Outlook:

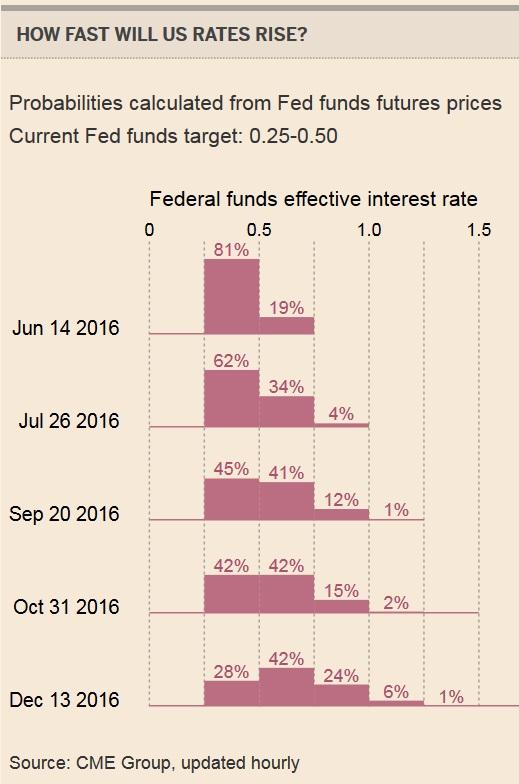

Market News reports that the markets got a little nervous when it was announced Yellen will speak to the World Affairs Council of Philadelphia on Monday, June 6—just ahead of the policy meeting on June 14-15. This news, coupled with higher inflation and the three Feds (see below), raised the odds of a June hike in the Fed fund futures from 4% on Monday to 15% near the close yesterday.

Meanwhile, the Bank of America Merrill Lynch's global fund managers survey released yesterday shows the managers bracing for a summer of shocks, starting with Brexit despite some 71% saying it ain’t gonna happen. Still, a net 36% of portfolio managers were underweight UK equities in May, way down from 20% in April and March and the lowest since Nov 2008. Next comes default, devalua-tion and general malaise in China, with 50% now expecting a slowdown from 22% in April. And every-one is holding more cash, over 5%--a sell signal for global equities. Market News reports “And yet equi-ty jitters did not spur more fixed income demand. A net 41% of portfolio managers were underweight bonds in May, versus a net 38% underweight in April and a net 37% underweight in March.” Managers don’t much like commodities or gold, either. Only 8% think gold is undervalued, even though the price is up 20% YTD.

One of the biggest concerns is Japan, a net 6% of managers are underweight Japanese stocks, the largest underweight since December 2012. What do the managers like? Emerging markets, where a mere 2% are underweight.

Here’s a kicker--a net 12% of managers viewed the U.S. dollar as undervalued, which is the highest reading in 10 months. It was 2% last month. “A net 20% of those polled viewed the Japanese yen as overvalued in May, the highest reading in 19 months [and from 13% in April]. A net 17% of portfolio managers saw the euro as overvalued in May, the highest reading in 10 months, and compared to a net 11% in April. ‘In addition, a net 20% of investors think GBP is now undervalued – the second most un-dervalued reading on record,’ the survey said.”

The key news today is the Fed minutes. In practice, parsing every comment is not really a good use of time. We get the main thrust of the Fed’s thinking from Yellen, Fischer and Dudley, and yet everyone will be picking away at the minutes for hawkish signs, anyway. Adding to the narrative are comments from regional Feds. San Francisco Fed Pres Williams told the WSJ “I think that the data to my mind are lining up to make a good case for rate increases in the next few meetings, not just June, which means it’s very live in terms of that.” Atlanta Fed President Lockhart also said the June meeting “live.” And Dallas chief Kaplan wants hikes to begin in the “not too distant future.” These three are non-voters so apply some salt. Last week we had Boston Fed Pres Rosengren, usually a dove, saying the market is underesti-mating the strength of the US economy and also underestimating how many rate increases lie ahead.

When trying to get a read on sentiment, we’ll take just about anything. This time we like the FT’s head-line “Stocks soft as traders tweak Fed timing.” The market had become too accustomed to a dovish men-tality, witness the BoA ML managers survey showing expectations for a hike this year down to 49% from 54% in April. Read that again—less than a 50% chance of a hike over the next 12 months.

But now the ship is turning around. The US 2-year yield is up 2 bp to 0.84%, the highest in three weeks. The 10-year is up 3 bp to 1.785 even while being suppressed by foreign buyers fleeing negative rates elsewhere. And the yield curve is the flattest since Dec 2007. Gloomsters who seeks signs of recession think it could invert, but actually, the yield curve is distorted by foreign buyers.

The disconnect between what the Fed is saying and what the market believes is a terrible thing. As the June FOMC gets ever closer—it’s now a mere 4 weeks away—the Fed has to convince traders that June is possible—or it cannot act in June. At least that is the assumption of Fed-watchers. The Fed wants not to surprise and upset the markets. The Fed considers “managing expectations” to be a serious component of transparency. But traders just won’t cooperate. The global fund managers see a less than 50% chance of a hike over the next 12 months when the Fed is saying two hikes this calendar year. Something’s got to give.

If the Fed retreats because of expectations of Brexit or any other factor, the market will be “right.” If the Fed says to hell with the market and hikes anyway in June, what is the fall-out? We don’t know but can guess that the egg-heads in the Fed’s back room are working on it. The cowardice case is dollar-negative and the shock case is dollar-friendly. Take your pick.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 109.41 | LONG USD | WEAK | 05/08/16 | 107.91 | 1.39% |

| GBP/USD | 1.4419 | SHORT GBP | WEAK | 05/16/16 | 1.4334 | -0.59% |

| EUR/USD | 1.1270 | SHORT EURO | WEAK | 05/16/16 | 1.1309 | 0.34% |

| EUR/JPY | 123.31 | SHORT EURO | WEAK | 05/02/16 | 122.33 | -0.80% |

| EUR/GBP | 0.7816 | SHORT EURO | WEAK | 05/02/16 | 0.7864 | 0.61% |

| USD/CHF | 0.9834 | LONG USD | WEAK | 05/10/16 | 0.9738 | 0.99% |

| USD/CAD | 1.2965 | LONG USD | WEAK | 05/10/16 | 1.2945 | 0.15% |

| NZD/USD | 0.6777 | SHORT NZD | WEAK | 05/10/16 | 0.6749 | -0.41% |

| AUD/USD | 0.7282 | SHORT AUD | WEAK | 05/08/16 | 0.7354 | 0.98% |

| AUD/JPY | 79.67 | SHORT AUD | STRONG | 04/02/16 | 81.17 | 1.85% |

| USD/MXN | 18.4062 | LONG USD | WEAK | 05/06/16 | 17.9418 | 2.59% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.