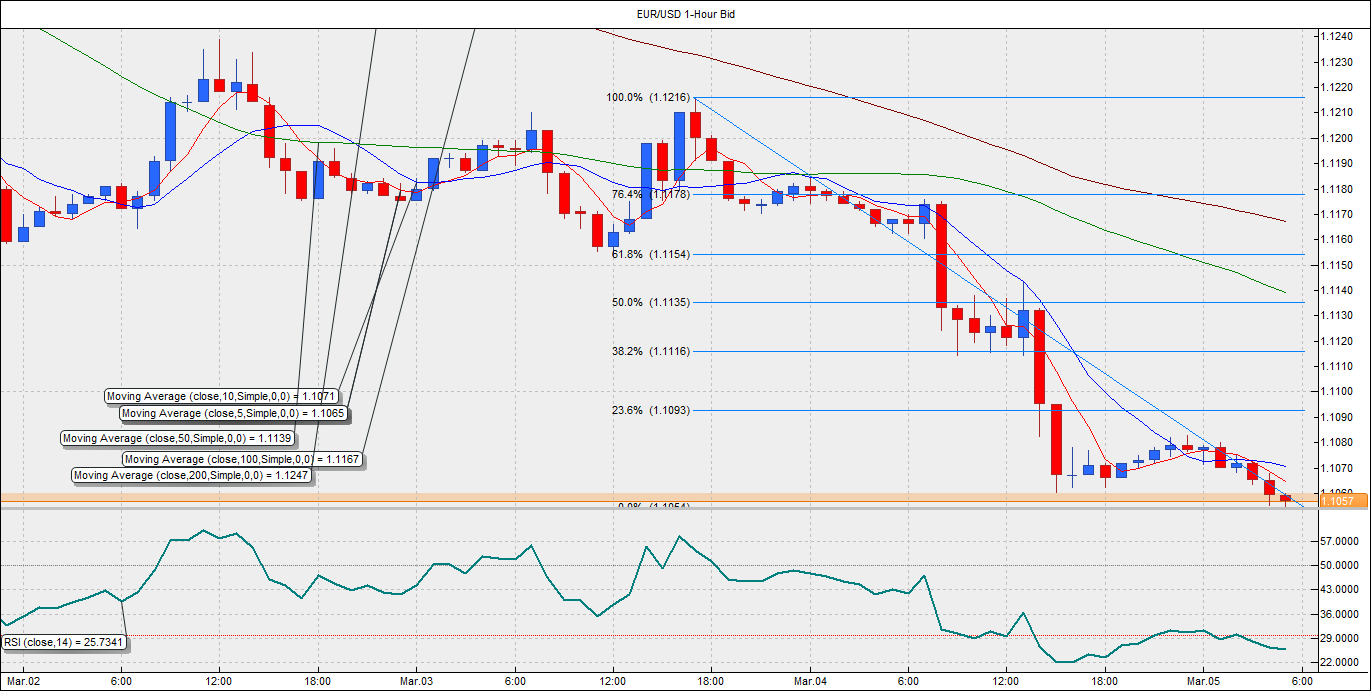

The Euros have been sold aggressively since Wednesday, taking the EUR/USD pair to its lowest since September 2003. The pair hit a low of 1.1054 today ahead of the European Central Bank (ECB) policy meeting. The bank is expected to unveil the details of its QE program today, and begin its EUR 1 trillion program from the current month. Given the divergent policy expectations from the Fed and the ECB, the reaction in the EUR has been exaggerated. However, the markets have largely ignored the recent upbeat economic data out the Eurozone. The risk of Grexit is also off the table for sometime now. Thus, the EUR could see a fresh buying demand, especially if the ECB upgrades its growth forecasts later today.

At the moment, the hourly chart shows a bullish divergence between the RSI and prices chart could be formed if the current candle closes above 1.1059 levels. In such case the immediate gains appear capped at the 23.6% Fib retracement (1.1216-1.1054) located at 1.1093. On the contrary, a break below 1.1054 could send the pair down to 1.10 levels. However, given the oversold nature of the RSI on the hourly and 4-hour charts, the pair is likely to see a minor recovery to 1.1093 levels. We are likely to see an intraday dip below 1.10 during the ECB President Mario Draghi’s press conference. However, the pair could be seen bouncing back above 1.10 levels in case ECB upgrades growth forecasts.

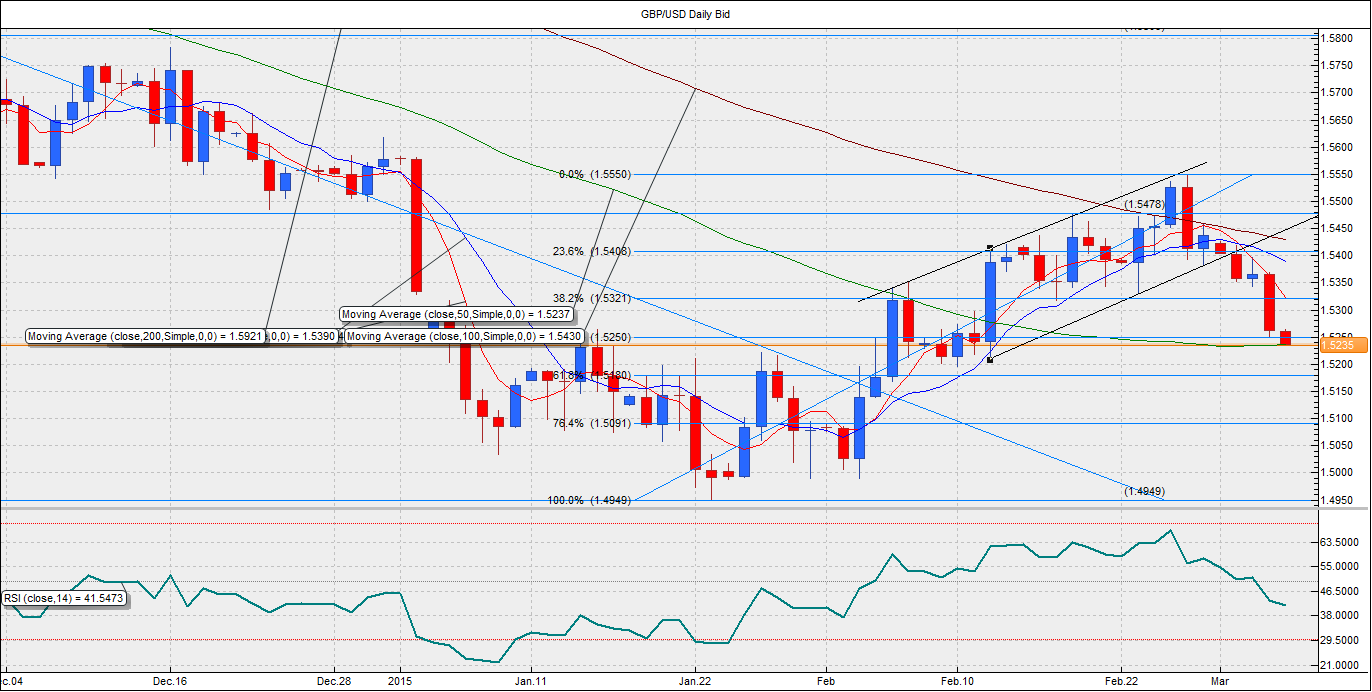

GBP/USD – Sell-off could halt around 1.5250

The British Pound, too, witnessed a massive sell-off that pushed the GBP/USD pair lower to 1.5250 levels, which is the 50% Fib retracement (of 1.4949-1.5550). The weakness in the GBP could be due to uncertainty surrounding the general election in the May. The pound could have also suffered a “negative rub-off” from the sharp fall in the shared currency to 2003 levels. Otherwise, the data in the UK have been more or less upbeat. The UK services PMI in February stayed very much in the expansive territory, although it narrowly missed the estimates. The sell-off was exaggerated after the stops were triggered below 1.5335 levels.

Given the absence of the fresh economic data in the UK, the pair is likely to take cues from the moves in the EUR/USD pair and from the weekly jobless claims in the US. At the moment, the pair is trading at 1.5234; a few pips below the 50-DMA located at 1.5237. The daily RSI has turned bearish indicating further sell-off in the pair. However, the hourly and the 4-hour RSI has hit oversold zone. Thus, a minor recovery to 1.5270 could seen before seeing a further sell-off, which appears restricted to 1.5200-1.5210 levels. In case the EUR posts sharp recovery on a upward revision of growth forecasts by the ECB, then the GBP/USD too, could recover to 1.5334 levels. The UK 10-year Gilt yield has seen an inverted head and shoulder breakout on the daily chart. Thus, the yield could rise to 2.049% in the short-term, which could help halt the sell-off in the pair.

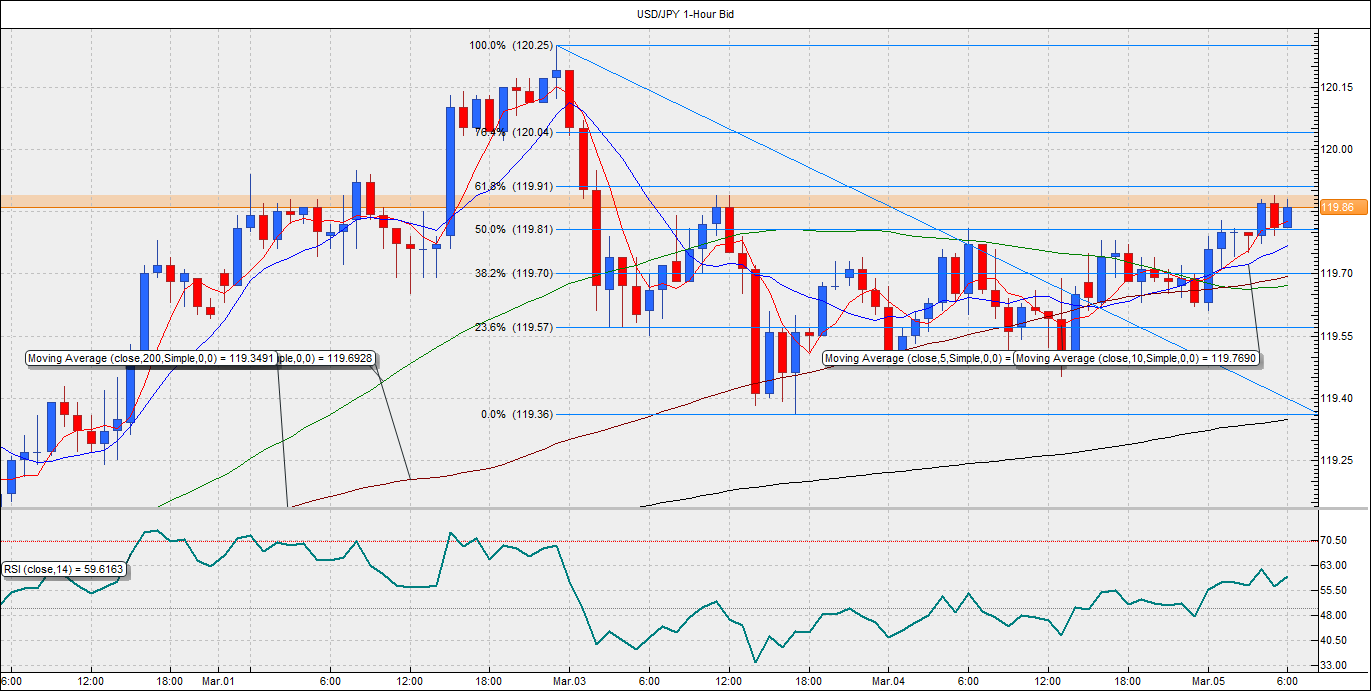

USD/JPY – Yen dips, but relatively resilient

The USD/JPY finished with a DOJI candle on Wednesday at 119.63 as the Japanese Yen stayed resilient despite of a sharp sell-off in the EUR and GBP. The US services PMI beat expectations, with a rise in the employment component, indicating a possibility of a positive surprise in the NFP tomorrow. The Fed Biege book also painted an optimistic picture with growth across most regions and industries. However, the 10-year Treasury yields weakened to 2.112%, with a spinning top formation on the charts. The yield continues to trade lackluster at 2.117% today. However, the USD/JPY has inched higher to 119.87 levels.

On the hourly chart, the pair is trading above 50% Fib retracement located at 119.81. A failure to break above 119.89-119.91, could push the pair down to 119.57 levels. On the other hand, a break above the same, could send the pair higher to the latest cyclical high of 120.25. Moreover, a failure to sustain above the 5-DMA located at 119.82 is likely to see a sharp sell-off towards 119.57-119.46 (10-DMA) levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.