What’s up, forex friends? The BOC ain’t the only one with a monetary policy huddle this week since the ECB officials will also have a little gathering, and they’ll be announcing the results of their meeting this Thursday (Jan. 21, 1:30 pm GMT).

So, what should forex traders focus on, and what can we expect from the ECB? Before all that, let’s do a quick review of.

The previous ECB decision

ECB maintains refinancing rate at 0.05% as expected

ECB maintains marginal lending rate at 0.3% as expected

ECB cuts deposit rate to -0.3% from -0.2% as expected

QE program maintained at €60 billion/month

QE program was extended by 6 months to March 2017

During their Dec. 3 rate decision and press conference, ECB officials pretty much maintained their monetary policy, but they did cut the deposit rate by 10 basis points to -0.3% from -0.2% and they extended the €60 billion/month quantitative easing (QE) program by six months. They also decided to include “euro-denominated marketable debt instruments issued by regional and local governments located in the euro area” in their list of purchasable assets for their QE program.

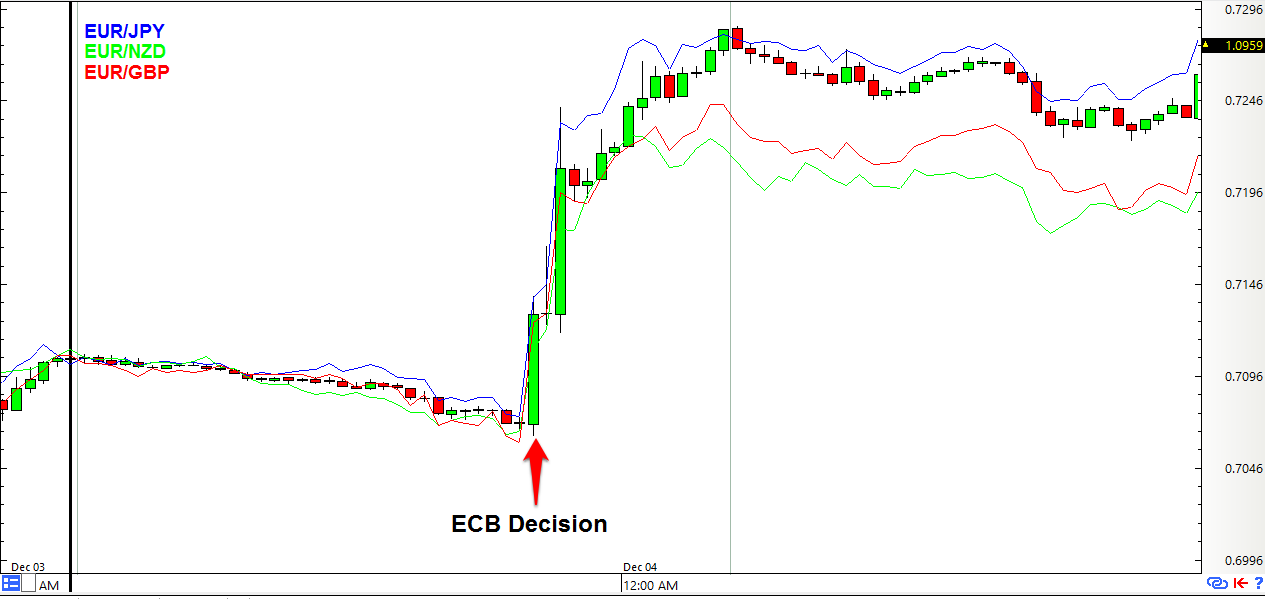

Overall, the easing moves were less than what most market players were expecting, which is why the euro spiked higher across the board. EUR/USD 1-Hour Forex Chart

If you’re wondering what was up with that, just know that market players have been pricing-in more easing moves ever since the ECB took a starkly more dovish stance during their Oct. 22 rate decision and presser. And it didn’t help that rhetoric from ECB officials in the-lead up to the Dec. 3 decision heavily implied more easing moves.

However, the additional measures failed to meet the market’s (*cough* over-hyped *cough*) expectations since the the 10 bps cut was deemed too shallow and the QE program was extended but not expanded. That was seen as good news for the euro since expanding the QE program would involve printing more euros for bond-buying purposes, which would devalue the euro.

As such, a lot of forex traders used the event as an opportunity to unwind on their euro shorts while European equity traders were very dismayed and sent European equities on a cliff diving mission, which then generated capital flows from European equities to the lower-yielding euro, pumping up the euro all the more.

What can we expect this time?

Most market analysts expect the ECB to maintain its current policy, so most forex traders would likely be focusing on the ECB’s tone or monetary policy bias instead.

Recent rhetoric from ECB officials have implied that they are less likely to ease further. Reuters even had an exclusive Jan. 14 interview with five unnamed ECB officials, and the juiciest tidbits are as follows:

“The ECB has done its job, created the space with exceptional accommodation. Now it’s time for others to do their job.”

“it’s clear that more ECB action will have to come. But it’s going to depend on the impact of the measures already taken and won’t come very soon.”

In short, the unnamed ECB officials were heavily implying that they don’t wanna ease no more. Also, the results of the January 2016 euro area bank lending survey were released yesterday and the report noted that “Further improvements in borrowing conditions for businesses and a return to an easing of standards for housing loans” and “Further increase in demand for loans across all loan categories but particularly by businesses,” which could be a sign that the ECB’s monetary policy is taking effect.

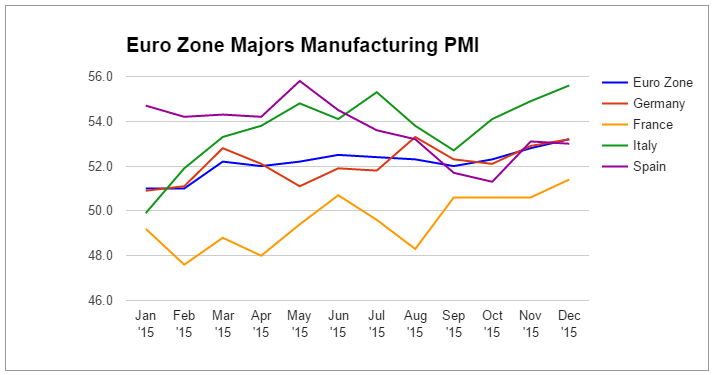

In addition, PMI readings for the euro zone have been improving recently, which is another promising sign.

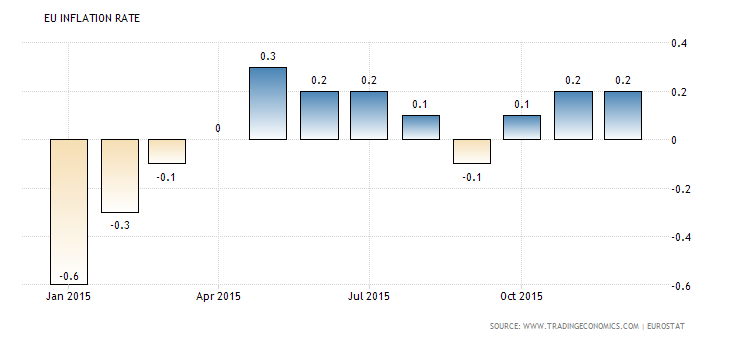

That’s well and good, but the headline CPI has been consistently below the ECB’s forecasts while the core CPI reading remained relatively low, and that’s not even considering the recent oil slump to 12-year lows and the implication that the euro zone’s inflation levels will remain low for longer.

Moreover, the minutes of the December meeting had these head-turning revelations:

“some members expressed a preference for a 20 basis point cut in the deposit facility rate”

“A cut in the deposit facility rate of 10 basis points was seen as unlikely to trigger material negative side effects and was also seen as having the advantage of leaving some room for further downward adjustments, should the need arise.”

Given all the above, ECB Emperor Draghi is likely to deliver a more balanced tone in the upcoming meeting but with some hints of dovishness, so watch out for deviations from this tone since that would likely cause the volatility of euro pairs to spike.

If the ECB delivers a more hawkish stance or communicates that it is very reluctant to ease further, then the euro will likely climb higher. The former scenario may even potentially cause sentiment in the European equities market to turn sour, sending capital flows towards the lower-yielding euro. In contrast, a much more dovish stance and/or explicit calls for more easing moves would likely cause the euro to weaken against its forex rivals.

BabyPips.com does not warrant or guarantee the accuracy, timeliness or completeness to its service or information it provides. BabyPips.com does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading at their own risk and BabyPips.com shall not be responsible under any circumstances for the consequences of such activities. Babypips.com and its affiliates will not, in any event, be liable to users or any third parties for any consequential damages, however arising, including but not limited to damages caused by negligence whether such damages were foreseen or unforeseen.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.