Outlook

We get the last FOMC minutes today and some folks will want to examine them in minute detail, but we bet all the action lies in the oil price story. Russian sources told the press some interesting nuggets (and the Russian Energy Ministry spokeswoman confirmed the information is accurate). First, Russia predicts the acceptable price is $45-50—this is the number that will balance the market, and do it faster than non-interference would do by about six months. Anything higher will goose the shale guys into raising output. "Now there is discussion of how long production will be frozen and ways to monitor the agreement," one of the sources said.

"A freeze without Iran is being discussed. At the moment we don't see tough conditions (from others) for Iran to join," one of the sources said. Russia thinks Iran is increasing exports with low-hanging fruit (oil from storage) and will take a long time to get to the target of 4 million bpd in exports. Besides, the Doha deal will target output, not exports. Doha will include 17 countries, including a few that used to belong to the Soviet Union. Russia itself wants to deepen cooperation with OPEC without actually joining.

We continue to believe Doha is a very Big Deal and will be a game-changer. Outcomes may include a rise in capital spending once companies have a better grip on costs. Another might be a fall-back in alternative energy initiatives, since it’s oil over $100 that gives them much of their momentum.

What does it mean for the dollar? The conventional wisdom is the inverse correlation—oil up, dollar down and vice versa. As we have complained too many times to count, this is a self-reinforcing idea that is fairly dumb at its very core, but never mind. We shall see if it works this time.

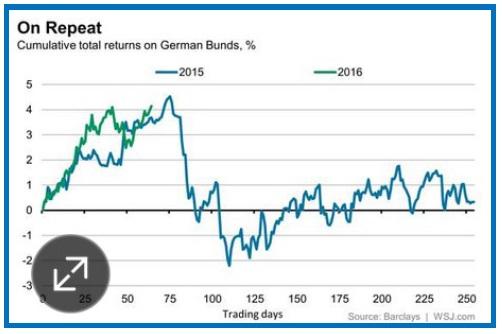

The debate about negative rates continues to simmer away on the back burner. The WSJ has a story today pointing out that near-negative rates actually raise risks for those condemned or choosing to invest in this sector. “The 10-year German yield fell below 0.1% Tuesday, moving closer to the all-time low closing yield of 0.073%. The yield has fallen around half a percentage point since the start of the year, with even larger declines recorded for longer-dated bonds. As a result, German bonds overall have returned 4.1% so far this year, according to Barclays indexes. Given the German DAX is down more than 10% year-to-date, that counts as a big result.

“But investors shouldn’t feel too comfortable. As yields decline, the margin for investment error shrinks drastically, as there is no cushion available to absorb moves in price. At a yield of 0.09%, more than 11 years’ worth of income would be wiped out if the 10-year bond drops in price by just one point. Yields wouldn’t even have to rise that much: a move one point lower equates to only a 0.1-percentage-point rise in the yield, to 0.19%, according to Tradeweb data.”

And it looks like this year could run parallel to last year. See the chart. By April 20, 2015 investors were up 4.5%. But by June 10, all of those gains and more had been wiped out, with the market down 2.2%.” Buying bonds at low yields can wipe you out if inflation and growth pick up. “A bond with a negative yield, if held to maturity, is like an expensive piggy bank that must be smashed to retrieve the cash inside. The German bond rally has delivered gains. But it has also left investors picking up pennies in front of a steamroller.”

Yesterday we wrote about bank leverage being (possibly) still dangerous. But leverage is not the only thing and leverage in US banks is not the only source of danger. What if some big European (probably German) banks take a big hit on holding bonds—which they are supposed to do as reserves and collateral?

Risk appetite may be on a new roll because of Doha, but some structural issues can still jump up and bite us on the rear-end. Here’s a shocker—Doha is more important than the US presidential candidates.

Fun Tidbit: The new Treasury rules on inversions is excoriated as a politically motivated and illegal move by the President in the WSJ, with a slant so steep it makes your hair hurt. The FT ranges more widely (and fairly) over the issues and quotes a professor who says “… the Treasury was right to eliminate what amounts to an unfair advantage for multinationals. ‘You shouldn’t have one set of rules for offshore companies and a different set of rules for others.’” Be careful what you read.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 110.44 | SHORT USD | WEAK | 02/04/16 | 117.57 | 6.06% |

| GBP/USD | 1.4107 | LONG GBP | WEAK | 03/31/16 | 1.4371 | -1.84% |

| EUR/USD | 1.1354 | LONG EURO | WEAK | 03/11/16 | 1.1094 | 2.34% |

| EUR/JPY | 125.40 | LONG EURO | STRONG | 03/29/16 | 127.24 | -1.45% |

| EUR/GBP | 0.8048 | LONG EURO | WEAK | 03/11/16 | 0.7759 | 3.72% |

| USD/CHF | 0.9601 | SHORT USD | STRONG | 03/11/16 | 0.9877 | 2.79% |

| USD/CAD | 1.3169 | SHORT USD | STRONG | 02/01/16 | 1.4031 | 6.14% |

| NZD/USD | 0.6790 | LONG NZD | STRONG | 02/01/16 | 0.6478 | 4.82% |

| AUD/USD | 0.7551 | LONG AUD | STRONG | 01/25/16 | 0.6980 | 8.18% |

| AUD/JPY | 83.39 | LONG AUD | STRONG | 03/03/16 | 83.57 | -0.22% |

| USD/MXN | 17.7344 | SHORT USD | STRONG | 02/23/16 | 18.1208 | 2.13% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.