To start this new week the Australian dollar has fallen sharply but landed on the previous key level at 0.77 which has offered considerable support. The Australian dollar enjoyed a solid week last week moving off support around 0.76 to reach a three week high just shy of the resistance level at 0.7850. In doing so, it moved through the key resistance level at 0.77. After placing great pressure on the resistance level at 0.77 a couple of weeks ago, the Australian dollar fell heavily earlier last week before surging higher again to finish out the week. Over the best part of the last few weeks, the Australian dollar has relied heavily on support at the 0.76 level after falling away sharply to down below the key 0.77 level over the course of the week prior, and it is relying on this level again presently. Throughout the last couple of weeks it felt significant resistance from the key 0.77 level which has been severely tested during this period and it will be interesting to see whether this level now acts as some support.

Its next obvious support level is down at 0.7550 and it will hoping to be propped up by it. For a couple of weeks it moved back and forth from below 0.76 and up to the key resistance level at 0.7850 and higher, before the recent fall. Back in early March the Australian dollar made a statement and broke down strongly through the key 0.77 level which then provided significant resistance for the following few days. It was also able to enjoy some short term support around 0.7550 which propped it up and allowed it to rally strongly back up to above 0.79. Throughout February the Australian dollar made repeated attempts to move up strongly to the resistance level at 0.7850 however it was rejected every time and sent back easing lower, which is why this level remains significant presently. Just prior to that towards the end of February the Australian dollar moved through the resistance at 0.7850 to reach a new four week high around 0.7900. In the second half of January, the Australian dollar fell very sharply and break lower from the trading range that had been established roughly between 0.8050 and 0.8200.

Back in mid-January it made numerous attempts at the resistance level at 0.82 only to be sent back often before finally finishing that week moving through this key level. In doing so it was able to reach a one month high near 0.83 before being sold back down again towards 0.82 as the resistance and selling activity above this level kicked in. Over the Christmas / New Year period, the Australian dollar seemed to have been content with trading in a narrow range below the resistance at 0.82, which continues to remain a key level as it is presently provides resistance. The Australian dollar experienced a disappointing November and December moving from resistance around 0.88 down to the new lows recently. For a couple of months from September through to November, the Australian dollar did well to stop the bleeding and trade within a range between 0.8650 and 0.88 after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650.

Australia’s jobless rate unexpectedly fell in March, spurring a jump in the local dollar on optimism the central bank’s effort to shore up the economy with record-low interest rates is paying off. Unemployment dropped to 6.1 percent from a revised 6.2 percent in February, as the number of people employed rose 37,700, the statistics bureau said in Sydney on Thursday. The currency extended gains as traders pared bets on the scale of rate cuts, after the report reinforced data showing improved business confidence in March. The Reserve Bank of Australia kept borrowing costs at 2.25 percent last week, after cutting in February, as it seeks to encourage spending by consumers and companies to offset falling mining investment.

(Daily chart / 4 hourly chart below)

AUD/USD April 21 at 02:00 GMT 0.7705 H: 0.7728 L: 0.7698

AUD/USD Technical

During the early hours of the Asian trading session on Tuesday, the AUD/USD is bouncing off support at the key 0.77 level after easing back from the resistance level at 0.7850. Current range: trading right above 0.7700.

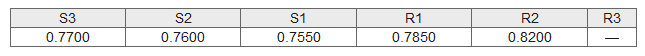

Further levels in both directions:

- Below: 0.7700, 0.7600 and 0.7550.

- Above: 0.7850 and 0.8200.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.