Highlights

- Market Movers: Weekly Technical Outlook

- What's up with the buck?

- Q1 earnings round-up: how companies have performed

- Look Ahead: Equities

- Look Ahead: Commodities

- Global Data Highlights

Market Movers: Weekly Technical Outlook

Technical Developments to Watch:

- Will the EUR/USD short squeeze continue?

- UK elections gave the GBP/USD a boost, can it continue?

- USD/JPY is ranging with the best of them, could the BoJ shake things up?

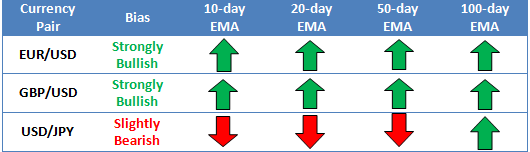

* Bias determined by the relationship between price and various EMAs. The following hierarchy determines bias (numbers represent how many EMAs the price closed the week above): 0 – Strongly Bearish, 1 – Slightly Bearish, 2 – Neutral, 3 – Slightly Bullish, 4 – Strongly Bullish.

** All data and comments in this report as of Friday’s European session close **

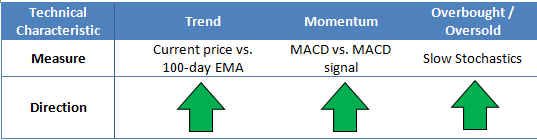

EUR/USD

- EUR/USD continued to squeeze higher despite QE and no resolution to Greece.

- Slow Stochastics crossed higher again, but is near overbought territory.

- If it can stay above the 100 day EMA, USD bulls may continue to be frustrated.

Despite all logical inclination that this pair should fall, it continues to soldier higher. The lack of positive US news is surely weighing on the USD, but the news isn’t any better out of Europe. This has all the signs of a short squeeze, and if this pair breaks below the 100 day EMA with conviction, we could be back to a EUR selloff.

Source: FOREX.com

GBP/USD

_4_20150515185252.png)

- GBPUSD was a superstar this past week after surprise UK elections result

- MACD is convincingly strong as we head into next week

- Slow Stochastics are in overbought territory, so a retracement may be in store

The convincing results of the UK election last week have given GBP/USD a boost. Inevitably the euphoria will die down and the enthusiastic rally will die down with it. The USD was trying to salvage some strength to end this week and may be a staging ground for a recovery as we start a new week, particularly if the Slow Stochastics are correct in their assertion of an overbought market.

Source: FOREX.com

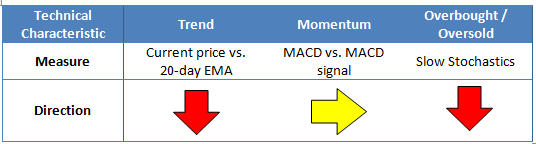

USD/JPY

- USD/JPY underperformed this week and fell below the 20 day EMA

- MACD and Slow Stochastics are mixed to slightly bearish respectively

- Range-bound environment continues to persist

This pair has been stuck between 118.50 and 121.00 since March, and doesn’t look to be too anxious to break out of this rannge. Unless the Federal Reserve meeting minutes or the Bank of Japan policy decision rocks the market, the ranging mentality may be here to stay for the time being.

Source: FOREX.com

What's up with the buck?

The buck is one of the worst performers in the G10 so far this month, and is down more than 4% vs. the GBP, and 3% vs. the NOK and AUD. Even the EUR, which has been weighed down by the ECB’s QE programme and the ongoing Greek sovereign debt crisis, has managed to eke out more than 2% in gains vs. the greenback so far in May.

What is driving the dollar lower, and can it last?

- US economic data continues to surprise on the downside, the Citibank economic surprise index for the US has slumped to a 3-year low, which could delay the timing of the first Fed rate hike.

- On that note, the market has also pushed back expectations for when the Fed will raise rates; the market now expects only 30 basis points of tightening before the end of the year, which is a little over 1 hike. If we continue to see weak economic data then a rate hike could be priced out for 2014 altogether.

- Momentum – the dollar has made a series of lower lows, and the downtrend continues to look entrenched. It has already fallen through key support including the 200-day sma and is below the daily Ichimoku cloud, suggesting that weakness in the buck could be here to stay.

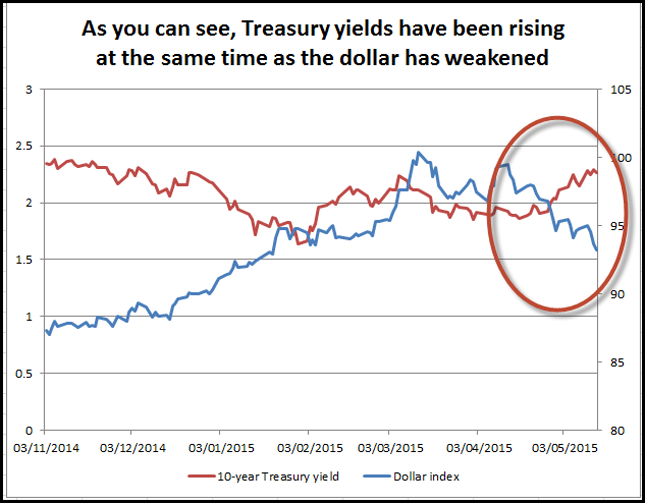

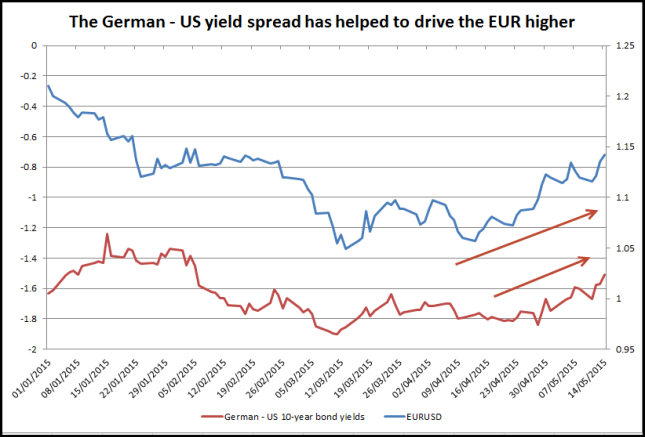

The yield effect:

Interestingly, as you can see in figure 1, the dollar is selling off even though bond yields are rising. The 10-year Treasury yield is now at its highest level since November. Usually rising yields can lend support to a currency, but not so with the dollar. Why?

The dollar’s relationship with yields looks weak at best. It rose while Treasury yields were falling, and is falling as they rise.

If the rise in global DM bond yields is a sign that the global economy can avoid the scourge of deflation and is thus a collective sigh of relief, it would be natural for a safe haven like the dollar to weaken.

US yields may be rising, but they are rising faster elsewhere, for example in Germany, which is why the dollar cannot keep up. As you can see in figure 2.

Conclusions:

The dollar rally is on hold for now and has sold off some 7% since peaking in mid-March. This does not look like a mere pullback, if we continue to see weakness then it could be curtains for the dollar rally that the bulls were waiting so long for.

In the meantime, we would be cautious about looking for a reversal in the dollar at this stage, as the downtrend seems fairly entrenched. We think GBP could rally to 1.60 and beyond in the next week or so, and there may be further gains for EURUSD if we continue to see upward pressure on German bond yields. 1.1534, the high from end of Jan, is a critical level of resistance for EURUSD that opens the way for a return to 1.20.

Figure 1:

Source: FOREX.com

Figure 2:

Source: FOREX.com

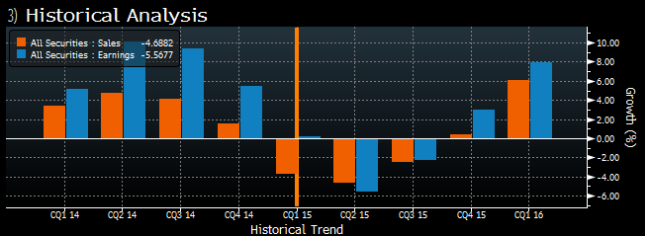

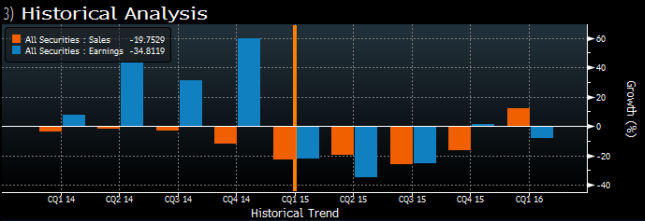

Q1 earnings round-up: how have companies performed?

As we near the end of the Q1 earnings season now is the time to assess how well companies have done in the past quarter and what their outlook is like for the future. It is worth noting that expectations were low as we headed into this earnings season, so was the market too pessimistic? We take a look at the FTSE 100 and S&P 500 to find out.

S&P 500: The corporate view:

With 461 out of 500 companies on the S&P 500 having reported Q1 earnings already, the verdict is in. The percentage of companies who beat earnings expectations was higher in Q1 2015 relative to Q4 2014, although this may be because the bar was lower this quarter compared to the end of 2014.

Although earnings growth picked up last quarter, sales growth tumbled. Sectors that saw sales growth fall included: oil and gas, basic materials, industrials, utilities and consumer goods. Oil and gas also missed out on the earnings front, with earnings growth slowing relative to Q4 2014. Overall in Q4 2014, sales growth rose by 1.58% while earnings growth increased by 5.45%.

Interestingly, the two largest sectors in the index, technology and financials, were some of the top performers, with sales and earnings growth for the tech sector at 7.85% and 8.69% respectively. The financial sector also recovered relative to Q4 2014 when sales growth was a mere 0.48% and earnings growth tumbled by 1.89%. In Q1 2015 sales growth had improved four-fold to 2.12%, while earnings growth was a respectable 7.37%.

Although these two important sectors did well in the first three months of the year it was not enough to boost the overall results for the S&P 500. As you can see in figure 2, historical analysis suggests that earnings and sales growth will not move back into positive territory until the end of this year.

The technical view:

Any concerns about future earnings do not seem to be impacting the performance of this index, which was close to the record high of 2,125 at the time of writing. A break above this level would open the way to fresh record territory. For now, the long-term uptrend remains in place, even if the oil and gas sector is letting the side down on the earnings front.

Figure 1:

Source: Bloomberg

Figure 2:

Source: Bloomberg

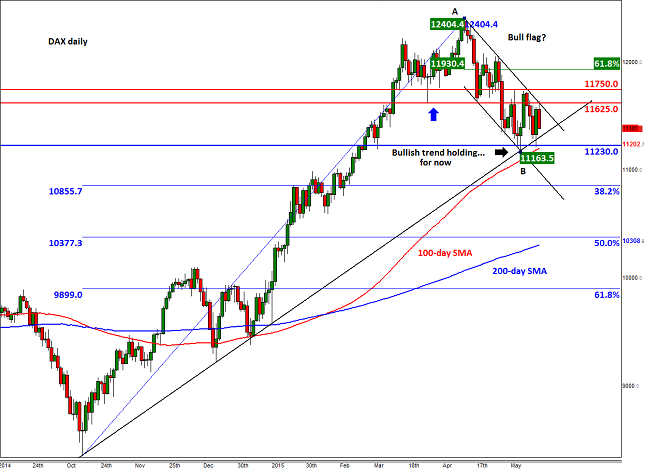

Look Ahead: Stocks

While some of the major US stock indices managed to test their prior record levels this week, European stocks remained largely downbeat. Sentiment has been dented by the turmoil in the bond markets and the on-going Greek saga. The rallying EUR/USD pair has also weighed on the European stock markets thanks to some disappointing US macro pointers. Though Mario Draghi’s comments regarding QE, namely that the ECB will "implement in full" its bond-buying programme and that it will stay in place "as long as needed", helped to lift the sentiment slightly, by Friday afternoon when this report was written, the European markets had relinquished a big chunk of their gains.

We believe that this sell off may be temporary and that calm will return to the bond and equity markets soon. After all, the ECB has only just started its colossal stimulus programme, which in theory should keep yields under extreme pressure for another 1.5 years or more. Indeed, we still hold the view that bond yields will probably head back lower soon not least because of the lack of inflation in the major economies (inflation being zero in the single currency bloc), and this in turn may result in a sharp rebound in European stocks.

The sharp rebound in the stock markets on Thursday caused the European indices to post interesting reversal-looking patterns on their chart. However by Friday, some of these indices were struggling to clear their respective key resistance levels, which are necessary before bullish speculators are encouraged to increase their bets. Take the DAX as example. As we have reported previously, the German index has managed to bounce twice now from its medium term bullish trend line, finding additional support around 11230. But so far it has been unable to clear the resistance trend of an apparent bull flag and resistance area between 11625 and 11750, which was previously support. Therefore, as things stand, the near term trend is still not very clear and what happens next could determine the near-term direction. But as the medium-term bullish trend line is still intact, the bulls are still in charge. Indeed, if the index does break above the aforementioned resistance range next week then it may go on to rally all the way to the 61.8% Fibonacci retracement at 11930 before making its next move. We wouldn’t be surprised either if the index were to hit a fresh record high, potentially before the end of this month. But, we would equally not be surprised if the DAX were to head back lower from this 11625 resistance area once again. We are therefore waiting for price action to guide us in terms of near-term direction: a potential break above 11625-11750 would be very bullish in our view, while a decisive break below the bullish trend would be bearish.

Figure 1:

Source: FOREX.com. Please note this product is not available to US clients

Look Ahead: Commodities

Precious metals staged a sharp rally this week as the dollar sold off. Also, the sharp rise in global bond yields in recent weeks may be good news for gold in the short term as investors price out the possibility of the global economy falling into deflation. That’s because historically, inflation – or at least the market’s expectation of inflation – and yields tend to go in the same direction. If Mr Market thinks that higher inflation may be on the horizon then yields will typically rise in order to compensate for the loss of the purchasing power of future cash flows of bonds. Therefore, if it is inflation that the market is worried about – or happy that deflation is not forthcoming – then inflation-hedging assets like gold should benefit as a result. Is this what we are witnessing now? The direction of the dollar will have a major say in the buck-denominated commodity and there will be plenty of US data releases next week to impact the world’s reserve currency (see the “Global Data Highlights” section below for more).

Another reason why we think gold has a high chance of extending its gains next week is the current negative sentiment towards the metal. Typically, the markets turn when sentiment is at an extreme – think of the stock market rally that began in March 2009, for example, or indeed the precious metals’ slump in 2011. At the moment with global inflation being this low and US equity markets near record highs, not many people are giving the shiny metals much attention. Indeed, the latest demand trends report from the World Gold Council (WGC) underscores this view. According the WGC, total demand for gold was down 1% in the first quarter versus the same period a year earlier. Jewellery demand was particularly weak in China, the world’s top gold consumer, down 10%. Nevertheless, this was offset by a sharp rise in Jewellery purchases of the former top gold consumer nation, India. What’s more, investment demand showed a modest recovery as ETF inflows rose 4% over the quarter. On top of this, central bank purchases expanded for the seventeenth time last quarter, although it was little-changed from the first quarter of 2014.

So, in the near-term, the stage looks set for gold to extend its rally further. Its weekly chart is showing a clear bullish sign, which is the bear’s inability to push gold decisively below the long-term 61.8% Fibonacci retracement at $1155 on at least five attempts since November. Anyone who trades gold will know how important this 61.8% Fibonacci retracement level is on literally any time frame. So the fact that the long-term 61.8% level is holding is very encouraging for the gold bugs. What’s more, gold has created a couple of higher lows already and is on the verge of making another one if it breaks decisively above the $1220 horizontal resistance level and the 200-day moving average at $1218. If broken, the next logical target would be the 61.8% Fibonacci retracement of the downswing from the January high, at just shy of $1245. Beyond the 61.8% Fibonacci level is the long-term downward-sloping trend of the falling wedge pattern around $1270. If and when gold breaks this barrier then we could be talking about much, much, higher levels. Meanwhile, if the sellers defend this $1218/20 area then we wouldn’t be surprised if gold drops back to support levels at $1200 or even $1180, before deciding on its next move. Put another way, gold is currently at a key technical juncture and what it does next could determine the near-term direction at the very least. More importantly, gold’s next move could certainly open some decent trading opportunities for next week.

Figure 2:

Source: FOREX.com. Please note this product is not available to US clients

Global Data Highlights

Monday, May 18, 2015

No Significant Events

Tuesday, May 19, 2015

1:30 GMT Reserve Bank of Australia’s Meeting Minutes

A couple of weeks ago, the RBA decided to cut rates, which was long expected by the market. In fact, one could argue that the RBA waited much longer to cut rates than most anticipated, and has actually provided more of a lift for the AUD than is typical when a central bank cuts. The reason being is that the RBA didn’t insinuate that more rate cuts were coming, and it’s that lack of voracity that has the market feeling more positive about the AUD. These minutes could clarify things a bit, particularly if there was talk of multiple cuts as the interpretation of the initial release was that this was a one-time affair. If the discussion of further rate cuts is flavored with ambiguity, the AUD could be put in a hurt locker.

8:30 GMT UK Consumer Price Index (April)

Just like the rest of the developed world, the UK is trying to deal with the effects of low inflation. Now that oil prices have surged slightly, there is the possibility that this could rebound, and since this is the first CPI read of many to come this week, it could have more impact than usual. Consensus is expecting a flat read, so anything positive could supplement the current GBP rally.

9:00 GMT German ZEW Survey – Current Situation & Economic Sentiment (May)

Sentiment in Germany has been slipping over the last couple months as the European Central Bank has begun their Quantitative Easing program and Greece continues to be a thorn in the side of Europe. The market isn’t really expecting anything grand here either with further declines being the general consensus. If this falls further than anticipated though, watch for the EUR/USD short squeeze to potentially come to an end.

12:30 GMT US Building Permits & Housing Starts (April)

Last month was pretty dismal for these reports as each missed consensus and Starts fell below the 1M level for the second month in a row after five straight months of being above it. The market is expecting these figures to get right back on the horse with 1.07M and 1.02M consensuses respectively, and it may have to perform to that level for any USD strength to be maintained.

Tentative Global Dairy Trade’s Price Index

The Reserve Bank of New Zealand is outright discussing rate cuts at their next policy meeting which has the NZD retreating from highs against a variety of currencies, and milk prices are a likely reason why. The last four releases from this twice monthly measure have shown declines to the order of -8.8%, -10.8%, -3.6%, and -3.5%. Since New Zealand is so heavily reliant on their milk product industry, declines of this magnitude are extremely punitive, and have the added effect of bringing inflation lower as well. More negative figures could cement the notion that the RBNZ will most assuredly cut at their next meeting on June 10th.

Wednesday, May 20, 2015

18:00 GMT Federal Open Market Committee’s Meeting Minutes

Since there wasn’t a press conference after the Fed’s last decision, this will be the preeminent look in to what they discussed. Due to their mentioning “transitive” effects in Q1 2015, watch for low oil and weather to be prominent subjects in addition to discussions about the timing of their first interest rate hike.

Thursday, May 21, 2015

1:35 GMT HSBC Chinese Flash Manufacturing PMI (May)

The discussion about a Chinese slowdown is a well-worn path, but needs to be continuously mentioned as a risk whenever Chinese data is released. Last month’s final figure brought this metric down to 48.9, and has done nothing but decline for the last couple months. Consensus is expecting something a little better this time around at 49.5, but if recent trends are any indication that may be a difficult hill to climb.

8:30 GMT UK Retail Sales (April)

Now that the UK election drama is in the rear view, the market can get back to loathing UK data releases. The decline of 0.5% last month in Retail Sales was the worst since June of last year, but it was even worse considering an increase of 0.4% was anticipated. Consensus this time around is for a 0.3% increase, but if it fails to reach that level, the GBP could suffer the effects of profit taking from its recent rally.

15:30 GMT European Central Bank Forum Speeches

There will be a variety of important speakers at this forum including ECB President Mario Draghi, Bank of England Governor Mark Carney, Bank of Japan Governor Haruhiko Kuroda, Federal Reserve Vice-Chairman Stanley Fischer, and Harvard Professor Larry Summers, among others. The events will go through Saturday, with discussions ranging along the economic spectrum. Draghi has a history of dropping important monetary policy hints at speeches, and if this is the European version of the Fed’s Jackson Hole meeting, we could see some policy tidbits from him or others.

Friday, May 22, 2015

Tentative Bank of Japan Monetary Policy Statement and Press Conference

Before BoJ Governor Kuroda can join the festivities at the ECB Forum, he has some work to do back in Japan. Recent speeches by Japanese officials seems to be pointing toward nothing new happening on the QE front for the BoJ, but as the Swiss National Bank taught us earlier this year, that doesn’t mean you should ignore it. There is the potential for more QE coming particularly since inflation hasn’t yet materialized and the economy hasn’t recovered like they would prefer.

12:30 GMT US Consumer Price Index (April)

The US Producer Price Index this past week didn’t give anybody any good feelings heading in to CPI. The PPI declined by 0.4% on expectations of a 0.1% increase, and CPI is also expected to rise by 0.1%. Whether that’s an ominous sign or not is debatable, but it may very well make investors nervous. The flurry of CPI releases that are being released before this one could give an indication as to whether inflation is rising globally, and the US data could trend along those lines.

12:30 GMT Canadian Consumer Price Index (April)

The situation in Canada on the inflation front is very similar to that of the US in that there isn’t enough of it currently. The Bank of Canada seems to be confident that things will start to turn their way as they mentioned in their most recent monetary policy decision, but if CPI doesn’t reflect the BoC’s confidence, the USD/CAD could be in for a rally.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.