Currencies

On Friday, the US payrolls report dominated markets. Headline payrolls growth was lower than expected, but the details of the report were constructive. On the release equities declined, as did US bonds, but the bond decline evaporated as sentiment turned risk‐off. The dollar spiked briefly lower upon the publication of the report, but after full lecture of the report soon returned into positive territory. Investors were apparently positioned for a negative surprise. The dollar maintained most of its intraday gains despite the equity sell‐off. EUR/USD closed the session at 1.1158 (from 1.1209 on Thursday). USD/JPY closed the week at 116.89 (from 116.78). The tradeweighted dollar (DXY) rebounded north of 97.

This morning, Asian trading started on a slow footing, as several markets are closed for the Lunar New Year. On Sunday, the PBOC reported that foreign reserves declined $99.5 bln in January. It indicates that the PBOC was again very active to support the yuan. However, the decline in reserves was slightly less than expected. Japanese equity markets trade stronger (+1 to 1.5%) despite Friday’s sell‐off in the US. USD/JPY is off last week’s low and trades again north of 117, currently around 117.35. The dollar remains also well bid against the euro. EUR/USD trades in the 1.1130 area. Commodity currencies like the Canadian and the Aussie dollar stabilize after Friday’s setback. Brent oil moves higher and trades around $34.5 p/b as investors ponder the potential impact of a meeting between the Saudi oil minister and its Venezuelan counterpart on Sunday.

Today, the calendar is devoid of market moving items. The guidance for Asia is also diffuse. So, USD trading will most probably be order‐driven and technical in nature. Friday’s US payrolls didn’t removed market uncertainty on the health of the global and the US economy and on the pace of the Fed policy normalisation. The dollar rebounded, but US equities turned in risk‐off modus. Friday’s rebound of the dollar was due to the pre‐payrolls bearish positioning. It was reversed on Friday, but there are few clues for USD trading at the start of the new week. Will Friday’s correction top at 1.1246 hold as a new strong support for the dollar. Later this week, Fed chair Yellen might clarify the position of the Fed as she appears before Congress on Wednesday (see rates section).

Regarding the US data, only the US retail sales (Friday) bring new info. We start with a cautiously USD positive bias.

From a technical point of view, EUR/USD broke above the 1.1060/1.1124 resistance area (15 Dec top: 62% retracement). This is a dollar negative. The short‐term correction high stands at 1.1246. Next important resistance kicks in at 1.1495.The jury is still out, but we have think that the EUR/USD rebound might be topping out. The picture for USD/JPY improved temporarily as the pair rebounded above 120 after the BoJ easing two weeks ago, but the gains evaporated very soon. The 115.98 pre‐BOJ correction low remains an important point of reference. We expect the BOJ to send warning signals in case of a break below this level. A technical rebound is possible after the recent sharp setback, but we stay very cautious on USD/JPY long exposure as global uncertainty persists.

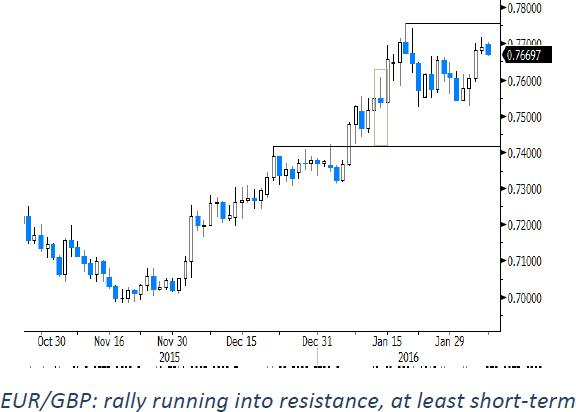

EUR/GBP rally slows, at least for now

In absence of important UK data. EUR/GBP held Friday close to, mostly slightly above the 0.77 barrier. Cable drifted cautiously lower in the 1.46 big figure as the recent decline of the dollar took a breather going into the US payrolls report. The picture for sterling trading didn’t change after the payrolls. EUR/GBP dropped temporary a few ticks in line with EUR/USD, but soon returned to the 0.77 area. The pair closed the session at 0.7690, little changed from the 0.7683 on Thursday as EUR/USD and cable moved lockstep after the payrolls. Cable dropped temporary below the 1.45 on post‐payrolls USD strength, but closed the session at 1.4503 (from 1.4589 on Thursday).

Today, there are again no important eco data in the UK. We expect again a lot of headlines this week on Brexit, as the EU summit on 18/19 February comes closer. Even as the uncertainty on Brexit persists, the decline of the sterling slowed last week. The rebound of cable was mostly an USD decline, but EUR/GBP is also running into resistance. A stabilisation/correction on the recent rally in EUR/USD might cap the topside in EUR/GBP too. EUR/GBP 0.7715 is the first resistance ahead of the 0.7656 (correction top). We think that a sustained comeback off sterling will be difficult as long as there is no clear sign how the Brexit debate will turn out. The medium term technical picture of sterling against the euro remains negative as EUR/GBP broke above the 0.7493 Oct top. Next big resistance stands at 0.7875. A return below EUR/GBP 0.74 would be a first indication that sterling enters calmer waters.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.