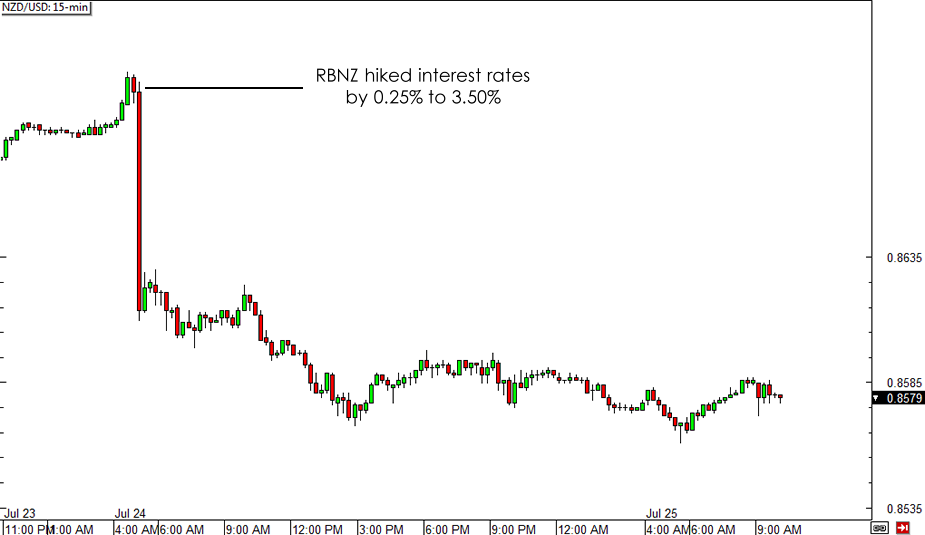

As you can see from the 15-min chart of NZD/USD below, the pair dropped by close to a hundred pips right after the announcement then continued to edge lower for the rest of the trading sessions.

Apparently, RBNZ Governor Graeme Wheeler hinted that this might be their last rate hike for the year, as he mentioned that they would pause from tightening to assess the impact of their latest moves. “It is prudent that there now be a period of assessment before interest rates adjust further towards a more-neutral level,” he said. “The speed and extent to which the OCR will need to rise will depend on the assessment of the impact of the tightening in monetary policy to date, and the implications of future economic and financial data for inflationary pressures.”

With that, analysts priced in lower odds of seeing another rate hike in the next few months, as some projected that the next increase might not happen until March next year. After all, inflationary pressures have been subdued, particularly among wages and in the dairy sector.

In fact, falling commodity price levels have been such a persistent concern for the RBNZ that they decided it’s time to jawbone their currency again. According to the central bank’s official statement, the trading level of the Kiwi is “unjustified and unsustainable” and there is “potential for a significant fall” as it has to adjust to weakening commodity prices.

This isn’t something new from the RBNZ, as Wheeler has a record of jawboning and has even staged a secret currency intervention last year. At that time, NZD/USD had been trading around the .8700 levels and dropped by roughly 300 pips in a few days.

If the RBNZ is all bark and no bite though, it won’t be long before market participants realize that the New Zealand central bank can’t afford to intervene in the currency market for now. Who knows? Perhaps Wheeler and his men are simply waiting for the Kiwi rallies to retreat before going on another rate hike streak.

For now, the shift in the RBNZ’s stance to a more cautious one could keep any Kiwi gains at bay. It doesn’t help the higher-yielding commodity currency that geopolitical tension has allowed risk aversion to extend its stay in the markets. Sooner or later though, market participants could be drawn back to the positive interest rate differential of buying the Kiwi against lower-yielding currencies and allow the longer-term climb to resume.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.