Polish Zloty (EUR/PLN) – MPC considers interest rate cuts, PLN stable

After the previous week we had hope volatility will be back on the markets for a longer period of time. It is not happening though. Despite disturbing news from Ukraine and the Middle East, market movements are rather shy. The biggest effect on the Zloty could have sanctions that Russia has introduced against EU countries. The agricultural sector could be hit the most as Poland exports vast amounts of goods to Russia. So far, the reaction on the Zloty market is mediocre. I was expecting more action on the market after the MPC minutes publication. The central bank will keep interest rates unchanged at least until the end of Q3 and it seems that the rebounding economy could put back inflation in line with projections in the next couple of quarters (ending horizon of the projections). At the same time, the possibility that inflation will be below the central path is higher than being above the path. Additionally, it was suggested that the current level of interest rates might cause deflation that could last longer than one month. In this case, MPC members discussed a possible interest rate cut since there is a lot of uncertainty ahead. One would think that all of the above should make the PLN depreciate. Surprisingly, the Zloty remained stable this past week.

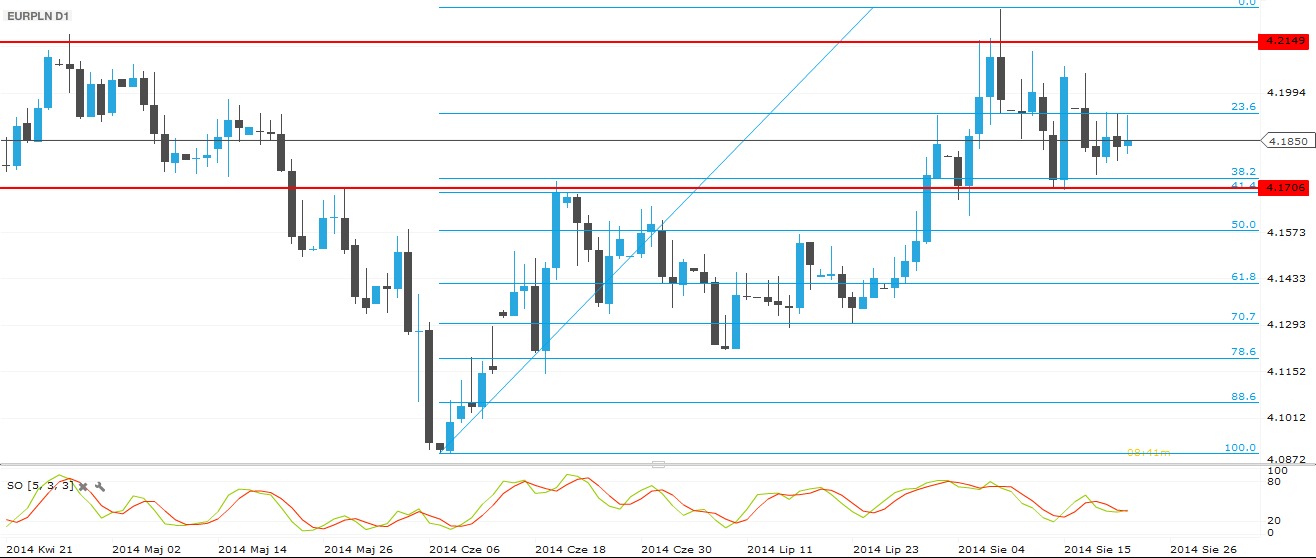

Looking at the daily chart, we see the market actually went down after the previous week Friday spike. Volatility was very low and the EUR/PLN rate oscillated around 4.1850 during the whole week. What can we expect next? Well, if the support at 4.17 is broken, the market might try reaching even 4.13. More probable though is another attack at the 4.2150 highs. If broken, the next target for the EUR/PLN would be 4.25.

Pic.1 EUR/PLN D1 Chart

Hungarian Forint (EUR/HUF) – Regional pressure can be softened

This week EUR/HUF moved between 312.65 and 314.67, in a 2 HUF wide range. We had no macro data from Hungary, so mainly the geopolitical voltages and the investors' mood in connection with the regional risks determined the exchange rate. The Hungarian economy really feels the effects of the embargo against Russia, but the exporters trying to save themselves with insurances. Hungary's export has significantly lowered, and the new sanctions have badly affected the car industry (Audi, Mercedes).

The judicial proceedings of the foreign currency debt problems are continuously ongoing. According to reports, greater part of the Hungarian debt can move to domestic hands next year. It can raise the classification of the country, because the Hungarian investors cannot back out of the transaction. As we all know, in October, FOMC will walk out QE3. It can easily reduce the level of capital flows into the Eurozone and emerging markets, but latest news said that there is a small correlation between the purchasing and the amount of money in circulation. After the end of QE, FED will keep its level of total assets high for a few months maybe. On the other side, Eurozone is increasingly dropping behind. At the weekend, Angela Merkel will negotiate with the Ukrainian leadership, and on Tuesday Putin can do the same. It means that the pressure on the HUF can soften, because the conflict between Russia and Ukraine is still the biggest external factor weighing on the forint. 314-315 is not convenient for the MNB (Hungarian National Bank) in extreme situation they can introduce hidden interventions near those levels.

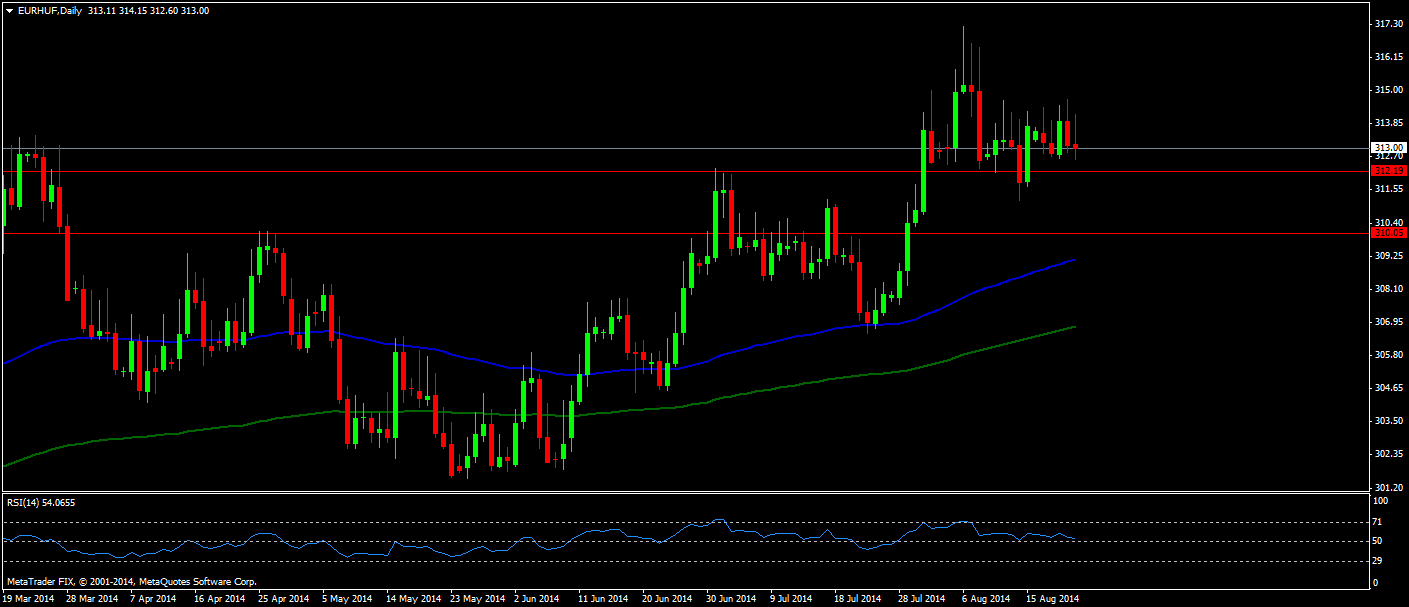

From the technical perspective we should focus on the resistance and support levels, 312 caused a strong indecisive situation, but also it is a strong support. If bears can break it down, we easily achieve 310.

Pic.2 EUR/HUF D1 Chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.