Polish Zloty (EUR/PLN) – weaker and weaker…

April has been a tough month for the Zloty. This past week the market tried to correct its recent jump, but it seems the PLN depreciation might continue. Throughout the month, the local currency lost 3.3% in value and this is the worst result among emerging market currencies. The Zloty is under pressure as the market is waiting for Moody’s, which will announce Poland’s debt rating on May 13th. The outlook does not look good and a possible downgrade is possible. Investors are minimizing risks and capital is flowing out of the economy. The yield spread between Polish 10-year bonds and the German Bunds reached its highest since January. Also, yields of 10-year Polish bonds are way over 3% (first time in years higher than Hungarian bonds…). Global banks have mixed views about the PLN. Deutsche Bank mentioned the depreciation of the Zloty has gone too far while ING expects even harder times for the PLN and HUF. Not much is expected from the MPC although cutting interest rates on the next monetary policy meeting will not be shocking. Interesting statements about the Swiss franc mortgages crisis were made by Mateusz Morawiecki, Deputy Prime Minister and Minister of Development. He expects President Duda to present a new a project how to solve that problem in June. Morawiecki noted that Swiss franc mortgages are a serious problem and it has to be solved. What is surprising though, he stated that financial markets are not worried about the situation in Poland. Really? Higher yield spreads, foreign capital flying away and a depreciating Zloty cannot be called a “crisis” but are certainly warning signs. Just to end this part with a positive sign – unemployment in March dropped to 10%. That would be it.

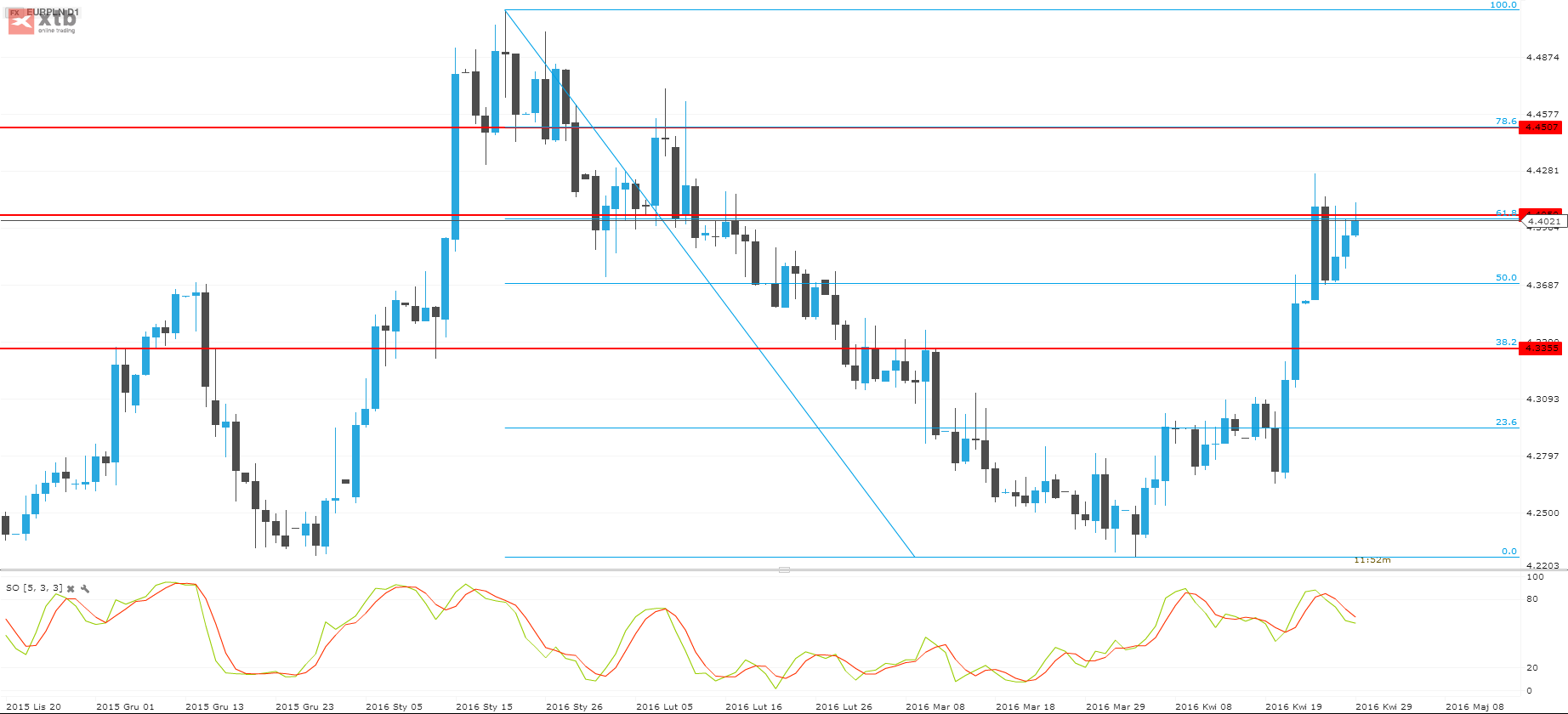

As we see on the daily chart, the EUR/PLN continued climbing and broke the 4.40 resistance level (61.8% retracement level of the last downward move) reaching 4.42, its highest level since February. The corrective movement ended at 4.37 and the market is back on its way up. If it breaks the resistance again, the EUR/PLN will be heading towards 4.45. On the other hand, if the market looses power and begins a corrective movement, the closest targets will be 4.37 and then 4.34.

Pic.1 EUR/PLN D1 source: xStation

Hungarian Forint (EUR/HUF) – Cut, cut, cut

As we have expected, the National Bank of Hungary (NBH) has lowered its key policy rate by 15 basis points to 1.05% on Tuesday. The MPC has drawn attention to the overnight deposit and lending rates in recent communication (which form the floor and ceiling, respectively, of the rate corridor). Furthermore, because of low inflation and slower growth, the monetary policy will remain extremely loose for the foreseeable future. The Monetary Policy Council said it "remains ready to use every instrument at its disposal to contain second-round inflationary effects." After all, the Forint was trading at 310.85 to the euro on the interbank market on Thursday, firming from 311.59 late on Wednesday.

From the technical perspective, despite of the interest rate cut, the EUR/HUF has decreased sharply after the NBH decision on Tuesday afternoon. On the other hand, the currency pair rebounded during yesterday's trading session. The pair maintains a bullish perspective on the H4 chart despite the previous short retreat. The current target for the market is 312.50 while the support remains at 311.

Pic.2 EUR/HUF H4 source: Metatrader

Romanian Leu (EUR/RON) – Fruit of volatility in May

The major watchpoint ahead is still the range of effects of the new law changing the rules of the game in the real estate loan sector. Banks have complained, European institutions frowned, yet the Parliament voted to allow debtors to free themselves of any obligation by giving away the property used as collateral, which may become a problem in a country where prices have collapsed by roughly 50% since the top of the market, and in some segments even deeper than that. This may not have had a very visible outcome on the market, but we have to remember the Orthodox Easter this weekend and the inflows of Euros changed into RON that generally precede it. In the macro area we have seen a 2.6% m/m jump in building permits in March, positive results in the qualitative survey of the INS in all sectors and an unemployment rate that fell to 6.4%. The general tone may seem positive, but the volatility that the global markets seem ready to embrace in May and the influence of the bank law may push the RON of a rather steep defensive path.

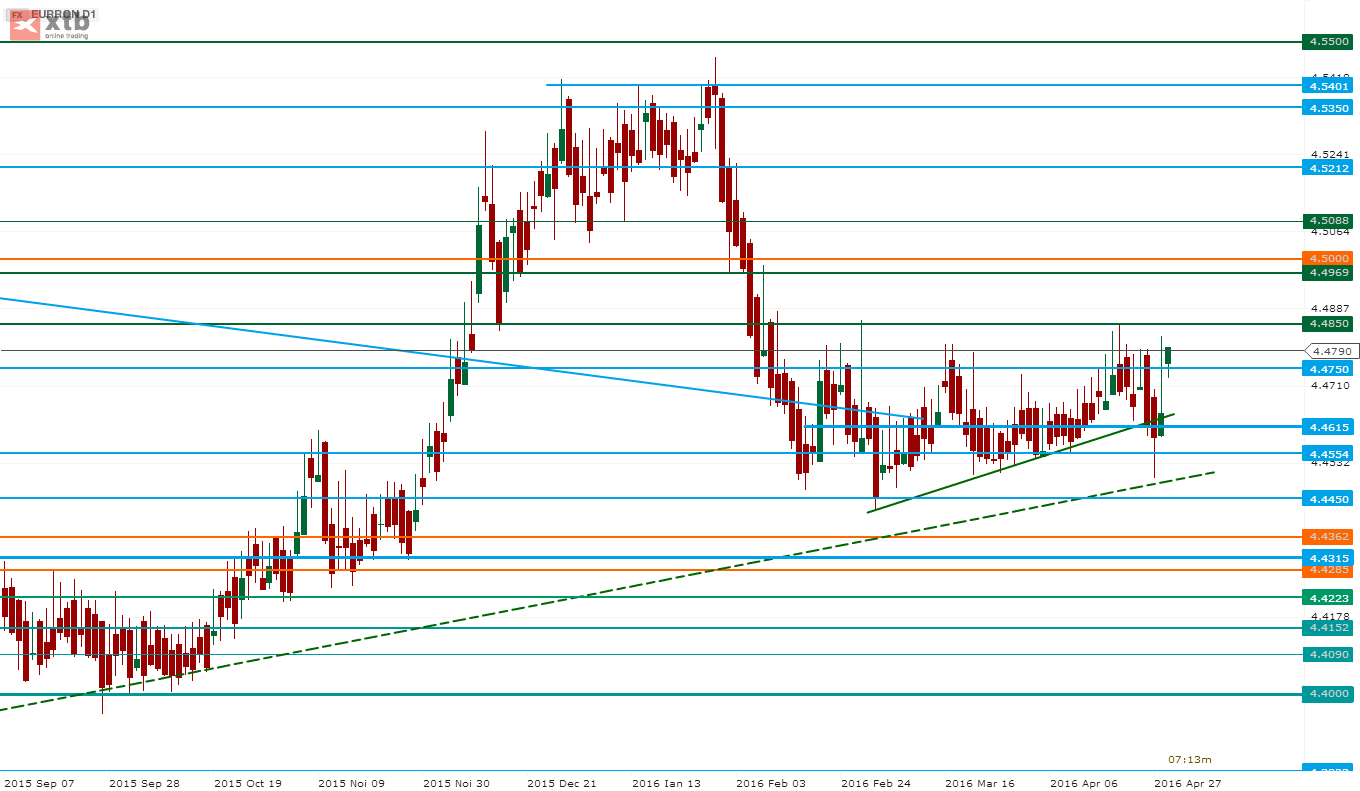

In the technical perspective one may witness a fresh bout of bullishness. While this is not yet definite, it may well be the case that a close above 4.4850 opens the way to further appreciation. It may be too much to rely on the triangle width to forecast a target of 4.5250, but 4.5000 may seem a reasonable first resistance. Initial support is at 4.4615 and then 4.4500.

Pic.3 EUR/RON D1 source: xStation

X-Trade Brokers Dom Maklerski S.A. does not take responsibility for investment decisions made under the influence of the information published on this website. None of the published information can be treated as a recommendation, disposition, promise, or guarantee that the investor will achieve a profit or will minimize risk using the information published on this website. Transactions including investment instruments, especially derivatives using leverage, are in its nature speculative and can provide both profits and losses that can exceed the initial deposit engaged by the investor.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.