In this edition of Piponomics, I’ve got a quick rundown of the main forex market movers this week. Did you get to catch ‘em all?

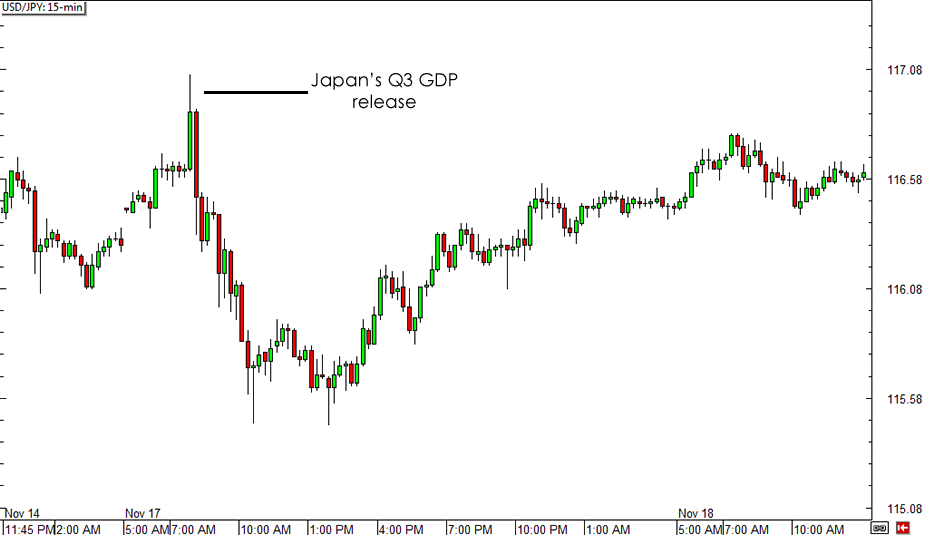

1. Japan’s Q3 GDP release

Japan’s GDP release on Monday pretty much set the tone for yen price movement for the rest of the week since the report revealed that the country slumped back in recession. The initial reaction to the release wasn’t as straightforward though, as the Japanese currency actually rallied when market participants predicted that Prime Minister Abe would have to delay the next sales tax hike.

USD/JPY 15-min Forex Chart

USD/JPY and the rest of the yen pairs quickly recovered upon finding support at areas of interest at the end of the Asian trading session, eventually erasing most of the day’s losses in the next sessions.

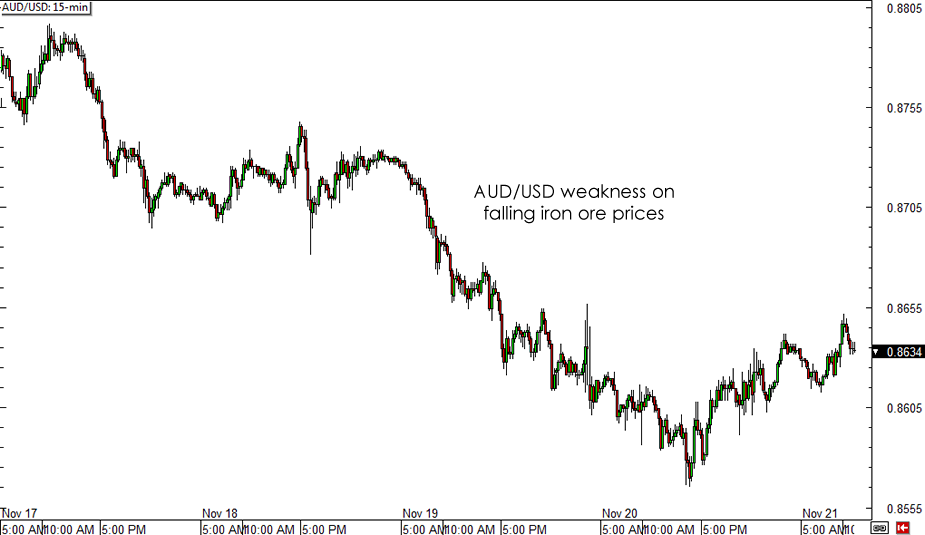

2. Drop in commodity prices

It looks like commodity prices ain’t done tumbling! News that iron ore prices reached new record lows took its toll on the Australian dollar, triggering a 200-pip drop for AUD/USD mid-week. Bear in mind that this commodity is one of the Land Down Under’s top exports, as its economy is heavily dependent on the mining industry.

AUD/USD 15-min Forex Chart

The New Zealand dollar also had its share of losses later on, as the dairy auction revealed another slump in prices. The Global Dairy Trade price index chalked up a 3.1% decline, leading analysts to speculate that another milk payout cut will be announced by Fonterra, the country’s largest company and the world’s biggest dairy exporter.

3. BOJ monetary policy statement

As though the yen’s post-GDP release losses weren’t bad enough, the currency got hit by another wave of selling when the BOJ drew more support for its monetary easing plans . Even though Governor Kuroda tried his best to sound hopeful about economic prospects, most forex traders didn’t seem to buy it this time since the numbers are looking grim.

BOJ officials also seemed to be urging the government to push through with the next sales tax hike next year, as the country needs to trim its public deficit. This suggests that the central bank could be open to the idea of more aggressive policy easing should another consumption tax hike wind up hurting growth again.

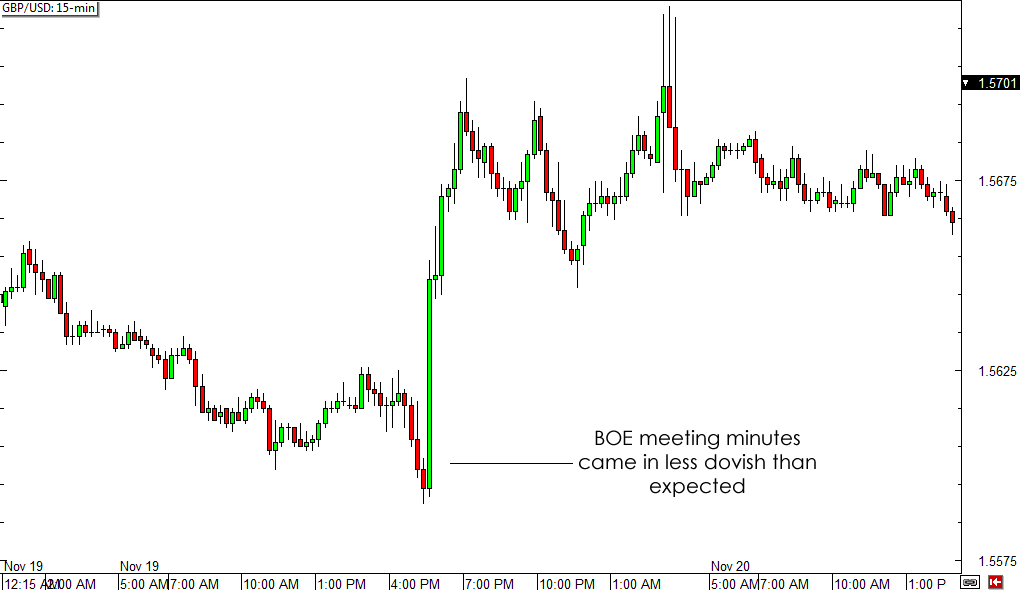

4. BOE MPC meeting minutes

In a surprising turn of events, the BOE meeting minutes led to a strong pound rally as policymakers didn’t seem as dovish as many expected. In fact, the two hawkish members who have been insisting on a rate hike for the past few months still voted to tighten policy even as data from the U.K. has failed to impress.

GBP/USD 15-min Forex Chart

GBP/USD 15-min Forex Chart5. FOMC minutes

Although the FOMC mostly stuck to the script and refrained from shocking the markets, the minutes of their latest meeting revealed that they are still on track to hike rates sooner or later, which was enough to keep the dollar supported. While the dollar’s reaction to the report was limited, the Fed’s policy bias could be indicative of longer-term forex market trends for the major pairs.

Some of these currency moves might not seem much since they’re not multi-hundred pip reactions after all, but remember that a good trading strategy and proper risk management techniques could still convert these to significant account gains. It’s also worth noting that market expectations play a role in determining how price would react, as surprises often lead to sharp moves with sufficient follow through for the rest of the week.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.