Outlook:

Equity market players prefer to trade on sentiment about uncertainty over the usual equity market measures (earnings, etc.). The WSJ writes “Some investors have also used the oil price as a gauge of the health of the global economy, responding to downward moves by selling risky assets, such as stocks, across the board.”

Oil prices are falling not because demand indicates a recession is coming, but rather because overpro-duction has generated a giant glut. It’s pretty simple Econ 101 supply-and-demand. It has nothing what-ever to do with the overall condition of the rest of the real economy or with earnings projections outside the oil patch. But obsessions can take on a life of their own, with or without facts and logic. The correla-tion of oil and equities seems like a “truth” and so traders make it self-fulfilling. The FT has a slightly more convincing argument—oil sector earnings are not negligible, especially in the FTSE 100. Banks’ balance sheets might be adversely affected by oil company woes. And oil-producing country sovereign wealth funds may have to sell assets. We don’t know if this last one is actually true, but it sounds good. We do read that Norway’s oil company will cut investment by a substantial amount, which may (or may not) imply a later drop in sovereign fund funds.

The real problem comes from the implications of a BoA-ML analysis: the oil price drop “has certainly rattled all asset markets, including rates, FX, equities and bonds — a shift that has increased the risks of a global recession in the near-term.”

Really? How does that work? The standard mechanism is supposed to be a giant drop in asset values that makes people feel poorer and so they cut back activity (and save more). This is true of companies as well as individuals. Producers of goods and services project falling demand and so produce less, creating a vicious circle. Prices fall as producers try to maintain market share. Employment falls.

Nobody would deny that fear of recession is one of the causes of recession, but honestly, the data is spotty so far on that score. Output PMI’s have been disappointing but not horrible. Employment is still rising. Even prices are still rising, if not by much. Economists continue to say the probability of reces-sion is about 20%. So then we have to ask at what level of expectations does the probability of recession create a self-fulfilling prophecy?

Let’s not forget that oil and the dollar are supposed to have a negative correlation. Oil up, dollar down and vice versa. Traders and analysts used to twist themselves into pretzels trying to make this one seem sane and reasonable. And indeed over the past year we have had a huge drop in oil and a big rise in the dollar, and yet we hear nothing about the supposed correlation anymore. Attention has switched to equi-ties instead. Golly, it looks like traders have a presumed correlation looking for a partner. We have something similar with the Chinese currency. Ahead of the G-20 meeting in Shanghai this Fri-day and Saturday, analysts are out in force with opinions about whether China should do another one-time devaluation or maybe the yuan should appreciate. Expectations are fading fast for a “new Plaza Accord” or a big and wonderful initiative from China.

The most we can realistically expect from G-20 is a repetition of the commitment to avoid currency manipulation/currency wars and a restatement of China’s commitment to continue freeing up its mar-kets. It’s an empty commitment in both cases. The capital outflow from China arises not only from expectations of devaluation but also the botched and mangled policy response to the equity meltdowns last August and again in January. Firing the top securities regulator over the weekend has no meaning. China has revealed that it lacks the spine to accept the consequences of free markets, which can indeed be awful (and a threat to political stability). Even if they know what to do on matters like circuit-breakers, the political leadership doesn’t always take guidance from the guys who have the market knowledge.

The US has already warned us not to expect anything big from G-20. This morning TreasSec Lew said “Don’t expect a crisis response in a non-crisis environment. This is a moment where you’ve got real economies doing better than markets think in some cases.” Lew also said the “US wants a more serious commitment from other G-20 countries to use monetary policy, fiscal measures and structural reforms to stoke demand,” according to Bloomberg, “’You can’t count on the United States providing all the de-mand for the world. You can’t be the consumer of first and last resort,’ he said, adding that China can do more to stimulate consumer demand and Europe and Japan can use fiscal policy to boost growth.” If there is “reticence to make the commitment to refrain from competitive devaluation and not take it a lit-tle bit of a step further, that would be a cause of real concern.”

So there.

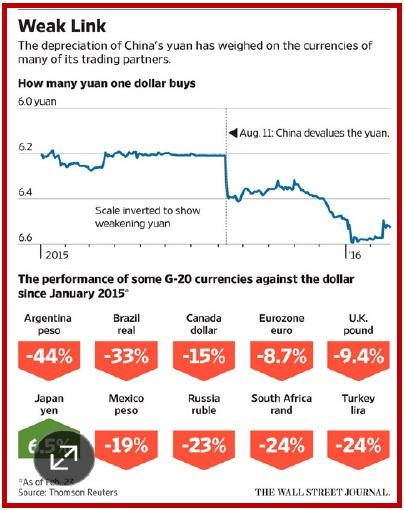

The falling yuan is seen as correlative to other currency movements when the actual relationship is weak or non-existent, and other factors carry far more determinative weight. See the table from the WSJ. You can imagine perfectly good reasons other than contagion from the yuan for every currency here to have fallen. We can name a dozen factors more important than China, including interest rate trends and confi-dence in government. Case in point—Moody’s just downgraded Brazil to junk. It’s a cute table but meaningless.

Probably the most interesting thing about the FX market today is the euro seeming to have lost its safe-haven status, which was always a curiosity. It’s hard to apportion blame. Some has to go to the expected robust policy response of the ECB come March 10, with a more negative rate for bank re-serves and possibly a rise in the QE amount. Some has to go to the recent crummy data that will be the ECB’s inspiration.

And some probably has to be attributed to Brexit. After all, Britain would be the first and only country to exit voluntarily. Greece didn’t have what Britain already has—an independent currency, so Grexit was different by a lot. Does the prospect of Brexit drag down the euro? Yes, probably, a little, but it’s hardly the topmost factor—yet. The time might come when some of the murky reasoning of the Brexit propo-nents becomes contagious. A financial transactions tax, which was always a stupid idea, may already be dead. What it means for social welfare programs for immigrants and refugees remains to be seen.

As for sterling itself, HSBC garnered headlines this morning with a report saying “sterling could lose up to 20 percent of its value and UK economic growth could be up to 1.5 percentage points lower next year if Britons vote to leave the European Union in the June 23 referendum,” according to Reuters. The rise in uncertainty would be horrible, leading to the pound down 15-20% and thus back to parity with the euro. Inflation would rise by as much as 5% and growth would contract by 1-1.5% (vs. 2.3% in the cur-rent BoE forecast). “The hit to growth could be even more severe if the Bank of England raises interest rates to counter the sharp fall in sterling.”

So now we have three major countries all in a tizzy—Japan, the UK and China. No wonder the dollar is in favor. It has little to do with yield differentials and other boring old financial metrics, and everything to do with uncertainty, which is becoming vastly more expensive. The options guys must be drooling.

The biggest threats to the dollar today are (1) the Fed backtracking on its one lonely hike last December and (2) Trump. Yesterday Dallas Fed Pres Kaplan said we may have to be patient for a very long time before moving again. This is hardly new. As for Trump, nobody really believes he would or could single-handedly impose a giant tariff on Chinese goods or execute any of the other wild ideas he has proposed. It may well be true that he is proposing this crazy stuff just to get the public’s attention, and of course it’s working. But at some point uncertainty about the US’ economic path could be dollar-negative. That’s a long way off. For the immediate future, we are removing our reservations on the dollar rally. Actually, it’s not the dollar rallying but rather other currencies falling, especially the pound and euro. We don’t see an end in sight.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 111.83 | SHORT USD | STRONG | 02/04/16 | 117.57 | 4.88% |

| GBP/USD | 1.3896 | SHORT GBP | STRONG | 02/17/16 | 1.4349 | 3.16% |

| EUR/USD | 1.0981 | SHORT EURO | NEW*WEAK | 02/23/16 | 1.1011 | 0.27% |

| EUR/JPY | 122.81 | SHORT EURO | WEAK | 02/11/16 | 126.19 | 2.68% |

| EUR/GBP | 0.7901 | LONG EURO | WEAK | 10/23/15 | 0.7194 | 9.83% |

| USD/CHF | 0.9923 | SHORT USD | STRONG | 01/04/16 | 0.9979 | 0.56% |

| USD/CAD | 1.3824 | SHORT USD | STRONG | 02/01/16 | 1.4031 | 1.48% |

| NZD/USD | 0.6607 | LONG NZD | WEAK | 02/02/16 | 0.6486 | 1.87% |

| AUD/USD | 0.7168 | LONG AUD | STRONG | 01/25/16 | 0.6980 | 2.69% |

| AUD/JPY | 80.16 | SHORT AUD | WEAK | 02/11/16 | 78.47 | -2.15% |

| USD/MXN | 18.2658 | SHORT USD | NEW*WEAK | 02/23/16 | 16.1208 | -0.80% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.