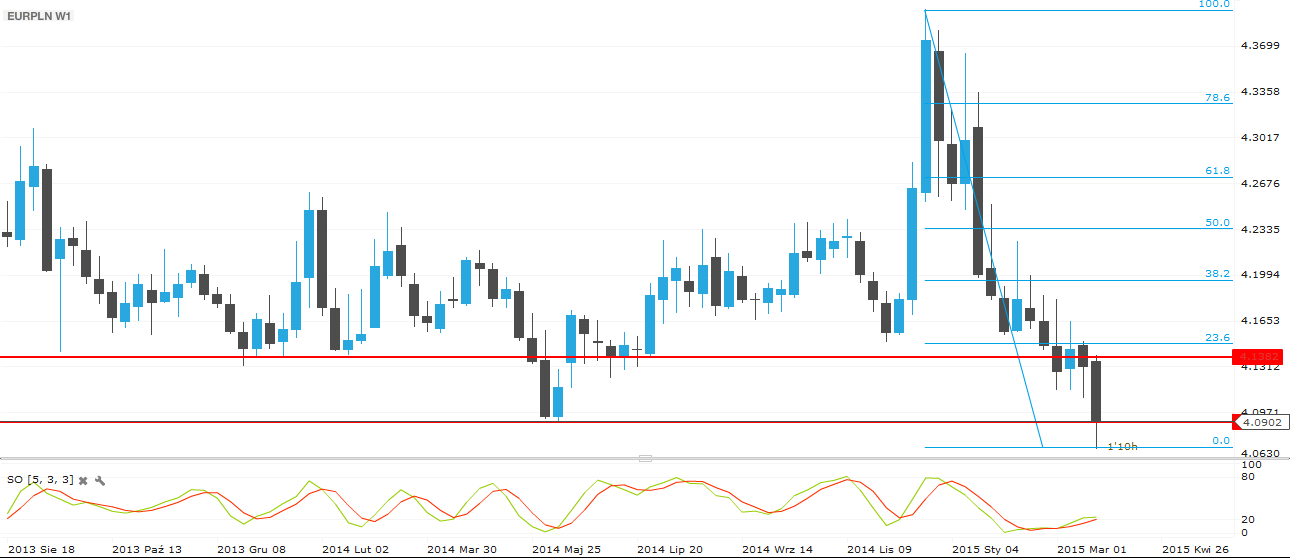

Polish Zloty (EUR/PLN) – fighting at the 4.09 support

This past week any financial events were in the shadow of the tragic plane crash of the Germanwings Airbus. Mixed macro data from the U.S economy along with the news from Yemen had not much impact as expected. In Poland, the unemployment rate remained at 12% so not much improvement in that area. The Zloty kept gaining, continuing its appreciation that began the previous week. One of the causes could have been the corrective movement on the EUR/USD but it is rather the fact that most MPC members stated there will be no more interest rate cuts. That confirms what Marek Belka, MPC Governor, had mentioned in various interviews. Also, deflation seems to be stable, which ironically, is good news. The only way prices can go now, is up. Sure, it will take some time (2 quarters?) but by the end of the year we might see again positive inflation. Till then, I do not expect any dramatic depreciation or appreciation of the Zloty. I will be surprised if I see levels of 4.00 or 4.50 in the next quarter. Next week macro calendar for Poland is empty, so PLN traders will focus on external factors.As we see on the weekly chart, the EUR/PLN finally broke the 4.12 support and continued its descent to reach yearly lows of 4.0696. The market rebounded and it is fighting at the 4.09 level. Breaking it should trigger a move to the 4.13 – 4.14 area. This scenario is suggested by the stochastic oscillator showing the market might be oversold. On the other hand, if the PLN continues its appreciation, the next target for the EUR/PLN will be 4.05.

Pic.1 EUR/PLN D1 source: xStation

Hungarian Forint (EUR/HUF) – Advantage from higher base rate

The National Bank of Hungary resumed the easing cycle and this was the biggest news of the week. The Monetary Policy Council has decided to lower the base rate by 15 basis points to a new record low of 1.95% on Tuesday. Furthermore, Dr. György Matolcsy, MPC’s Governor, has introduced an inflation tolerance range of 3±1%. He is also commenting that the MPC had started a new easing cycle, what defines more small rate cuts in the future. The Central Bank has published its latest quarterly Report on Inflation, which forecasts the country’s budget deficit to remain steadily below 3% of GDP. The labor market processes are seen improving further, while the business sector is expanding and the rate of unemployment is decreasing. All the local macro data shows massive growth in Hungary's economic so the fundamental view for the Forint is attractive for swap hunters. Hungary still has the highest interest rate in the region what could save the Hungarian currency from a suddenly depreciation.Actually, the NBH's rate cut cannot stop the Forint bulls and the EUR/HUF went below the 300 level (touched 14-month lows of 297). Despite of the continuation of the easing cycle, the Hungarian currency could keep its performance for the next couple of weeks. From the Forint buyers’ perspective, the most important support is the 297 levels (200 WEMA). The EUR/HUF used to turn around to an uptrend when the quotes sank below the 200 weekly exponential moving average (2010 - 2011 -2012) and we believe this can happen again.

_20150327160715.png)

Pic.2 EUR/HUF W1 source: Metatrader

Romanian Leu (EUR/RON) – The brief and the reasonable ranges

Not only that the market did not move sideways, the Leu actually had a brief time trading below 4.40 vs. the Euro. It may have been a happy coincidence of risk on (thanks to Yellen) and local factors (budget payments day on 25th for companies) yet it certainly did not last. Some may have seen this as a possible attempt of the NBR to juice a favorable move that would bring down the value of USD in RON terms indirectly but there are many doubts surrounding this view. On the macro side, unemployment increased in Q4 to 6.7% on average, a jump of 0.2 points, but the market keenly awaits the more fresh February data on the 31st. The economy seems to be doing fine, and the proposed tax cuts starting mostly in 2016 but possibly even this year may boost the morale. The market takes its cues from general international sentiment, in this low-rate environment, so risk-on would favor a range of 4.4150 to 4.4350, if nothing unusual happens in Athens.In technical perspective, we have only seen the range widening. After the market gets bored of the upper third, it moves below, and in a short while may be back above the 4.4315 dividing line. A revisited 4.4315 – 4.4525 area would come into attention on a push above 4.4315. For a few days however the market may play cool between 4.4150 and 4.4315. We see the 4.4000 support to be strong for the time being, despite a brief push below this week that does not seem to seriously deny its value.

_20150327160807.png)

Pic.3 EUR/RON D1 source: xStation

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.