The Euro eventually attacked key 1.1374 barrier (11Feb high), on fresh rally that commenced from 1.1300 zone, where corrective pullback was contained and hourly higher base formed.

The pair maintains firm bullish tone on all time frames and favors further upside.

Sustained break above 1.1374 breakpoint is needed to confirm bullish resumption of the uptrend from 1.0519 (03 Dec low) and recent rally that emerged after massive downside rejection at 1.0820, where double-bottom was left.

The pair is on track for the fourth consecutive bullish daily close and bullish monthly close that signals the strongest monthly gains since April 2015.

Former peak at 1.1341 is now reverted to immediate support, followed by more significant 1.1300 zone higher base and rising 5 / 10SMA’s that formed bull-cross at 1.1236 and underpin the action.

The pair so far ignores overbought conditions of Slow Stochastic, but hesitation at 1.1374 breakpoint cannot be ruled out.

Res: 1.1400; 1.1430; 1.1465; 1.1495

Sup: 1.1341; 1.1300; 1.1280; 1.1236

GBPUSD

Cable is at the back foot, following yesterday’s upside rejection at 1.4457 and subsequent reversal that left Doji candle with long upper shadow.

However, today’s action is so far shaped in long-legged Doji, signaling indecision and sidelining immediate downside risk, as pullback was so far contained above pivotal 1.43 support (Fibo 38.2% of 1.4056/1.4457 upleg.

Setup of daily MA’s remains bullish, while daily indicators hold in neutrality zone and conflicting technicals suggest prolonged directionless mode.

Session high at 1.4393 marks initial resistance, ahead of yesterday’s upside rejection at 1.4457 and trendline resistance at 1.4475, which guard key barrier at 1.4512 (18 Mar peak).

On the downside, hourly higher base at 1.4324 marks immediate support, followed by 1.4300 and daily Ichimoku cloud base at 1.4238.

Res: 1.4393; 1.4457; 1.4475; 1.4512

Sup: 1.4324; 1.4300; 1.4256; 1.4238

USDJPY

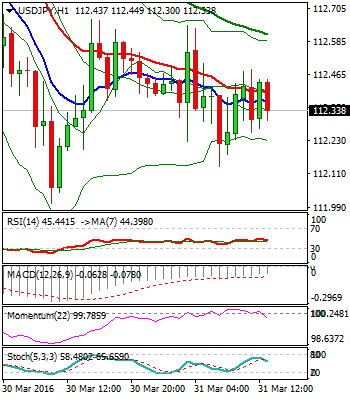

The pair remains pressure, following yesterday’s repeated close in red after recovery stall at 113.79. Pullback has so far found footstep at 112 handle, with near-term price action holding within 65-pips consolidation.

Bearish tone prevails on all timeframes, with daily ma’s being back to full bearish setup. This maintains downside risk, which sees increased pressure towards critical 111 support zone, lower boundary of 5-week congestion, break of which to signal resumption of larger downtrend from 125.84 05 June 2015 peak).

Only sustained break above 112.88 (30SMA), would sideline downside risk.

Res: 112.64; 112.88; 113.10; 113.79

Sup: 112.00; 111.85; 111.00; 110.65

AUDUSD

Aussie maintains positive near-term tone, following three-day rally that cracked former high at 0.7678 and briefly probed above psychological 0.77 barrier.

The pair failed to close above 0.7678 barrier, signaling consolidation, before fresh attempts higher. Pullback was so far contained at 0.7632, where hourly trough is forming, with lift above yesterday’s high at 0.7706, needed to signal bullish resumption.

Firm bullish setup of daily technicals supports further upside action, which may be delayed by overbought Slow Stochastic conditions, which so far did not generate negative signal.

Session low at 0.7632 marks immediate support, ahead of 0.7589 (10SMA), with extended dips expected to hold above rising 20SMA at 0.7543, which guards daily higher base and breakpoint at 0.7475.

Res: 0.7685; 0.7706; 0.7750; 0.7810

Sup: 0.7632; 0.7589; 0.7543; 0.7475

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.