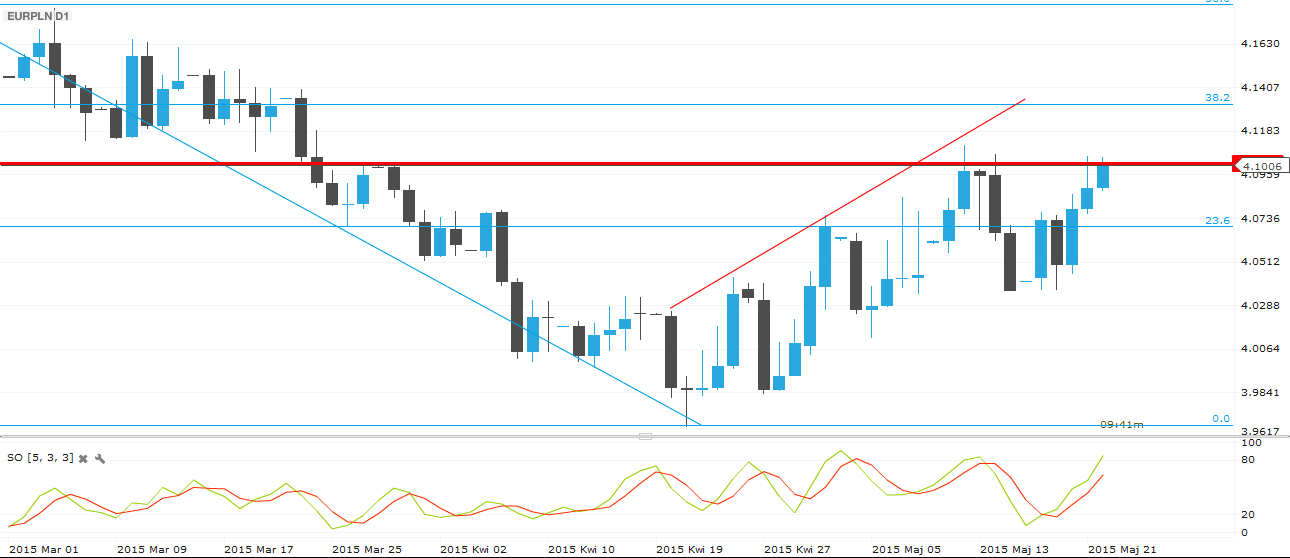

Polish Zloty (EUR/PLN) – approaching the 4.10 resistance

This upcoming Sunday the final round of presidential elections is coming up. Polls show it will be a close one. The two debates that both candidates took part in (ruling President Bronislaw Komorowski and rightist candidate Andrzej Duda) were supposedly won by Komorowski. Thanks to that, the current President regained some of the votes as it seemed he will lose in the second round. Now, both candidates have equal chances of winning. We will all find out after the weekend. The market can react as Komorowski is regarded (very subjectively) as more business-friendly. So the main news were mainly about the elections but in the meantime we had some macro publications. Average wages increase d by 3.7% in April (yearly basis) which was lower than expected. The negative (surprising) news were published on Wednesday when we learned that retails sales declined by 1.5% (yearly basis) and industrial production increased only by 2.3% (also yearly basis) in April. Despite the lower than expected readings, we do not expect any moves by the MPC.As we see on the daily chart, the EUR/PLN was unable to break the 4.04 support and rebounded. Currently, it is attacking the 4.10 resistance (levels from May 12th). If the market rushes through that level, the next target will be 4.14. On the other hand, it seems the market it losing some power. The stochastic oscillator also shows it could be overbought. If the EUR/PLN bounces back, it should head towards 4.07 and then back to 4.04.

Pic.1 EUR/PLN D1 source: xStation

Hungarian Forint (EUR/HUF) – Greece still holds back the Forint power

The Hungarian Forint was mostly affected by the news from Greece this past week. Internally, Hungary’s Economy Minister, Mihály Varga, has submitted a package of laws for the 2016 budget bill that would amend the debt formula. It had not much impact on the Froint market. To put it in a nutshell, the Economy Ministry classifies numerous budget data and will eliminate the bonus system for advertising agencies. According to the bill, a flat-rate corporate income tax system would enter into effect on January 1st of 2020, instead of January 1st of 2016. Next week will be one of the hardest periods from the economic calendar perspective. Hungary is faced with the MPC interest rate decision, labor market data and PPI indices publications during the next 7 days. Probably, the National Bank of Hungary would not miss the chance and members will reduce the base rate from the current 1.8%. Basically, this step has already been discounted by the market. However, it could also hold back the Forint bulls in the near future.Technical analysis also shows that the EUR/HUF could stay at higher levels. We can see a strong upward channel which determined the currency pair's movements in the past few weeks. The 38.2% Fibonacci level is the last chance for Forint bulls because after a possible break out the target would be at 311-312 (4 months high). Furthermore, quotes are moving above the 200 DEMA what should secure a good support for Euro bulls.

_20150522141432.png)

Pic.2 EUR/HUF D1 source: Metatrader

Romanian Leu (EUR/RON) – One GDP report does not bring the spring (for now)

We have all been surprised by the Q1 GDP data, with a growth rate of 4.3% annualised that does not seem European (EU, even more distant from E-Zone of course). The banks have rushed to review their growth targets for the year, to the upside of course, with view even of a 4% growth for the year. We view however some risks from the investment side, where especially the public sector has been lagging, possibly also from the agricultural year. The ride of the RON had a lot to do with feelings over Greece, and with rumours pertaining to a large municipal bond related currency operation (buying around 500m EUR, by June 22). There is apparently an intuitive move towards EUR, as the rewards of just a bit juicier interest rates vs. the core does not compensate for the short-term uncertainty. Once Greece is off the radar, we may get into a clearer RON-positive trend, but one may be very attentive to a slide in the Leu before that.Technically speaking, we are still pointing upwards, and we only need a small push above 4.4525 to aim for 4.4750. The blurry action last week seems more like a test of the previous channel, while the market consolidates in assuming another jump. Support is at 4.4315 and 4.4150, whose touching would not necessarily invalidate the larger upward view inclination of the chart.

_20150522141519.png)

Pic.3 EUR/RON D1 source: xStation

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.