Daily Forecast - 30 September 2014

EURJPY Spot

EURJPY rocketed in the second 2 weeks of September but collapsed last week to lose 50% of the gain. We have stablised over the past 2 sessions but will only look more positive above immediate resistance at 139.05/15. Be ready to go with a break higher to target 139.42/45. Exit longs & try shorts here with stops above 1.3960. If we can reach as far as 1.3970/75 try shorts again with stops above 139.90.

Failure to hold above 138.70/65 keeps the market under pressure & targets the 2 week low at 138.40/35. Obviously this is key but a break lower looks increasingly likely for this week & would target good support at 138.15/10. Exit shorts & try longs BUT be prepared to add to longs down at 137.95/85 with a good chance of a bounce from here at this stage. This area could even mark the low for the 2 week correction.

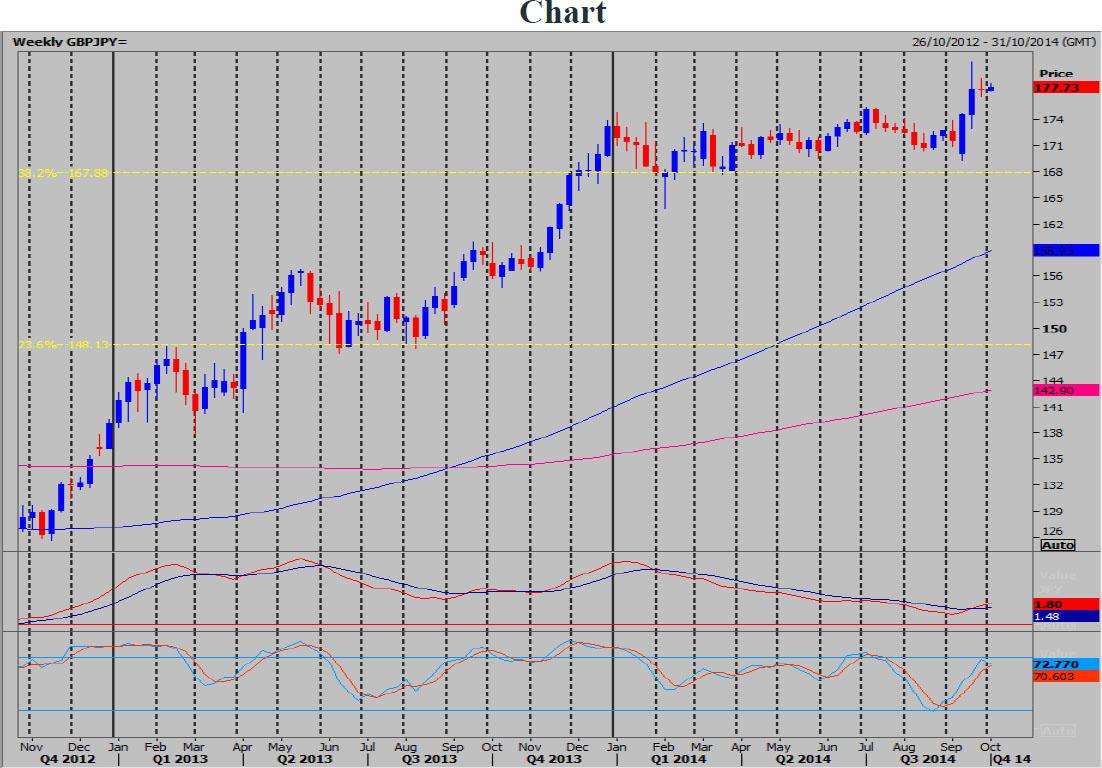

GBPJPY Spot

GBPJPY in a longer & short term bull trend. We have been pausing for breath over the past week to relieve the overbought conditions before the next leg higher. If we can beat last week's high at 178.60/70 we can re-start the bull trend & target trend line resistance at 179.20/25. Above here we look for a retest of September highs at 180.60/66.

The 3 day low of 177.25/10 is key for today. A break lower does look possible & should target support at 176.45/35 for a buying opportunity with stops below 176.00. Go with a break lower however as we could then target 175.25/00. Exit shorts & try longs with stops below 174.50.

EURGBP Spot

EURGBP in a 12 month bear trend with no sign of this reversing yet as we approach 2012 lows at 7753. However we are ranging for 3 days now & this may continue throughout the week to unwind oversold conditions. The 2 day low is 7795 but below here tests September lows at 7781. A break lower always likely in a bear trend & we then look for a test of important 2012 lows at 7753. A yearly low is always going to grab attention. This is also 7 year Fibonacci support BUT last time we bottomed here we also had the 200 month moving average here adding support. This is not the case now. However it is still worth exiting shorts & trying longs with wide stops below 7725.

Holding above 7805/00 is more positive for today & targets the 3 day high at 7830. If we continue higher look for a selling opportunity at 7845/50 with stops above 7867.

AUDJPY Spot

AUDJPY in a strong 3 week bear trend but has bounced aggressively off 9510/08 in the past 2 sessions. We could reach as far as strong resistance at 9590/95 today. Exit longs & try shorts with stops above 9615. An unexpected break higher however sees 9595/90 act as support for a move towards 9640/50. Again exit longs & try shorts with stops above 9670.

There is a good chance we will be unable to beat 9590 keeping the outlook negative for a return to last week's low at 9540/35. A break below the 2 day low at 9510/08 should trigger stops in the market & targets important key weekly support at 9470/65. It is possible we see a low for the week here, despite the strong bear trend. Exit shorts & try longs with stops below 9430.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.