If you didn’t get a chance to tune in to the BOC monetary policy statement and see the Loonie’s forex reaction, I got yo back! Here’s a rundown of the takeaways from the event.

As expected, BOC Governor Poloz and his men decided to keep interest rates on hold at 0.75% and maintained its relatively neutral monetary policy bias. Recall that the Canadian central bank already cut interest rates earlier this year in order to limit the negative impact of the oil price slump on the economy, which means that they don’t really see the need to ease monetary policy again for now.

1. Piggyback with U.S. economic recovery

What’s keeping BOC policymakers confident that economic prospects will improve later on is Canada’s close ties with its friendly North American neighbor Uncle Sam. You see, the U.S. is Canada’s BFF when it comes to trade activity, as they exchange approximately $2 billion worth of goods and services daily. Heck, exports to the U.S. comprise roughly 20% of Canada’s GDP!

According to BOC Governor Poloz, the U.S. and Canada are in the same boat right now when it comes to dealing with a temporary slowdown in growth. “The bank expects a return to solid growth in the second quarter,” indicated their official statement. “This will help advance the rotation of demand in Canada toward more exports and business investment.”

2. Still upbeat but wary of risks

With that, the BOC managed to maintain its optimistic economic outlook in saying that consumption is “holding up relatively well” and that credit conditions remain “highly stimulative” for households and businesses.

On more cautious note, Poloz added that annual inflation is currently running at around 1.6% to 1.8% – still a few notches away from the central bank’s 2% target. He also mentioned that “risks to financial stability remain elevated but appear to be evolving as expected.”

3. Watching the Loonie’s forex rallies

Speaking of the Loonie, a bit of jawboning was evident during the latest BOC statement when Poloz suggested that further rallies might weigh on growth and inflation prospects. “The Canadian dollar has strengthened in recent weeks in the context of higher oil prices and a softer U.S. dollar,” he explained. “If these developments are sustained, their net effect will need to be assessed as more data become available in the months ahead.”

Several forex analysts zoomed in on this particular line, interpreting it as a sign that the BOC isn’t too happy about the Canadian dollar’s appreciation. After all, a stronger local currency typically makes imports cheaper and exports more expensive, leading to a double-whammy of weaker domestic price levels and lower export demand.

4. Overall bearish for the Loonie?

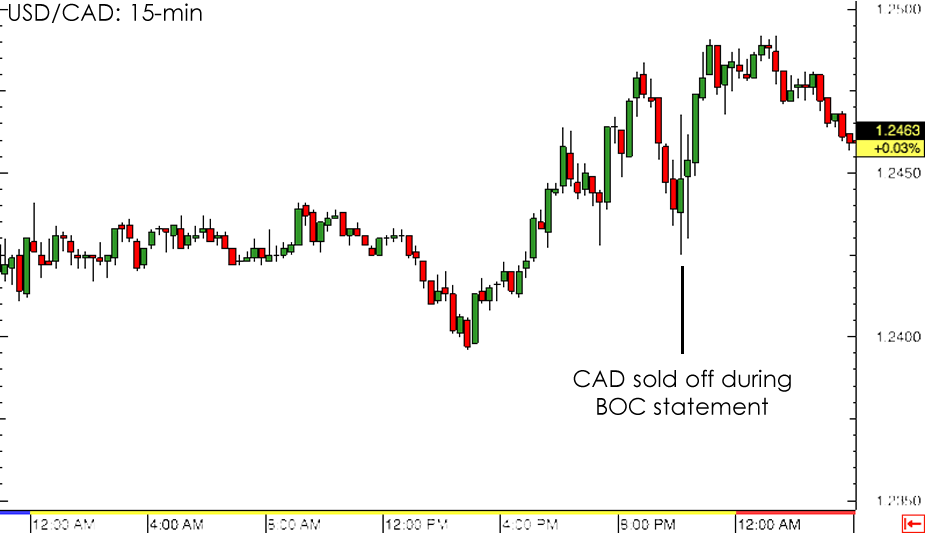

Cautious remarks from BOC officials kept Loonie bulls in hiding and allowed the bears to take control of forex price action. This suggests that most market participants thought that the BOC was a little more dovish this time around.

In a nutshell, future monetary policy changes by the BOC hinge on three main factors: 1) oil price trends, 2) U.S. economic performance, and 3) the Canadian dollar’s exchange rate levels – all of which are clouded with a lot of uncertainty.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.