Most analyst blame the Russia-Ukraine conflict for the major depreciation of emerging markets currencies. Partially, they are right. We have to remember though the negative effects of the slow growth of the Eurozone. Also, local factors start making their impact. In Poland growth slowed down and last month deflation was experienced. That is not the major danger though. As Marek Belka, MPC Governor, pointed out, a bigger threat comes from the possible Zloty appreciation when the Russia-Ukraine conflicts gets resolved. The Polish economy requires a weaker Zloty now, which was also mentioned by Mateusz Szczurek, Minister of Finance. At the same time, the Ministry of Finance will lower the forecast for GDP growth for 2015 – from the previous 3,8% to 3,4%. Average yearly inflation is expected to stay in a 1,0 - 1,4% range. What is worth mentioning, Szczurek mentioned the government has excess Euros, which can be liquidated. Issuance of Euro-denominated Treasuries is expected to halt this year as the MF wants to keep a 30% weight of foreign debt in total debt. So as we can see there are actors that can either strengthen or weaken the Zloty. Which of them will be deciding?

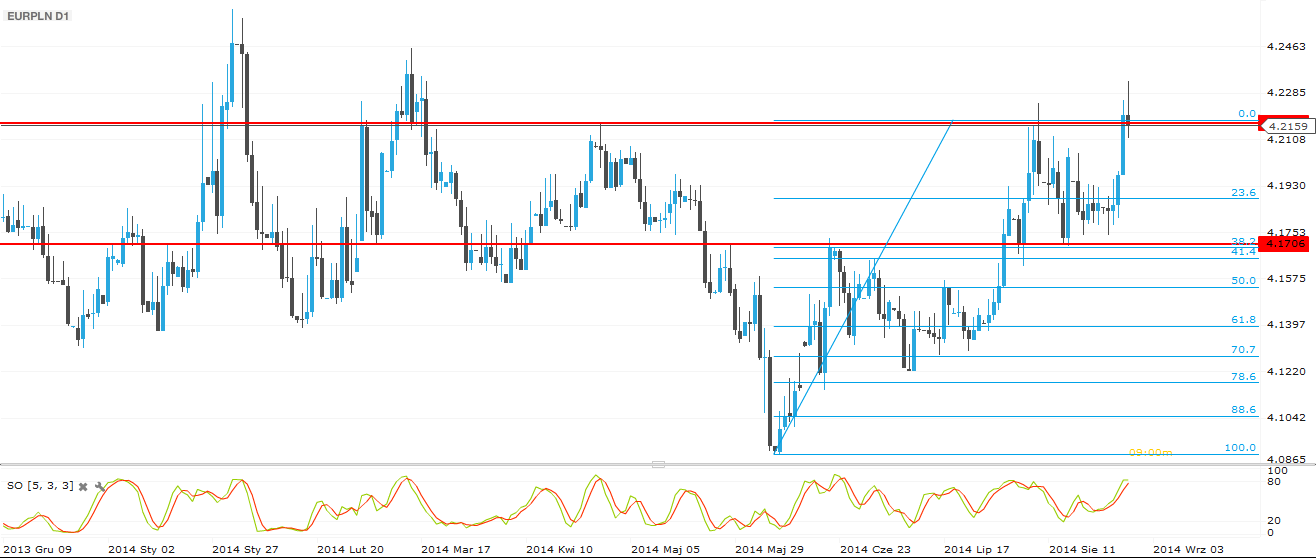

As we see on the daily chart, after trading close to the support of 4.17, the EUR/PLN shoot up and is testing the resistance at 4.2150. This week it reached even 4.23, but a further upward move can be expected if the closing price of this week will be above the esistance. Then, the market could attack 4.25, the highs from January of this year. A corrective movement could bring the EUR/PLN down to the first support at 4.2050 and if this is broken, then 4.17 could be the target.

Pic.1 EUR/PLN D1 Chart

Hungarian Forint (EUR/HUF) – testing the 315 resistance

This past week the EUR/HUF was stocked in a narrow range, but on Thursday it was shocked again. Emerging markets broke again because of the Russian supposed invasion. From what we have heard, Russian forces crossed the border and started providing armed assistance to separatists. Moscow denies but what the market react to, are the news. On Thursday night, NATO has published satellite images, which prove that the Russian troops in Ukraine carry out military operations. Putin asked the separatists to "open a humanitarian corridor" to let the Ukrainian forces leave the battlefield. The Ukrainian government will give a deliberate answer, because without Russian gas they cannot get through the upcoming winter - they can just hope for international assistance. Western states are considering additional economic sanctions, but so far those were only words. Obama and Merkel are on the same page when talking about the conflict. Other EU countries and Hungary experience to feel the bad effects of the "secret war". The low efficiency of Eurozone's economy also affects the Hungarian economy and

its currency. Still, macro data from the economy is not bad and the main reason causing the Forint to depreciate is the Russia-Ukraine conflict.

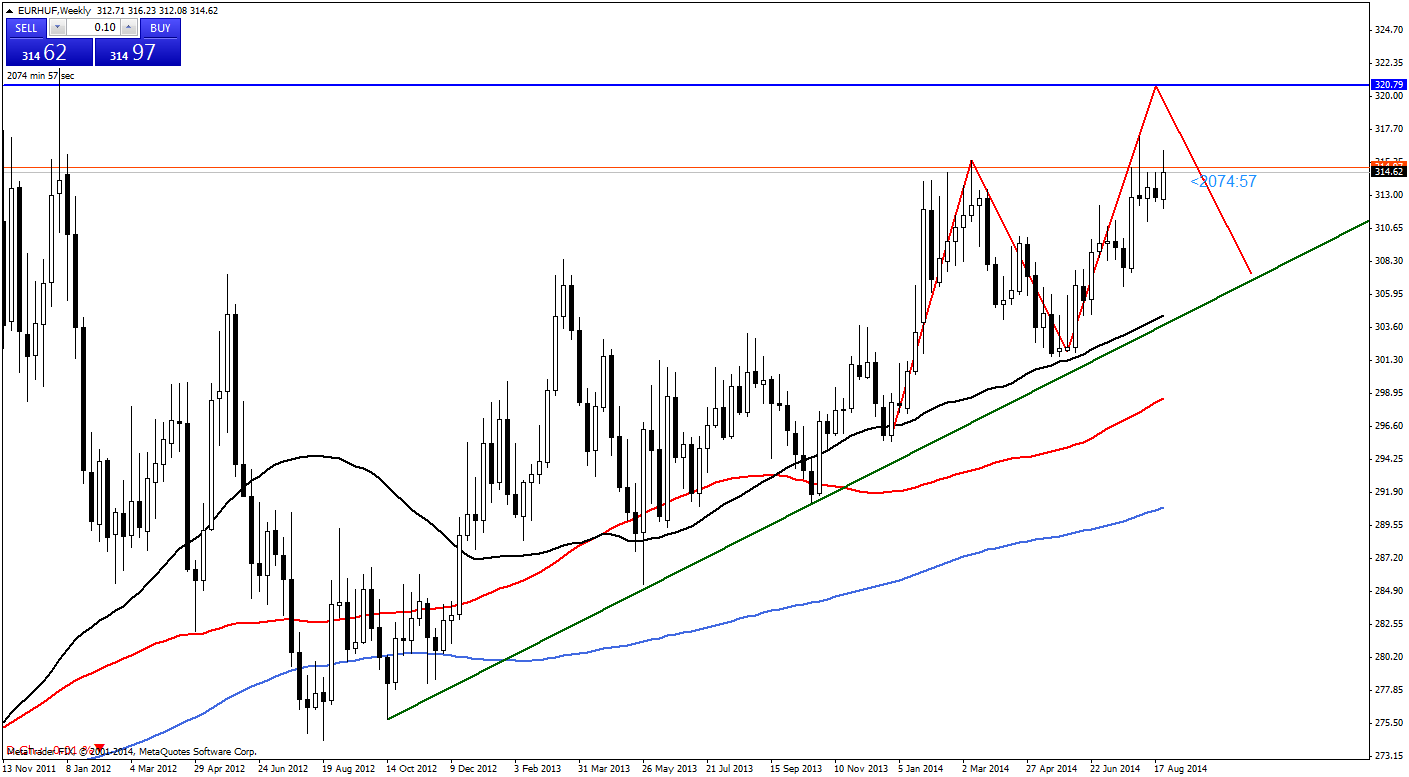

Just to note, Neil Shearing, the chief economist of Capital Economics said that regional currencies still have space to get stronger - in 2015 the EUR/HUF can be under the 300 level. If the conflict in Eastern Europe escalates, a huge selling wave can unfold and weaken the merging markets currencies. Currently, the EUR/HUF is fighting at the 315 resistance level. Breaking it would mean the market will target 317 next week. The closest support to which the market can decline, remains at 312.

Pic.2 EUR/HUF W1 Chart

Romanian Leu (EUR/RON) – Rangebound, for now, with some risks lurking

For the Leu the 4.40 area appears to be the new balance line, barring some out-of-the-ordinary developments in Ukraine. Some good news on the unemployment front – the rate fell to 7% in July – were prevented from swaying the markets by the regional worries and the somewhat shocking return to recession in Q2 to gain points for the local currency. We may easily assume that the National Bank is comfortable with levels at or above 4.40, but would much rather see EUR/RON above 4.45. The playground for next week seems to be, given the Ukraine situation, more or less above 4.40 but below 4.45.

The technical image paints a symmetrical triangle in the making. A clear breakout below is less likely, in our view, than one above, but only time will tell. For now the support stays at 4.3850, the lower bound of the triangle then at 4.36 and 4.34. Resistance is nearest at 4.4090, followed by 4.4200 and then 4.44 as the upper border of the triangle. Any push above 4.45 would be a clear sign the market still has about 600 pips (the width of the pattern) to go.

Pic. 3 EUR/RON D1 Chart

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.