On Tuesday, the overall US Dollar index, which measures USD's strength against a basket of major currencies, witnessed a dramatic turnaround after falling to its weakest level since January 2015. Among major currencies, the GBP/USD pair was dragged lower on data showing contraction in manufacturing activity in April. According to the data released on Tuesday, the Markit/CIPS UK Manufacturing PMI for April dropped below the critical 50.0 mark to 49.2, marking its lowest level since February 2013. The reading for March was also revised lower to 50.7 from 51.0 registered previously. Immediately after the release the GBP/USD pair reversed from 1.4770 level to drop back below 1.4550 level. The spillover effect was felt on the Euro as well. The EUR/USD pair dropped back below 1.1500, reversing from a peak of 1.1616, its strongest level since late August reached earlier on Tuesday.

Investors now turn their attention to a widely watched monthly US private-sector employment number, ADP report, which shows the number of private-sector jobs addition during the month. US economic data on Wednesday also features the release of ISM non-manufacturing PMI figure. From UK, investors will look forward to UK construction PMI data for trading cues.

Technical Outlook

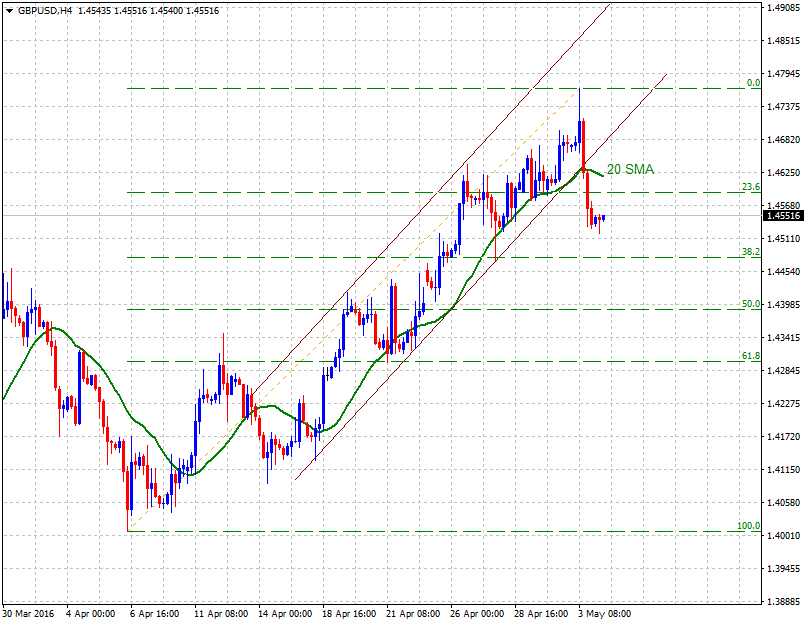

GBP/USD

On Tuesday, the pair broke through an important confluence support near 1.4630 level, comprising of a short-term ascending trend-channel support and 20-SMA. The pair subsequently dropped below 23.6% Fibonacci retracement level of 1.4009-1.4770 up-move. Hence, from current levels the pair seems vulnerable to extend its near-term corrective move towards and important support near 1.4480 level, also coinciding with 38.2% Fibonacci retracement level.

Meanwhile on the upside, 23.6% Fibonacci retracement level near 1.4585-90 area now seems to act as immediate resistance. Even if the pair manages to clear this immediate resistance, any further up-move now seems to be capped at the ascending trend-channel and 20-SMA support break-point, turned resistance near 1.4620-30 area.

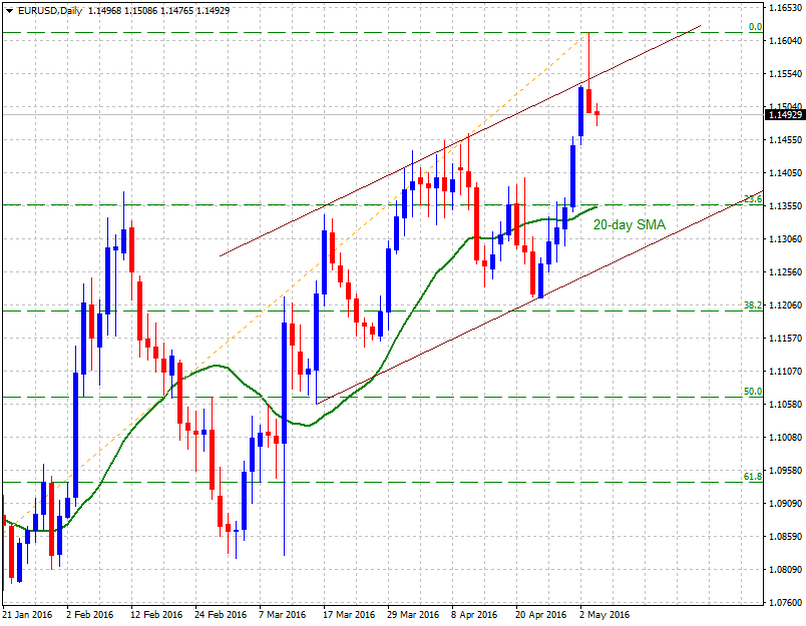

EUR/USD

The pair surged past a short-term ascending trend-channel intermediate resistance near 1.1545-50 area, but failed to sustain strength at higher levels. The pair subsequently dropped back below 1.1500 mark to currently trade near 1.1485 level. A follow-up selling pressure below 1.1460 immediate support now seems to extend the Tuesday’s reversal from higher level, towards testing its next major support confluence near 1.1360-55 region. The 1.1360-55 support confluence comprises of 20-day SMA and 23.6% Fibonacci retracement level of a nearly 1000-pips up-swing from 1.0522 to 1.1616.

On the upside, strength back above 1.1500 handle might continue to face hurdle at the ascending trend-channel resistance near 1.1550 level. A sustained break-through this immediate resistance, now seems to assist the pair to surpass Tuesday’s high resistance near 1.1616 and continue climbing higher towards a medium-term ascending trend-channel resistance near 1.1660-65 zone.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.