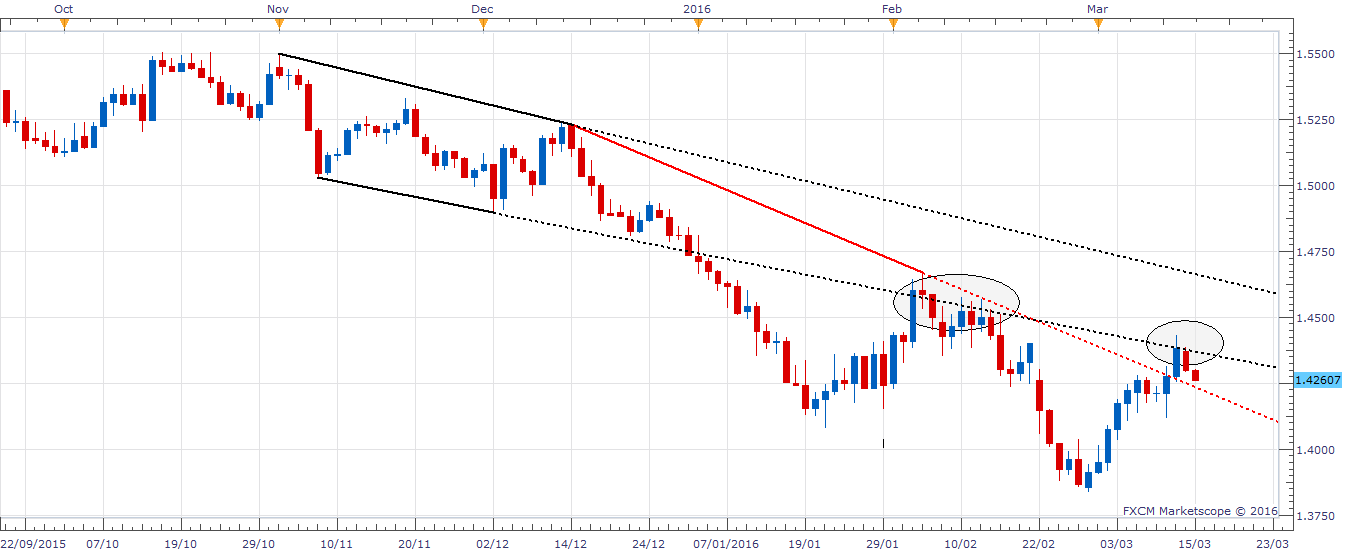

Sterling looked to re-enter the falling channel seen on the daily chart, but was rejected and fell to a low of 1.4293 levels. US dollar made a comeback across the board as significant majority believes the Fed may surprise markets with its hawkish stance. Consequently, offered tone around the pair remained intact in Asia, pushing it to a low of 1.4256 levels. Ahead of tomorrow’s FOMC rate decision, the spot could be influenced by US advance retail sales report.

Eyes US retail sales report

The January retail sales report was positive on all fronts. The headline figure had rose at the fastest pace eight months as incomes continue to post gains. Personal spending rose 0.5% in January. February non-farm payrolls report indicated labor market strength remains intact, while wage growth slowed. Overall, economy is holding up well in early 2016 despite global headwinds.

The financial markets are on a strong footing as well. This triggered speculation the Fed may come out less dovish than expected in March. The American dollar may receive another boost if the February retail sales figure due later today shows another solid uptick in consumption. Moreover, that would add to speculation of less dovish Fed.

The headline figure is seen falling 0.1%, while core/control group figure growth is seen slowing to 0.2% from Jan’s 0.6% rise. A better-than-expected data is what USD bulls would be looking out for.

Technicals – Daily close below 1.4228 would be bearish

Sterling’s failure to re-enter falling channel brought the bears back in the game, still scope for another bullish attempt exists as long as the spot does not see a daily close below 1.4228 (falling trend line support on the daily chart)

Bears need to watch out for a rebound from 1.4228, in which case the spot could test resistance at 1.4375 (falling channel). A violation there, preferably on daily closing basis, would mean recovery from 1.3835 has resumed and the spot may yield 1.4436-1.45 levels.

Intraday break below 1.4228 needs to be treated with caution, but such a break could materialize into a drop to 1.4134 (Mar 7 low).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.