Outlook:

On Wednesday the market overreacted to low retail sales data and trashed the dollar, and on Thursday the market overreacted on high CPI data in the other direction, causing an outsized dollar gain. This is not the Big Picture overshooting that economists talk about, but rather overshooting from frayed trader nerves.

And traders have good cause to feel disoriented and confused by a lack of guidance from the Fed. Yesterday NY Fed Dudley came right out and said he doesn’t know if we will get a hike this year. There is still a lot of data to come in. "So let's see what the data is. It's crazy to presume what the data is going to be before you actually observe it." Market News reports when “Asked specifically whether the Fed was going to raise rates in December or not, Dudley said ‘I wish I knew the answer to that.’"

The WSJ notes that Dudley also denied any “revolt” or unusual divisiveness among the Feds. "At the end of the day people are exaggerating" the differences among members “We are all pretty much on the same page."

That’s nice to hear. What page is that? Cleveland Fed Master said Fed decision-making is a “journey.” Oh, great, hippie-dippie gibberish. What’s next, crystals? It may not be fair to characterize economic thinking that way, but honestly, “journey” is not helpful.

The splendidly acerbic John Taylor (he of the Taylor Rule) said "No one knows what you are doing. You can be out there talking all the time and thinking you're being transparent and just confusing things."

Reuters ends its story on the conference where all this was taking place yesterday (at NYU) with Dudley’s remarks that (1) the slowdown in due to temporary factors, including the strong dollar and (2) falling unemployment will eventually lead to rising prices. You don’t have to see actual price increases to have confidence they are trending higher eventually. "I see a linkage between pressure on labor market resources and my confidence in inflation." Oh, good, imaginary data.

The WSJ opines that “… more Fed officials seem to be coming around to the view that the relationship between falling unemployment and rising inflation isn’t as strong as they supposed. The result: chances of them raising rates before the year is out have diminished. It would take a stronger inflation report than Thursday’s for those odds to change.”

Fed funds futures, a very bad indicator that we all watch anyway, shows a 30.9% probability of a Dec hike, from 64.3% a month ago, according to the FT. March is the new December, with odds of 53.6%.

Traders in more than one market are girding their loins for China’s release of GDP on Monday.

Forecasts range from 4% (Capital Economics) to 7% (the official Q2 number), with most analysts saying they believe China will deliver whatever number they think the financial world can live with. The idea is that China does not want to be the source of a crisis and has to tweak the data to avoid scaring the pants off commodity and equity traders. This may be a scurrilous false charge or it may be true. The Chinese data has taken on more weight than it should be expected to carry or is warranted (like payrolls).

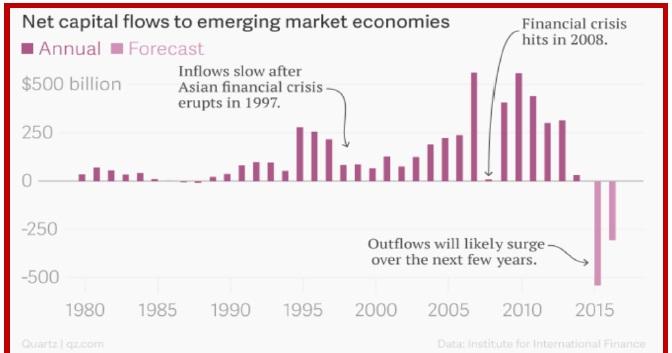

China’s GDP data does warrant the attention. The Institute of International Finance, a Washington lobby for the big banks, projects capital outflows from emerging markets that will re-arrange the global financial landscape. See the chart. The EMs will see outflows for the first time in 27 years this year and next because China is sharply cutting its imports of the goods, chiefly raw materials, it buys from them. The outflow will be about $500 million this year alone. Moreover, because of slowing global demand, China will have lower exports and thus lower export earnings, meaning fewer dollars to spend on reserves. It could even continue to dump dollars as it uses reserves to intervene or for other purposes. Meanwhile, a vicious circle develops in which the EM’s currencies fall even further, driving more investors away.

The IFF may be a business lobby, but it has some good economists and has earned clout. It has been delivering data about the capital outflow from emerging markets for some time now and can be said to have succeeded in getting everyone’s attention. The problem is that it’s still just forecasting. It may have terrific data and cogent reasoning, but so have many other Big Picture Macro scenarios that never came true. For example, maybe the capital outflows projected on the IFF chart have as a base assumption that the US raises rates before year-end. Take away that assumption and the outflow would surely be lessened. Or maybe the forecasters are not giving enough weight to a Chinese stimulus plan that would substitute domestic demand for foreign demand, or a re-balancing between goods and services. After all, during the 2008-09 financial crisis, China did a heroic job.

Besides, the dithering at the Fed really does mean “lower for longer” no matter when the first hike comes, and capital is already flowing back to emerging markets. This morning BoA/ML reported “EM is back...The collapse in Fed hike expectations gave oversold junk a bid." Reuters reports “BAML said global equity funds had received $2.6 billion, the first inflow in four weeks while bond inflows of $3.8 billion were the largest in 12 weeks. Emerging equity funds which have shed around $60 billion year-to-date, enjoyed their first inflows in 14 weeks, albeit just $700 million, while emerging debt received $400 million, the first inflow in 12 weeks, the report said. Chinese equity fund inflows hit a 14-week high, according to EPFR.

"Although the recent run of outflows from EM equity funds has arguably pushed into excess territory, and is hence sending a contrarian 'buy' signal, it is the more benign interpretation of China's growth trajectory that is having the biggest impact on flows."

So, consider the vast outflow from emerging markets that IFF projects for this year. Assuming the Fed takes no action until March, we could easily get a big reduction or even a reversal of that outflow. We could even get a net inflow that lasts into 2016 as investors keep doing what they always do—seek yield.

This is not to downplay the effect Chinese GDP is going to have on Monday. It is to say we shouldn’t rush to into a doomsday scenario. Maybe China will report a high number, or a high enough number that skeptics can’t be sure it’s an engineered number. We don’t know for sure the calumny of phony numbers is accurate, anyway. For all we know, the Chinese are as honest about their numbers as anyone else—Japan, say, where official data is as good as it gets. A high-enough number would reduce or postpone a crisis mentality.

A low number could indeed set off a pinball effect of falling equities, crashing commodities, and safe haven flows into some currencies (Swiss franc, yen). The last China-driven crisis sent the euro soaring, but we have no guarantee that will be the effect this time.

One thing we can feel relatively confident about is that nobody will want to go into the weekend long dollars. We may well get a dip to the Fib levels named above, but that would only make it a “normal” pullback. Pullbacks can be very short-lived and this one is likely to be short-lived, too.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 119.11 | SHORT USD | WEAK | 10/15/15 | 118.41 | -0.59% |

| GBP/USD | 1.5447 | LONG GBP | WEAK | 10/08/15 | 1.5346 | 0.66% |

| EUR/USD | 1.1347 | LONG EUR | WEAK | 09/29/15 | 1.1226 | 1.08% |

| EUR/JPY | 135.16 | LONG EURO | STRONG | 10/13/15 | 136.32 | -0.85% |

| EUR/GBP | 0.7346 | LONG EURO | STRONG | 08/13/15 | 0.7117 | 3.22% |

| USD/CHF | 0.9453 | SHORT USD | STRONG | 10/09/15 | 0.9612 | 1.65% |

| USD/CAD | 1.2898 | SHORT USD | STRONG | 10/06/15 | 1.3082 | 1.41% |

| NZD/USD | 0.6790 | LONG NZD | STRONG | 10/05/15 | 0.6523 | 4.09% |

| AUD/USD | 0.7277 | LONG AUD | STRONG | 10/07/15 | 0.7206 | 0.99% |

| AUD/JPY | 86.68 | LONG AUD | STRONG | 10/08/15 | 86.06 | 0.72% |

| USD/MXN | 16.4319 | SHORT USD | WEAK | 10/08/15 | 16.6283 | 1.18% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.