The Australian dollar has enjoyed a surge higher in the last 24 hours moving from its consolidation zone just below 0.73 up to a two week high above the previous key level at 0.74. The 0.74 level has kicked in as resistance and has sent the AUD/USD back under where it is presently trading. Over the last month the AUD/USD has fallen sharply which culminated in a new six year low near 0.7200 towards the end of last week. It has spent the last week trading right around the key 0.73 level after enjoying some support from around 0.7260. before its recent surge higher. For the best part of the last few weeks the AUD/USD has traded in a narrow range between 0.74 and 0.75 with the former providing reasonable support and the latter providing stiff resistance during this time. It had been relying upon support at 0.74 and testing this level however this has now been broken and the AUD/USD has been consolidating around the 0.73 level for the last week or so. Back at the end of June the Australia dollar was starting to feel some selling pressure from the 0.77 level and it had its eyes firmly focused on the long term support level at 0.76.

In the first half of June the Australian dollar surged higher from below 0.77 up to a three week high, however it ran straight into resistance at the key 0.7850 level, which has performed this role several times this year. Throughout this time it also spent most of its time trading quite steady around the 0.7750 level whilst receiving solid support from 0.77. Over the last couple of months the resistance level at 0.7850 has played a major role and continues to place selling pressure down on the AUD/USD. Throughout this same period it has been enjoying rock solid support from the long term support level at 0.76 which has allowed it to rebound strongly back up to above 0.78 on more than one occasion.

Throughout the second half of May the Australian dollar fall sharply from a four month high above 0.8150 down to the key support level at 0.76. This level has been a significant level for a couple of months and has propped the Australian dollar up on multiple occasions. This recent price action has been a significant reversal as it wasn’t so long ago, the AUD/USD was in a solid medium term up trend having broken through the key 0.7850 level and achieved the four month high above 0.8150. For most of this year the Australian dollar has traded within a wide trading range between the support at 0.76 and resistance around 0.7850. Earlier this year in February that range was tighter with the support level higher at 0.77. Throughout this period it experienced reasonable swings back and forth between the two key levels with very few excursions beyond the levels.

(Daily chart / 4 hourly chart below)

AUD/USD August 4 at 23:40 GMT 0.7380 H: 0.7428 L: 0.7263

AUD/USD Technical

During the early hours of the Asian trading session on Wednesday, the Australian dollar is easing back below 0.74 after surging higher to above 0.74. Current range: trading right around 0.7380.

Further levels in both directions:

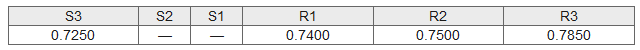

- Below: 0.7250

- Above: 0.7400, 0.7500, and 0.7850.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.