The Australian dollar has been on quite a rollercoaster ride of late moving sharply back and forth from below 0.76 and up to the key resistance level at 0.7850. It presently has eyes on the resistance level at 0.7850 after being rejected at that level earlier last week. A couple of weeks ago the Australian dollar made a statement and broke down strongly through the key 0.77 level which then provided significant resistance for the following few days. It was also able to enjoy some short term support around 0.7550 which propped it up and allowed it to rally strongly in the last week. Several weeks ago the Australian dollar made repeated attempts to move up strongly to the resistance level at 0.7850 however it was rejected every time and sent back easing lower, which is why this level remains significant presently. Just prior to that the Australian dollar moved through the resistance at 0.7850 to reach a new four week high around 0.7900.

In the second half of January, the Australian dollar fell very sharply and break lower from the trading range that had been established roughly between 0.8050 and 0.8200. Back in mid-January it made numerous attempts at the resistance level at 0.82 only to be sent back often before finally finishing that week moving through this key level. In doing so it was able to reach a one month high near 0.83 before being sold back down again towards 0.82 as the resistance and selling activity above this level kicked in. Over the Christmas / New Year period, the Australian dollar seemed to have been content with trading in a narrow range below the resistance at 0.82, which continues to remain a key level as it is presently provides resistance. The Australian dollar experienced a disappointing November and December moving from resistance around 0.88 down to the new lows recently. For a couple of months from September through to November, the Australian dollar did well to stop the bleeding and trade within a range between 0.8650 and 0.88 after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650.

Back at the beginning of September the Australian dollar showed some positive signs as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory. It seems a long way away now but the Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

Australia is likely to avoid a recession as the mining boom fades, the Reserve Bank boss says. The economy fell into recession during the 1980s and early 1990s after a peak in commodity prices, but Glenn Stevens is confident history won’t repeat. Coal and iron ore prices have plunged in recent months and investment in the resources sector has waned as a result. “If we come through this terms of trade event with neither a major outbreak of inflation in the upswing nor a major crash in the downswing, even if we have a period of sub-average growth in the process, we will have done far, far better than in any previous event of this kind, let alone one of this magnitude,” he told an American Chamber of Commerce in Australia lunch. “I still think that is the most likely outcome.” The RBA governor also said a falling Australian dollar would help the economy deal with the resources downturn, although not as seamlessly as hoped. “We have always said we cannot hope to fine-tune this transition, however much we may wish otherwise,” he said. Meanwhile, Mr Stevens expects US interest rates will rise in 2015 for the first time in nine years, which along with bond buying by the European Central Bank, is set to shake up financial markets.

(Daily chart / 4 hourly chart below)

AUD/USD March 22 at 22:00 GMT 0.7800 H: 0.7807 L: 0.7773

AUD/USD Technical

During the early hours of the Asian trading session on Monday, the AUD/USD is continuing to rally higher as it has its eyes on the resistance level at 0.7850 after enjoying a lot of volatility in the last few days. Current range: trading right around 0.7800.

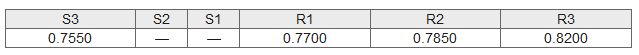

Further levels in both directions:

- Below: 0.7550.

- Above: 0.7850 and 0.8200.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.