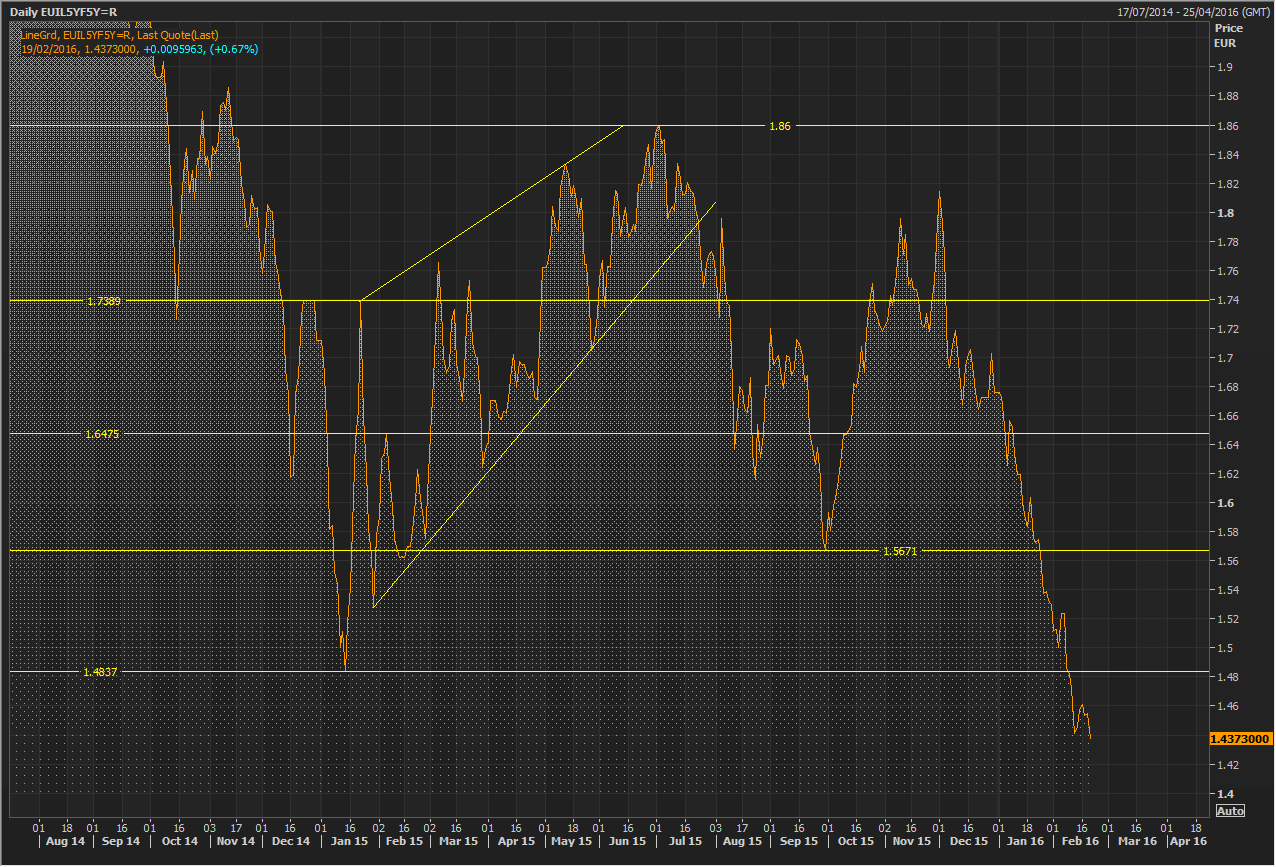

5y5y InflationSwaps Breaking Lower Aggressively

One of the ECB's preferredmeasures of inflation expectations in the medium term has been plumetting withno end in sight since the beginning of 2016. This is an occurance that willsurely be occupying the ECB's discussions on the Governing Council as the lastthing they want is for the market to believe the economy is falling into adeflationary spiral. This is a market to watch as ECB members could begin toget very vocal ahead of the March meeting in the scenario that it continues tofall this rapidly..

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.