Outlook:

Today we get the usual weekly jobless claims, the Nov Philadelphia Fed index and October leading indicators. We also get speeches from two important Feds, Atlanta Fed Pres Lockhart and Vice Chairman Fischer (after the close).

The bigger news will be the minutes of the ECB meeting and a speech by Draghi. At a guess, the Fed will be doing less on the hawkish side (25 bp) than the ECB will be doing on the dovish side, expected to be a rise by €15 billion in QE purchases plus a 10 bp cut in the deposit rate. This would widen the divergence to the euro’s disadvantage, but we don’t yet know if it will set off a new euro rout because it may be priced in already.

The Fed minutes were fully priced in and we got a strong “sell on the news” effect. In addition to profit-taking and position adjustment, we also got a kickback against the newly re-formed shift in the consen-sus of a stronger dollar. If there’s one thing the FX market hates, it’s consensus. We name it the “Yeah, but” effect—once the market determines an outlook, it has to go out and find something wrong with it, probably that it’s a “dovish hike,” a silly term if ever we heard one.

The focus is on the number of hikes. The Fed’s Sept dots came up with four, but that is widely derided as not do-able in the context of every Fed in sight and especially Yellen saying the word “gradual” so often it has worn a path in our heads. And those who forecast a tepid one-time Fed have confidence in their own forecasts of a tepid economy, or at least one that is not generating inflation.

This seems entirely reasonable today, but macro forecasts have a funny way of being wrong almost all the time. For example, we could easily get a recovery in commodities next year that is really just a reac-tion to oversold conditions (a so-called bear market rally). Yes, the Fed considers commodity prices temporary and often aberrant, but the market sees a rise in oil and industrial metals, and thinks “inflation.” Who is to say a commodity rise would not induce clamor about the Fed being behind the curve and a more rapid pace of hikes looking appropriate?

The strange thing about perverse FX price moves like this one is that you can pretty much know what is going on and still not know how to trade it. We could get a “sell on the news” effect from the ECB news today, or even a fresh “buy on the rumor” if Draghi says anything out of line with expectations. These wobbles can cloud perception of the main move—a breakout, eventually, of the psychological line in the sand at 1.0500 and then parity.

This Big Picture consensus is based on yields. In the 2-year, US yields closed at 0.875% yesterday (from 0.60% a month ago). And that rise is in the face of increased demand, which pushes yields down. In the 10-year, the current yield of 2.265% is only a little more than 2.173% at year-end for the same reason, and therefore with a lot of room on the upside. Now look at the Schatz and Bund. The 2-year is a negative 0.037% and the 10-year is a measly 0.512%. The spread is widening in the dollar’s favor. In fact, it’s the widest since 2006, according to the WSJ.

But all this is uncharted water and traders fear dragons. If they didn’t Fed funds futures would have a higher projection of the Dec hike. It’s currently 68%, according to the CME. This is better than 38% before the Oct FOMC statement, but it’s not a dead cert. And we find it worrisome that the projection has stayed at 0.68% for over a week. Fed funds futures are a lousy forecasting tool, but why is it not changing?

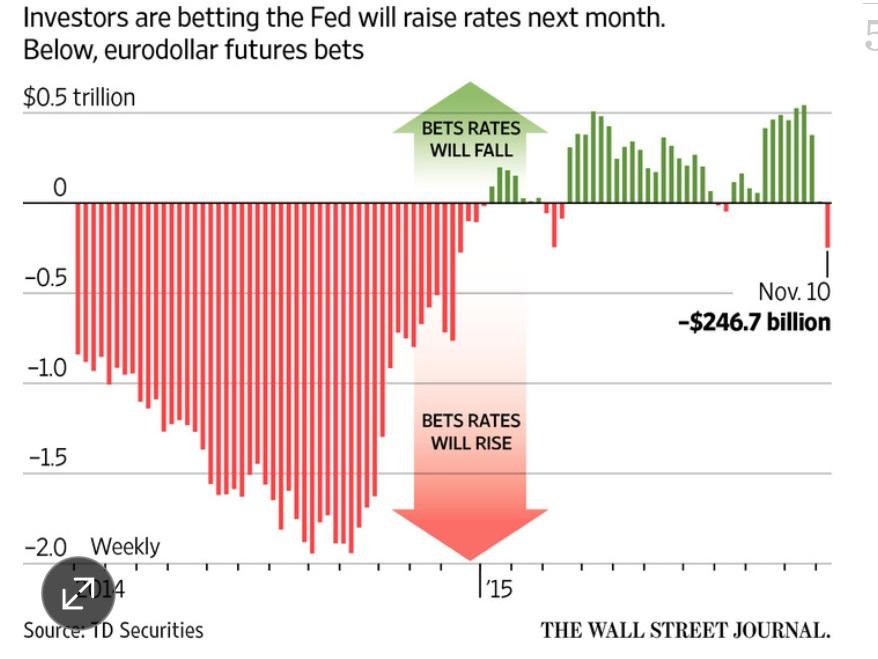

Another measure is Eurodollar futures. See the chart. The WSJ writes “Rate-increase wagers in the euro-dollar-futures market, reflecting expected interest rates on dollars held in banks overseas at a certain date, reached $246.7 billion last week, according to Cheng Chen, interest-rate strategist at TD Securi-ties…. The value of net shorts on eurodollar futures contracts was $246.7 billion for the week ended Nov. 10, the highest level since Dec. 16, 2014. It was the first weekly net short since August. The net long bet, reflecting a wager on continued low rates, hit $542.8 billion before the Fed’s October meeting, the highest since May 2013.”

This takes a little unravelling. First is the volatility. The market was still betting against the Fed and by the most since May 2013 the week before the Oct FOMC. This shows a scary lack of confidence in the Fed, or maybe a lack of confidence in the communication skills of the Fed.

Second is the scope. The chart is lopsided, with the size of earlier bets against a hike far bigger than the bets now favoring a hike. Maybe it has something to do with hedger’s needs and thus the composition of the hedging group, but it would seem as though real trust in economic recovery and in the Fed is pretty weak. If this market was willing to go negative on the Fed just three weeks ago, it can do it again on any sign of lack of commitment. Finally, the green will-hike bars are waxing and waning. Sentiment shifted at the beginning of the year, but is not rising in a steady, tidy trajectory. This is more than plain-vanilla volatility. It’s messiness, and messiness generates a self-reinforcing feedback loop to volatility and low-confidence sentiment. It will be interesting to see this same chart on (say) March 31.

As noted above, you can pretty much know what is going on and still not know how to trade it. If you take the long view and just load up on dollars on the assumption that 1.05 and parity are inevi-table, based on yields, you can get zapped with an aberrant euro rise. This is exactly what happened yes-terday. And fiddly position-adjustment corrections can be fatal to those without deep pockets. On the whole, we favor the dollar, but we must always be mindful that the market as a whole has a long-standing anti-dollar bias that can jump up unexpectedly and bite you on the rear when you least expect it.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 123.16 | LONG USD | STRONG | 10/23/15 | 120.45 | 2.25% |

| GBP/USD | 1.5268 | SHORT GBP | STRONG | 11/06/15 | 1.5137 | -0.87% |

| EUR/USD | 1.0702 | SHORT EUR | STRONG | 10/23/15 | 1.1115 | 3.72% |

| EUR/JPY | 131.79 | SHORT EURO | STRONG | 10/23/15 | 133.88 | 1.56% |

| EUR/GBP | 0.7009 | SHORT EURO | STRONG | 10/23/15 | 0.7220 | 2.92% |

| USD/CHF | 1.0181 | LONG USD | WEAK | 10/23/15 | 0.9735 | 4.58% |

| USD/CAD | 1.3259 | LONG USD | STRONG | 10/28/15 | 1.3235 | 0.18% |

| NZD/USD | 0.6517 | SHORT NZD | WEAK | 10/05/15 | 0.6641 | 1.87% |

| AUD/USD | 0.7169 | SHORT AUD | STRONG | 10/29/15 | 0.7087 | -1.16% |

| AUD/JPY | 88.28 | LONG AUD | WEAK | 10/08/15 | 86.06 | 2.58% |

| USD/MXN | 16.6362 | LONG USD | WEAK | 11/06/15 | 16.6275 | 0.05% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.