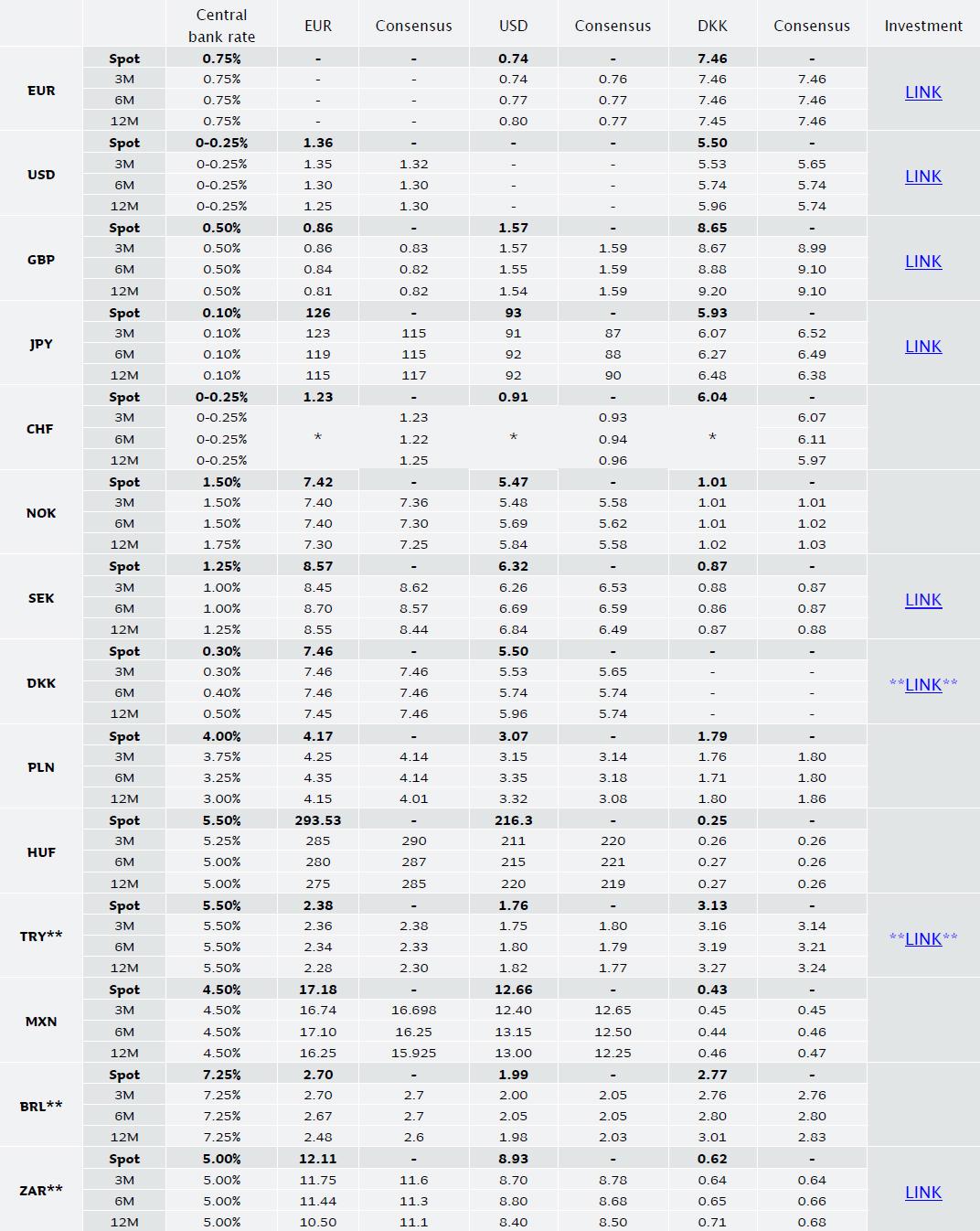

FX forecasts

FX overview

US dollar - USD

We had expected to upgrade our short-term USDDKK 3M price target this February, but a number of circumstances which are positive for the euro made us maintain all price targets. After having hit our 3M price target, all price targets are now pointing to a strengthening of the dollar. This is, among other things, due to the following:

-

A further 5% strengthening of the euro will bring the euro to the strongest trade-weighted level since the financial crisis. The exchange-rate development is a serious growth problem and may contribute to a revival of the debt crisis.

-

We anticipate solid growth divergence between the US and Europe. QE3 is expected to be withdrawn at end-2013. If we are right, the market will already in H2 2013 turn around to a strengthening of the dollar.

-

Debt and loans: The national debt will continue to increase in Europe in 2013, and the banks are and will continue to be hesitant granting new loans to private individuals and businesses. This will put a damper on growth.

Fundamental valuation Investment case

-

Monetary policy: The Fed rate is 0-0.25%.

-

Every month, the Fed buys government and mortgage bonds worth USD 85bn (expiry has not been determined).

-

The ECB allows repayment of the so-called LTROs. Hence, the ECB’s balance sheet is on the decline whereas those of the US and Japan are sharply increasing. This monetary policy divergence is positive for the euro.

-

Fiscal policy: The Americans have succeeded in delaying the debt ceiling to end-May where a long-term fiscal policy tightening plan will also be announced.

-

Economic growth: In 2013, we expect to see economic growth of 2.4% in the US compared with 0.5% in Europe.

-

Global economic indicators have stabilised – Europe is only stabilising now.

-

Purchasing Power Parity: EURUSD 121.10.

Price triggers

-

The US: Debt ceiling negotiations and negotiations about a fiscalpolicy recovery plan reaches a deadlock in May. USD strengthens.

-

Increasing inflation in the US.

-

Europe: The debt crisis escalates. Greece exits the euro.

-

The negative credit spiral deteriorates and hampers growth and credits in Europe, especially in the Eastern European countries.

-

Additional downgrades of the ratings of European countries.

-

The ECB lowers its interest rate.

-

Global markets: China sees a hard landing (no indications at present). Global economic growth slows down.

Investment case

Last time, we wrote ”…the potential is already 2% lower and in our opinion leaves only a further max. 2%-3%”. After January’s USD depreciation, we have in other words seen the expected weakening – and even more so.

-

Relative monetary policy, safe-haven back flow and the currency war theme are all supportive of the euro. In the short term, the euro may have more potential.

-

0-3M: A number of the elements which should result in a shortterm trend shift have been postponed until later in the year. It may go either way…

-

3-6M: Growth divergence, withdrawal of QE3 ahead and renewed negative focus on Europe which is hit by a too strong currency.

-

6-12M: Growth divergence, end to withdrawal of QE3 and negative focus on Europe which has become a far too strong currency, relative to the development of economic fundamentals.

Risk factors

-

The US: The Fed reduces its monetary policy even further. We do not yet know how far the Fed will go to reach its target.

-

Unhealthy public finances in the US may result in a new downgrade of the US credit rating and eventually a debt crisis.

-

The debt-ceiling problems are not unambiguously positive for the dollar. The US has the potential of its own debt crisis.

-

Europe: The ECB signals further long LTRO allotments.

-

Spain asks for assistance and the ECB makes purchases.

-

Global markets: Higher current-account surpluses in Asia and the Middle East (strong global economic growth) increase the sale of US dollar (not a current issue).

-

Global growth indicators are positive surprises. The fear of recession in the US and the rest of the world is phased out.

Pound sterling - GBP

Due to a disturbing development we downgrade our 3M price target of GBPDKK. In the long term, we maintain that sterling must be stronger relative to the euro. Sterling will depreciate because:

-

The ECB’s participation in the solution of the European crisis has reduced the risk of a euro collapse. The massive demand for safe havens we saw in H2 2012 has gone and will instead return to more risky waters.

-

Money market rates in Europe have increased massively due to the banks’ repayment of ECB liquidity.

-

The UK has got off to a weak start to 2013 and the coming central-bank governor has stated that in future it would be a good idea to shift to a growth target, as opposed to the present inflation target (highly negative for sterling).

The depreciation of sterling was expected, and we assess that in the short term a further depreciation of sterling is in store.

Fundamental valuation

-

Monetary policy: The interest rate of the Bank of England is 0.50%. We do not anticipate any changes in interest rates over the next twelve months.

-

QE is still a weapon in the Bank of England’s arsenal. The coming central-bank governor’s signals about a shift to a growth target indicate further QE (=negative for sterling).

-

Fiscal policy: It is more than difficult for the state to attain its budgetary targets. Despite an AAA rating the UK is slowly losing its safe-haven status.

-

Economic growth: Imminent risk of a triple dip in 2013. High unemployment rate, chronic current-account deficit and inability to profit from a weak currency is strongly alarming.

-

Purchasing Power Parity: Approx. 0.73 EURGBP.

Price triggers

-

The UK: The coming central-bank governor, Mark Carney, backs down concerning his statements on growth targets.

-

The Bank of England refrains from QE and particularly from interest-rate cuts (currently unlikely).

-

Better-than-expected economic indicators in Q1 2013. Analysts have downgraded their expectations rather solidly.

-

Europe: The debt crisis in Europe is not over. Renewed turmoil will strengthen sterling against the euro.

-

Global markets: Slower global growth supports sterling.

Investment case

-

We maintain that the early spring will be the turning point for sterling, but in the short term there will be room for further depreciation of sterling.

-

0-3M: Weak indicators, general strengthening of the euro and uncertainty about the central bank’s targets will weaken sterling.

-

3-6M: We believe in a general turn in investor sentiment in the early spring (like in 2011 and 2012). The shift will be boosted by fiscal cliff concern as well as high prices of risky assets relative to the economic cycle. Through the entire period, there will be a risk of a revival of the European debt crisis, but the timing is difficult.

-

6-12M: Structural problems, debt problems, etc. in Europe overshadow the UK with respect to negative news.

Risk factors

-

The UK: The country remains in recession and the Bank of England cuts interest rates and initiates further QE.

-

Downgrade of the credit rating. Fitch and Moody’s have a negative outlook.

-

The market loses confidence in the economy and the government’s fiscal-policy recovery plan.

-

We expect to see weak economic indicators in Q1 2013.

-

Europe: The debt crisis escalates and sends unexpected waves into the financial system. The UK economy’s exposure to the banking sector is reduced but remains very high.

-

Positioning: Despite massive strengthening of sterling lately investors still hold fairly large positions in sterling.

The Swiss franc – CHF

On 18 January, we published the research report ”CHF: Bottoming out” – read here. The report was published in the wake of a very solid depreciation of the franc. Since then, the franc has stablised. Like last month, we expect that CHFDKK will be trading in the range of 597-621 over the next 12 months (EURCHF 120-125). The franc will remain strong because:

-

The debt crisis in Europe remains unfinished. This may still take a long time.

-

Swiss external balances are supportive of the franc.

-

Liquidity effect in the markets is short-lived. It is doubtful whether the real economy can take over.

A great risk contrary to our expectations is if the market sentiment remains positive. Alone in H2 2012 the SNB’s currency reserve rose by CHF 200bn. Money which has poured in in the search for a safe haven. If the money will out again, the franc may depreciate considerably.

Fundamental valuation

-

Monetary policy: The interest rate in Switzerland is 0.25%. Inflation is low and the currency is strong. We expect no changes.

-

The SNB has determined a minimum price for EURCHF of 120. The market has confidence in SNB. So have we.

-

The Swiss franc is still a ”safe-haven currency”. If the SNB does not succeed in maintaining its minimum rate, the franc will strengthen considerably in a short period of time. 100-110 for EUR/CHF is not unlikely.

-

Economic growth: The Swiss economy is strong relative to that of the euro zone. Unemployment is very low (3.1%) and the current-account surplus is 13%-14% of GDP.

-

Purchasing Power Parity: 1.335 EURCHF.

Price triggers

-

Switzerland: The economic trend in Switzerland is of minor importance for the franc. But the current-account surplus supports a stronger franc.

-

Europe: Renewed debt crisis turmoil will strengthen the franc very quickly. After Japan’s new monetary-policy strategy, the franc is one of the world’s most attractive safe havens.

-

With continued moderate growth scare and debt crisis turmoil, EURCHF will remain around 120.

-

Global markets: The US debt ceiling negotiations reach a deadlock. ‘Hard landing in China’. Turmoil in the Middle East.

Investment case

-

Our expectation of a downward correction of CHFDKK at yearend turned out to be more than perfect.

-

The present level is still at the at the weak end of our expected trading range for 2013. If you consider closing your CHF funding, the present levels are attractive.

-

Read our recent CHF research report (read here).

-

We anticipate that the franc will be maintained in the range of 120-125 in the next 12 months.

Risk factors

-

Switzerland: Given the SNB’s announced minimum rate, it will be difficult for EUR/CHF to breach below 120.

-

Solid currency outflow in H2 2012 (corresponding to CHF 200bn) may result in a strong weakening of the franc if investors abandon the franc again.

-

Europe: Spain asks for a rescue package and the ECB makes heavy purchases of Southern European bonds. This will ease the pressure on CHF temporarily.

-

Global markets: The global economy regains positive momentum. The crisis in the Middle East between Iran/Israel/the West calms down.

The Japanese yen - JPY

-

We must throw in the towel and downgrade our expectations of the yen. The general trend is, however, unchanged. We anticipate an appreciation of the yen at 3M, 6M and 12M. The depreciation of the yen of recent months has primarily been boosted by changed rhetoric. Monetary policy has actually developed more or less as expected. In the short term (1-2M), it may go either way, but in the long term we are bullish about the yen:

-

The movement down for the yen is significantly overdone. The yield spread to EUR and DKK signals that JPY should be much higher.

-

The crisis in Europe has not come to an end – we will see new periods of turmoil in 2013. JPY will continue to be a partially safe haven.

-

2013 will be a difficult investment year without major expected returns on risky assets – this will support the yen. The yen is currently boosted by short-term investors. Fundamentally, we still see a net demand for JPY.

Fundamental valuation

-

Monetary policy: The interest rate of the Bank of Japan is 0%-0.10%. It will stay at this level.

-

The BoJ has announced massive QE (purchases of Treasury bills and government bonds) in 2014. The term of the papers it will buy is, however, short.

-

Fiscal policy: Japan has a large deficit on its public finances (expected –9.7% of GDP in 2012) and the Japanese national debt is above 210% of GDP. Most of the national debt is owned by the Japanese themselves and is thus not yet of major importance for the exchange rate.

-

Growth: The growth prospects in Asia have as a whole become weaker, but the weaker yen is tremendously positive for exports.

-

The conflict in China may be of some importance for exports.

-

Purchasing Power Parity: 1.03 EURJPY.

Price triggers

-

Japan: Investors have so far sold yen massively on expectations of further monetary-policy relaxation and higher inflation. If the effects of the policy do not materialise, investors will be disappointed.

-

The demographic trend also shows a significantly rising proportion of elderly people over the coming years. This results in an ongoing liquidation of assets (pensions). This also includes assets outside Japan (=inflow of yen).

-

Europe: The debt crisis escalates. The yen has for many years been a safer haven than the dollar. USDJPY declines in a debt-crisis scenario.

-

Due to the narrowing of the yield gap to Japan investors can tolerate to keep bought JPY for a longer period of time.

-

Global markets: Hard landing in China. Australia slows down drastically.

Investment case

-

We anticipate that the bottom of JPYDKK has come considerably closer. The yen has depreciated by more 25% since the summer of 2012.

-

0-3M: Generally, the euro is supported by the news flow, but on the other hand, the yen has attained a very low level. We see strong potential in the purchase of the yen.

-

3-6M: The trade balance stabilises if nuclear power plants are started up again. Europe is once again responsible for the negative headlines. The yen will improve as safe haven.

-

6-12M: It is difficult to predict how large the potential of the yen really is. 115 EURJPY is relatively conservative. If the euro crisis breaks out again, there may be much more to gain.

Risk factors

-

Japan: Prime Minister, Shinzo Abe, takes control of the Bank of Japan and relaxes the monetary policy on a massive scale. If he succeeds (we doubt it) the yen may depreciate quite significantly.

-

Europe: A lid is put on the crisis in Europe. Unemployment begins to fall.

-

Global markets: A sharp turn in US and European economic indicators will result in sales pressure on the yen. Yield spreads will widen.

-

Better economic indicators will strengthen equities and commodities and depreciate the yen.

The Norwegian krone - NOK

We maintain our expectations that EURNOK will in 2013 generally be trading in the range of 730-760. The pressure will be greatest towards the upside (stronger krone), but we only expect to see short-term fluctuations outside the indicated range. Generally, Norway is in a league of its own:

-

OECD expects growth of 3.1%-3.2% in 2013 (our estimate is 3.1%).

-

Unemployment is around 3% and consumer confidence is at its highest level in more than 12 months.

Although everything points to a stronger krone, we expect that Norges Bank will not accept that EURNOK dives below 720 since competitiveness will deteriorate – especially towards the US, China and other countries outside the euro.

Fundamental valuation

-

Monetary policy: The rhetoric of Norges Bank has been surprisingly hard and the bank is expected to raise its interest rates in the first half of 2013. We doubt it – the currency will strengthen too solidly.

-

Fiscal policy: Norway has very sound public finances, a currentaccount surplus, a huge oil fund and still higher interest rates than in Europe. As long as we have no serious debt crisis in the EU, the krone will be in demand due to its AAA rating.

-

Economic growth: The high oil price keeps up growth, but a too strong krone will reduce the value of oil exports and hit the remaining industry.

-

Liquidity: The trading volume of the Norwegian krone is approx. 20% of the trading volume of the franc and 60% of that of the krona. The krone is not a safe haven.

-

Purchasing Power Parity: 7.29 EURNOK.

Price triggers

-

Norway: New hawkish statements from the central bank will support an even stronger krone.

-

Europe: Lower ECB rates or higher Norwegian interest rates will widen the yield spread between Europe and Norway in favour of the krone.

-

The ECB launches further 3-year liquidity allotments.

-

Global markets: A turn in global economic indicators to the better will strengthen the krone.

-

If QE3 sends up the prices of oil and equities in the coming months (as we expect), the krone will remain strong.

-

Higher oil prices – especially if driven by demand - may result in demand for the krone.

Investment case

-

The krone is still trading in a clear uptrend. We have difficulties seeing NOKDKK above 102.60 and expect a general trading range of NOKDKK 98-102 (EURNOK 730-760). The range is narrow and small non-lasting deviations should be expected.

-

0-3M: EURNOK is expected to trade at the lower part of the trading range in the coming period of time. We do not expect EURNOK to breach below 725.

-

3-6M: The krone remains strong and will most of the time be above NOKDKK 1.00 (below 7.46 NOKEUR).

-

6-12M: The Krone is no longer a ’one way street’. The krone is very strong at the present levels. We do not anticipate that Norges Bank will accept a permanent appreciation of the krone below 725 EURNOK.

Risk factors

-

Norway: The krone has ”semi-safe-haven” status due to low debt, relatively high interest rates and sound public budgets. If the debt crisis flares up in combination with recession in Europe and the US, the krone will depreciate due to its low liquidity.

-

The krone is at its highest level against the euro since 2003. Investors are heavily invested in the krone. All in all, a dangerous cocktail if the sentiment turns.

-

The housing market collapses and constitutes a risk to the banks.

-

Global markets: Slower global growth or pressure on the oil price – negative for the krone.

The Swedish krona – SEK

SEK 0.85 (875 EURSEK) is still expected to be the bottom this time around. We anticipate an encounter with 845 EURSEK over the coming three months. Generally, we anticipate that the krona will be trading in the range of EURSEK 820-880 for most of 2013, but as we know, the krona may make some sharp fluctuations in a very short period of time. This will also be the case in 2013. The krona is generally incredibly strong relative to many other currencies, but dark clouds are lurking on the horizon:

-

The trade-weighted krona is close to its highest level in 10 years – the real economy will be affected even further. Will the Riksbanken strike back? We see more and more signals in this direction.

-

Threatening house prices, a change in the unemployment trend (it will rise), etc. Risks are highest on the downside.

We believe in a strong krona in 2013, but point out that you should not rule out the risk of a sudden depreciation of the krona.

Fundamental valuation

-

Monetary policy: The Riksbanken has cut its interest rates to 1.25%. The interest-rate market discounts a further interestrate cut in the first half of 2013 – we do not share the expectation.

-

Fiscal policy: Sweden has a by now rare AAA rating and very sound public finances.

-

Economic growth: Swedish exports account for approx. 50% of GDP. Approx. 70% is sold to crisis-ridden Europe. 2013 will be a year of slow growth.

-

The trade-weighted krona is approaching its highest level for more than 13 years. Will the Riksbanken strik back? The likelihood is in our view considerably on the increase.

-

Purchasing Power Parity: 98.90 SEKDKK (7.54 EURSEK).

Price triggers

-

Sweden: Rising inflation pressure combined with a strong housing market. The Riksbanken raises interest rates (not likely).

-

Europe: A credible solution to the debt crisis is found. The krona will lose some ”safe-haven” flow, but will strengthen due to a positive equity-market correlation (cyclical currency).

-

The ECB cuts interest rates and widens the yield spread to Sweden.

-

Global markets: When the slowdown in economic growth comes to an end, it will be positive for the krona (global indicators are improving).

-

QE3 from the US supports higher equity prices. The krona is highly dependent on equity prices.

Investment case

-

We maintain that you should continue to buy the krona up to the spring of 2013. If the krona increases to 0.88-0.89 we encourage to cautiousness since the krona will at this level be very strong and slow the real economy.

-

0-3M: The interest-rate market is too aggressive in relation to relaxations from the Riksbanken, and fundamentals will not disappoint to the expected extent.

-

3-6M: SEKDKK stabilises around 0.86 and returns to an increasingly “normal” correlation pattern with higher equities = a higher krona and vice versa.

-

6-12M: Vi expect that the global economy will regain positive momentum and support cyclical currencies (the krona).

-

Risk: Breach of 880-890 EURSEK risks a depreciation of 3%-5%.

Risk factors

-

Sweden: Weaker economic indicators will open the door for interest-rate cuts from the Riksbanken. Keep a special eye on PMIs, consumer confidence and industrial confidence.

-

A falling housing market increases the likelihood of moderate interest-rate cuts.

-

Europe: European money-market rates increase even further (short-term risk – in the long term it will kill European economic growth).

-

Global markets: If investors abandon the safe haven in their search for return, the krona will come under further pressure.

-

Significant equity-price declines.

The Polish zloty – PLN

We recommend to BUY EURPLN in the long term in the range of 406-412. The recent central-bank meeting surprised market participants by signalling that we may see a break in the cycle of interest-rate cuts initiated by the central bank. Especially the positive economic momentum in Europe lately has had an impact on the central bank. We anticipate that EURPLN will in the course of February dive below the 410-12 level one last time before EURPLN will later in H1 trade up to the 425-30 level. The reasons behind the expected weakening are:

-

that market participants keep their focus on the deteriorated economic indicators;

-

that the central bank has started a rate cut cycle. Interest rates are expected to be cut to around 3.5%;

-

that economic growth has plunged and is expected to continue to fall in H1 2013;

-

that the currency is relatively strong; the NBP has room for further weakening.

Fundamental valuation

-

Monetary policy: The central-bank rate is 4.0%. We expect that interest rates will be cut even further in 2013, which will be bad news for the value of the zloty.

-

Fiscal policy: The budget deficit is large and the debt is rising. Poland has difficulties fulfilling the convergence criteria and therefore they do not have funds to make an aggressive fiscalpolicy relaxation.

-

Economic growth: Relative to the EU countries, Poland enjoys strong economic growth but the pace has slowed down considerably over 2012. We expect that the central bank will cut its interest rates to support growth in 2013.

-

REER: The zloty is 7% above the 5-year moving REER average.

Price triggers

-

Poland: A more ambitious plan for reducing the budget deficit.

-

The central bank begins lowering its interest rates more aggressively.

-

Flow due to privatisations of Polish government-owned companies will have a positive effect on the zloty.

-

Europe: Poland will be the Eastern European country that will benefit the most from a solution to the European debt crisis. Hence, any initiative from the ECB or the EU towards a stronger euro zone will affect the zloty relatively strongly. On the other hand an escalation of the debt crisis will have an adverse effect.

-

Global markets: QE from the Fed, new initiatives from the ECB, and easing from PBoC.

Investment case

-

0-3M: In Q3, QE from the large central banks supported a consolidation phase for the zloty. We anticipate that the Polish central bank has initiated an interest-rate-cut cycle by more than 1% over 18 months which will result in a negative bias against the zloty in 2013.

-

3-6M: We will see a pressure on the zloty in H1 2013. Especially the interest-rate cuts and focus on the slow economic growth in the EU will have an impact.

-

6-12M: In the long term, we still believe that the problems in Europe will dominate the FX market. In H2 2013 the ECB and the EU will launch further initiatives that will once again put a damper on the debt crisis. This will support the emergingmarket currencies. Particularly those closest to the EU, including the zloty.

Risk factors

-

Poland: The zloty is the most liquid Eastern European currency and is therefore often used as an indicator of Eastern Europe and the euro zone. The zloty is just now relatively strong compared with the other EEC currencies. The strong positioning in zloty may backfire in case of financial turmoil.

-

Investor focus on the wide budget deficit.

-

A widening current-account deficit will be negative for the zloty.

-

Central bank leaves interest rates unchanged.

-

Growth stabilises.

-

Europe: If the debt crisis in Europe escalates, the zloty will depreciate.

-

Slowdown in economic growth in Germany and the EU in

The Hungarian forint - HUF

We recommend selling EURHUF in the range of 288-300. Jyske Bank’s scenario is that EURHUF will be trading in the range of 270 – 310 in 2013. Due to the relatively large political risk involved in Hungary we recommend that an investor's share of the forint should be considerably lower than in other EM countries.

So far, Hungary has succeeded in obtaining funding up to end-2013, which has given the country an incentive to sign an agreement with the IMF and the EU. Although Hungary is comfortable about the country’s funding situation, we believe that if an agreement is not in place in H2 2013, it will put economic pressure on the country. And the risk is that Hungary will be forced to implement extraordinary reforms to improve the development in the country.

Fundamental valuation

-

Monetary policy: The central bank has several times cut its interest rate to 5.50%. We anticipate that the central bank will continue testing the market by lowering its interest rate at a measured pace as long as the currency does not show a strongly negative reaction.

-

A loan agreement with the IMF/EU has so far been postponed indefinitely. Hungary has succeeded in obtaining funding at an acceptable level in the market. Large national debt (approx. 80% of GDP) as well as a continued budget deficit above 3% of GDP will contribute to squeezing the forint.

-

Economic growth: Like large parts of the euro zone Hungary is in recession.

-

The export sector accounts for a very large proportion of the total economy and a large proportion is sold to Germany where we see increasing signs of crisis.

-

The forint is slightly undervalued.

Price triggers

-

Hungary: The government delivers the planned fiscal tightening.

-

Home owners and businesses have funded their loans in the forint. A lift of EUR/CHF will be positive news (at present EUR/CHF is at 120).

-

Investors are generally slightly underweight in the forint.

-

Hungary surprises by tightening so much that the budget deficit is kept below -3%.

-

Europe: The debt crisis in the EU flags off.

-

Global markets: Global economic indicators gain a foothold.

-

Additional monetary-policy easing from the Fed or new easing measures from the ECB or the People’s Bank of China will support the forint.

-

Exports especially to Germany increase.

Investment case

-

0-3M: The central bank’s recent rate-cut cycle has put the forint under pressure. The most important aspect in this relation is that if the currency attains the level of 300-310, the central bank will stop short. Hence, there is an indirect ceiling on EURHUF.

-

EURHUF has now depreciated to the level where we see the forint as a long-term strong buy.

-

3-6M: If an EU/IMF agreement should be signed, it may be during this period. Later, we expect bright spots in the global economy and this will, other things being equal, ease the pressure on Hungary.

-

6-12M: Regained foothold in the European economy will help reduce the pressure on Hungary and strengthen the forint.

-

We see good opportunities of a long-term investment in Hungary, especially with EURHUF in the range of 285-300.

Risk factors

-

Hungary: An EU/IMF agreement has become less likely. Most analysts still anticipate that it will become a reality. If investors suddenly realise that the agreement may become a reality, it will be negative for the forint.

-

Further interest-rate cuts from the central bank.

-

Europe: Generally, a deterioration of the EU debt crisis and a slowdown in economic growth in the EU will be very bad news for the forint.

-

The capitalisation process for European banks is still at the initial stage. New regulations etc. may speed up the process and increase the flight out of Eastern Europe.

-

If the Swiss central bank cannot fulfil its target at EUR/CHF 120, the forint will be very vulnerable due to a high degree of borrowing in Swiss franc. The forint will depreciate.

The Turkish lira - TRY

EURTRY seems overbought for the medium term. We recommend investors to read the EM tip of the month: Turkey looks interesting. Why do we recommend to buy Turkey:

-

Interest rates are attractive

-

Strong growth story and successful exports

-

Great likelihood of an upgrade of Turkey's credit rating to investment grade.

-

The euro shows signs of being overbought. We anticipate that the euro will decline more sharply than the lira over 2013.

The biggest challenges for Turkey in 2013 are: Plunging economic growth, that investments do not materialise and that consumers are hesitant.

Fundamental valuation

-

Monetary policy: We expect that CBRT will continue experimenting with the interest-rate policy in 2013. Experience has taught us that CBRT is often easing too much and is then tightening considerably.

-

The central bank has improved its credibility, which is positive for the lira and contributed to a minor fall in the lira in stressed periods.

-

Fiscal policy: The public as well as the private debt is low.

-

Turkey is highly dependent on foreign capital, which is negative in periods with stress in the financial markets.

-

Economic growth: The economy is losing momentum but inflation remains high.

-

The current-account deficit is expected to fall moderately from the current 10% to 5%-7% in the coming year.

-

Demography supports the high long-term growth potential, but the problem is that reforms are lacking.

Price triggers

-

Turkey: If the CBRT lowers its interest rate to stimulate economic growth, the lira will depreciate.

-

If credit growth, core inflation and current-account deficit begin to slow, it will support the lira.

-

If EURTRY breaches above 242, it will result in further depreciation.

-

Europe: If the ECB’s rescue of Southern European countries, especially Spain, succeeds, it will be positive for the emerging markets.

-

If we see focus on the debt crisis in the EU again, it will in the short term result in an appreciation of the lira, but in the long term it will depreciate the lira.

-

Global markets: A strong US dollar due to a stronger USA will strengthen the lira.

-

Higher global economic growth will generally be positive for EM currencies and the lira.

-

Deterioration of the recession in the EU will put pressure on the lira.

Investment case

-

A depreciation of the lira due to a stronger EURUSD was dominating in Q4 and in early 2013. The development is expected to stabilise. So, the lira is expected to bottom out.

-

0-3M: In the coming months we expect that the crisis in the EU will again be the focus of attention and we also expect that global economic growth will be challenged. This may put pressure on the euro and therefore we recommend investors to replenish their holdings of lira since EURTRY will decline.

-

EURTRY 236-242 is the expected consolidation level. If the breach is above 242, there is a risk of further depreciation.

-

3-6M: If the CBRT, as expected, eases its monetary policy (and not unambiguously interest rates), it will offhand be negative for the lira.

-

6-12M: Jyske Bank’s anticipations of higher global economic growth and lower risk premium of EM currencies will result in an appreciation of the lira.

Risk factors

-

Turkey: If the CBRT cuts its interest rate, it will be bad news for the lira.

-

A current-account deficit constitutes an increasing risk for the lira.

-

Turkey is dependent on the attraction of foreign capital which may result in problems in a volatile financial market.

-

If inflation goes up, this will be bad news for the lira.

-

Ambiguous changes from the CBRT will be bad news.

-

Global markets: A general increase of the risk aversion with closure of EM positions will have an adverse effect on the lira.

-

Falling growth in the US, the EU and China will be bad news for the lira.

-

A continuation of the uptrend in EURUSD will force down the lira.

The Mexican peso - MXN

-

Long-term BUY recommendation for Mexico. See Jyske Bank’s recommendation of MXN-denominated bonds (EM weekly). Since the change of government we have seen fair winds over Mexico. The reason why we as euro investors have not benefited from the more favourable winds is that the euro has been in a very strong uptrend since Mr. Draghi’s speech in July. We believe that time has now come for the appreciation phase of EURMXN to have come to an end. When EURMXN breaches below 1700 again, an extraordinary sales pressure will emerge. We anticipate a potential of at least 4% in H1 2013. We point to the following positive factors which will be supportive of Mexico:

-

The government focuses on reforms (particularly reforms within the energy sector and the labour market are positive).

-

A robust increase in the Mexican manufacturing industry.

-

General expectations of stronger growth in 2013 which will attract investments.

Fundamental valuation

-

Monetary policy: The central-bank rate is 4.50% which is among the lower rates in our EM universe, but it is also the least volatile rate.

-

We do not anticipate any rate changes for 2013.

-

Economic growth: We have seen a minor decline in economic growth in Mexico in 2012 but it is still at a relatively strong level. We project improvement in 2013.

-

¾ of the country’s exports is sold to the US (US economic indicators again show signs of stabilisation/improvement which will support the peso).

-

Competitiveness is high due to the low unit wage costs. This will benefit the peso even further over the next couple of years.

-

The country runs a small current-account deficit.

-

REER: The peso is slightly (approx. 3%) overvalued relative to REER.

Price triggers

-

Mexico: An escalation of the cartel turmoil will result in an adverse trend of the peso.

-

New ‘hawkish comments’ from the central bank will support the peso. Keep an eye on inflation – whether it is still accelerating.

-

Europe: Risk factors in the EU have fallen over the past six months. If EU banks begin relaxing their credit granting again, it will be positive for EM and especially the peso will be the winner.

-

The US: The peso is a dollar-related currency. Hence the peso has fallen in step with the decline of the dollar. We anticipate that the dollar will again be attractive in Q2 which will support the peso.

-

If the budding economic upswing in the US fades away, it will result in a sale of the peso since exports will be hit hard.

-

Global markets: A medium-hard landing for the Chinese economy will depress global economic growth and may especially hit EM currencies.

Investment case

-

We recommend to maintain investment in the peso. 2013 is expected to be supportive for the trend of the peso.

-

New investors should sell EURMXN above the 1700 level. Alternatively, sell EURMXN when it breaches below 1650.

-

0-3M: There is a risk that global growth indicators will be poorer than expected and that we will see stress in the financial market in February/May due to the US debt ceiling and fiscal cliff and the presidential election in Italy.

-

3-6M: We expect the peso to appreciate against the euro and the dollar due to a credit-rating upgrade or reforms in the first half of 2013.

-

6-12M: The coming appreciation of the dollar will contribute to sending EURMXN considerably lower in H2 2013.

Risk factors

-

Mexico: Mexico is an oil exporter. If oil prices decline significantly, it will have a negative effect on the peso.

-

The central bank cuts its interest rate (very unlikely).

-

The cartels increase the turmoil. This will put pressure on the reform process, which may hit growth and investor demand.

-

Europe: An escalation of the European debt crisis will hit EM hard. EM assets will be closed down.

-

The US: SELL of the peso may to a high degree be used as a hedge on US crises, and an escalation of the fiscal cliff and the debt ceiling problems will most likely result in a sale of the peso (medium likelihood).

-

The US: The budding economic upswing fades away.

-

China: sees a hard or “medium hard landing”. Commodity prices fall, risk aversion increases, EM currencies depreciate.

The Brazilian real - BRL

Recommendation: Keep investments in Brazil and replenish if USDBRL rises above 209 again. The interest-rate policy has a great impact on the exchange-rate development in Brazil. When interest rates rise, the currency appreciates and vice versa. The central bank has indicated that the interest-rate cuts in the past year have come to a halt. This implies that investors can anticipate a consolidation period where USDBRL will end up forming a peak pattern, which means that there is a greater likelihood of an appreciation of the real in 2013 than a continuation of the depreciation in 2012.

The economic trend is weak but is expected to appreciate over 2013. Especially the low interest rate will result in higher economic activity in Brazil. Jyske Bank expects the first interest-rate hike at the end of 2013 or early 2014. Growth for 2013 will be 3.5%-4.0%, which is a significant improvement indicating that a depreciation of the real is coming to an end.

Fundamental valuation

-

Monetary policy: The central bank rate in Brazil is 7.25%. We believe that the central bank has finished its rate-cut cycle.

-

Inflation is around 5%. This is an acceptable level.

-

The central bank primarily focuses on creating growth. Hence, interest rates have been cut aggressively throughout 2012.

-

Fiscal policy: Since 2008, Brazil has had a current-account deficit (approx. 2% of GDP).

-

Economic growth: The export sector only accounts for approx. 10% of the economy. Hence, the domestic economy is an important driving force. Retail sales show incipient optimism. The solid interest-rate cut contributes to supporting domestic demand.

-

Growth in 2013 is expected to be 3.5%-4%.

-

REER: The real is close to the 5-year moving trade-weighted average.

Price triggers

-

The primary price trigger will be a further increase in the intervention we saw in January when the BCB forced USDBRL from above 210 down to 198.

-

The BCB has signalled that it will attempt to keep USDBRL stable in the range around USDBRL 200-210.

-

If the underlying inflation shows an extraordinary increase, the BCB may be forced to raise its interest rate again, which will strengthen the real.

-

An upgrade of the country’s credit rating will be good news for the real.

-

A generally rising demand for risky assets will support the real, which is undervalued in relation to the emerging markets in general.

Investment case

-

The relatively wide yield spread between the real, the US dollar and the euro makes investments in real attractive in the long term.

-

With the BCB’s latest interventions, the central bank indicates that a further depreciation of the real is not acceptable.

-

0-3M: The debt ceiling problem in the US during the spring may offer short-term depreciation of the real by up to 3%-6%.

-

6-12M: Jyske Bank anticipates a stabilisation of global economic growth in 2013, which will offer support to the real.

-

We recommend investors to maintain their investments in real and to replenish their holdings in case of a depreciation of the real.

-

New investors should look for the level 205-10 of USDBRL.

-

The ’low’ interest rate in Brazilian terms contributes to a significant stimulation of the economy, and growth is expected to rise in 2013.

Risk factors

-

If focus is once again changed to the European debt crisis, the emerging markets will in general come under fire. Keep a close eye on developments in France, the Spanish banking sector and the election in Italy.

-

If the capitalisation of European banks intensifies, it will result in a close-down of EM assets.

-

If underlying inflation continues to increase, the BCB will hike its interest rates, which will result in a solid appreciation of the real.

-

Investors are strongly positioned in the equity and bond markets, which poses a considerable risk: if investors sell, this will activate a strong sell-off.

-

If the taxes imposed on foreign investors are once again strengthened, this will result in rising sell-offs of real assets.

The South African rand - ZAR

We recommend investors to buy the rand. Please note that we upgrade our EURZAR price target for 3, 6 and 12 months. Although we hereby indicate a slightly weaker rand that we otherwise expected, it is still a very attractive long-term investment.

- Global growth has stabilised and metal prices increase.

- Especially an improvement in growth in Asia and the US will be a driving force for exports from South Africa.

- On weekly and daily charts the rand is oversold, against the euro, the dollar and sterling.

Keep a close eye on the following risk factors: Can South Africa attract sufficient foreign capital? Will USDZAR breach above 930? Or EURZAR above 1250? New taxation of the mining sector or nationalisation of subsectors? Will the rating agencies rattle the sabre once again? Will domestic consumption gain momentum? Consumer confidence is at its lowest level since 2008.

Fundamental valuation

-

Monetary policy: The SARB keeps interest rates at 5.00% in 2013. We do not expect changes over the next 12 months. Rising inflation is a concern for the central bank (inflation target: 3%-6%).

-

Slow growth is still the greatest concern for the SARB, and hence further interest-rate cuts cannot be ruled out.

-

Fiscal policy: Risk of downgrade of credit rating.

-

The budget deficit is too wide (approx. 5% of GDP), while the total national debt is below 40% of GDP.

-

Economic growth: The government and the SARB have disagreed about initiatives to boost growth. The SARB has been the greatest contributor in the battle against declining growth. Interest rates have plunged over the past couple of years. This has resulted in bias against the downside for the rand.

-

REER: The rand is undervalued.

Price triggers

-

South Africa: If inflation rises above the target (6%), interest rates will probably be raised.

-

If political instability in the country is reduced, it will give a boost.

-

Europe: A sustainable solution to the European debt crisis.

-

Quantitative easing in Europe and the US as well as more relaxed monetary policy in a number of emerging markets (China, AUD) will support risky assets and especially the rand will benefit.

-

Global markets: A global economic upswing which gains momentum and becomes self-sustaining.

-

A continued strengthening of commodity prices.

-

The rand is among the more liquid EM currencies and hence typically among the first to be sold or purchased.

-

A renewed upswing in the US will be supportive of the rand.

Investment case

-

The rand is undervalued and has long-term potential. After a successful party congress in ANC the way is paved for a slow appreciation of the rand. We recommend investors to buy the rand.

-

0-3M: We expect that the rand is more or less flat against the euro, but as a potential appreciation may emerge relatively fast and interest rates are good, we see no reason to stay on the sidelines.

-

3-6M: A stronger dollar will make the rand stronger against the euro. We also expect an appreciation of the rand against the dollar.

-

6-12M: Due to reasonable macroeconomic prospects, our macroeconomists anticipate that the global economy will regain its foothold. This will strengthen the rand.

-

The rand is a good long-term buy.

Risk factors

-

South Africa: South Africa still has a relatively high interest rate which contributes to supporting investors’ persistence with respect to the rand.

-

South Africa is, with underinvestment and a current-account deficit, highly dependent on foreign capital. The deficit widened throughout 2012. If this trend continues, the rand risks being highly exposed during periods of financial turmoil.

-

Europe: If the debt crisis flares up, a yield pickup will not be sufficient to calm investors.

-

The monthly Sharpe ratio plunged over 2012.

-

Global markets: Economic growth in China is important for South Africa. A hard or medium-hard landing in China will be negative for the rand. China is South Africa’s largest export partner.

The analysis is based on information which Jyske Bank finds reliable, but Jyske Bank does not assume any responsibility for the correctness of the material nor for transactions made on the basis of the information or the estimates of the analysis. The estimates and recommendations of the analysis may be changed without notice. The analysis is for the personal use of Jyske Bank's customers and may not be copied.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.