In today’s edition of my Forex Trading Guide, let’s zoom in on the upcoming jobs release from Canada. As usual, we’ll be taking a look at what the report is all about, what happened last time, what’s expected this time, and how the Loonie might react.

What is this report all about?

Canada’s jobs release typically contains two main figures: the employment change reading and the jobless rate. Since the employment change figure measures the change in the number of employed Canadians from the previous month, it is considered an indicator of job creation. Meanwhile, the jobless rate shows the percentage of the work force that is unemployed and is actively seeking employment.

These jobs figures are important economic indicators because these can provide clues on how consumer spending might fare. After all, a stable jobs market usually makes consumers more confident about their financial situation, making them more likely to spend instead of keeping their hands in their pockets.

What happened last time?

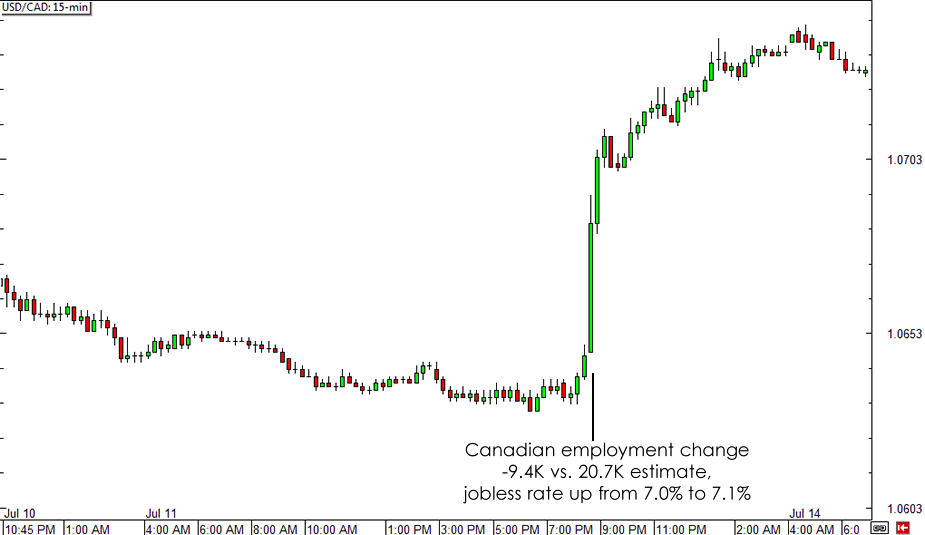

Unfortunately for the Canadian economy, the June jobs report printed dismal results as it showed a 9.4K drop in hiring versus the estimated 20.7K increase. The June employment change figure was also much weaker compared to the previous month’s 25.8K increase in hiring.

With that, the Loonie suffered a massive selloff against most of its major forex counterparts, including the Greenback. USD/CAD jumped by around 60 pips moments after the release then continued its ascent in the next trading sessions.

USD/CAD 15-min Forex Chart

What’s expected for the upcoming release?

For the month of July, Canada’s jobs sector is expected to get back on its feet and print a rebound of 25.4K in employment. This should be enough to bring the jobless rate back down from 7.1% to 7.0%.

Bear in mind though that the Canadian employment change figure has missed the mark in three out of the last five months, suggesting that there’s a good chance of seeing another disappointing result this time.

How could the Loonie react?

A quick review of USD/CAD price action after the Canadian jobs release reveals that the pair has a strong reaction to the actual data, with better than expected results spurring a Loonie rally and weaker than expected figures leading to a Loonie selloff. The price reaction lasts anywhere from 50-80 pips, depending on how far off the mark the actual data lands.

Another dismal jobs report for July could lead to a sharp selloff for the Canadian dollar, especially if the employment change reflects more job losses. Do you think Canada will print another weak employment report for July or will it show a rebound?

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.