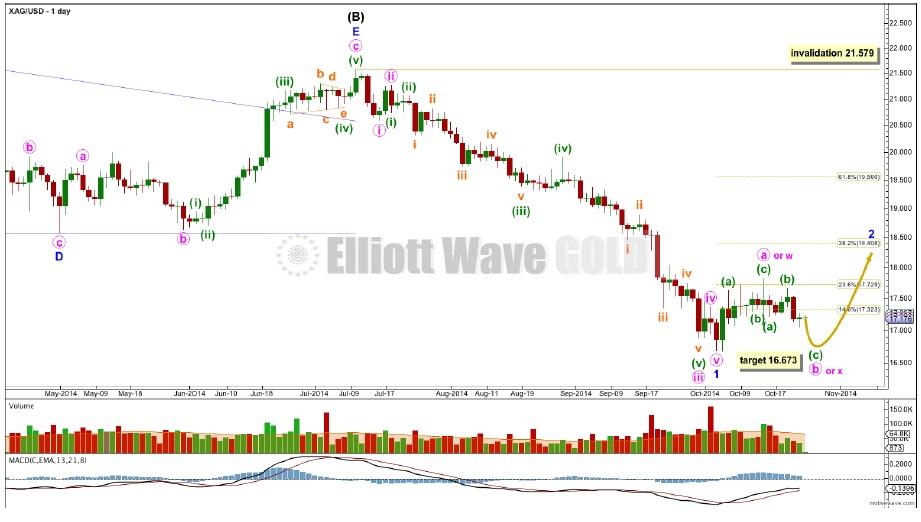

Sideways movement has confirmed an end to minor wave 1.

At this stage it looks like minor wave 2 may be a shallow correction, maybe only reaching up to the 0.382 Fibonacci ratio of minor wave 1 at 18.408. Second waves are most commonly deep corrections, but they are not always deep. That is a tendency not a rule.

So far minor wave 2 may be labeled minute wave a-b-c or w-x-y.

So far the first upwards movement within minor wave 2 subdivides as a zigzag. This may be either minute wave a within a flat correction for minor wave 2, or the first zigzag in a double zigzag for minor wave 2, or a zigzag as the first structure of a combination for minor wave 2.

If minor wave 2 is a flat correction then within it minute wave b must reach a minimum 90% length of minute wave a at 16.799. Minute wave b must subdivide as a three wave structure.

If minor wave 2 is a double zigzag then minute wave x should be a relatively shallow correction. The purpose of double zigzags is to deepen a correction when the first zigzag does not move price deep enough. To achieve this purpose their X waves are normally very shallow.

If minor wave 2 is a double combination then minute wave x be a deep correction. The purpose of double combinations is to take up time and move price sideways. To achieve this purpose their X waves are commonly rather deep (and may be very time consuming).

Within minute wave b downwards (or minute wave x) at 16.673 minuette wave (c) would reach 1.618 the length of minuette wave (a).

If minor wave 2 is an expanded flat or combination then minute wave b or x may make a new price extreme beyond the start of minute wave a or w. A new low below 16.685 is possible. There is no lower invalidation point for this reason.

Our service is educational, we aim to teach you how to learn to perform your own Elliott wave analysis.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.