Asia:

Overnight saw some of the biggest moves we’ve had for a while, right across the board. The Aussie kicked it all off with a less than dovish Monetary Policy Statement from the RBA, but it was Greece and USD driven flows that really gave markets the kick that traders had been waiting for.

In the Technical Analysis section of the Vantage FX News Centre, I spoke yesterday about how we would look to position ourselves heading into the RBA decision. I spoke about the biggest risk heading into the release was being short, no matter the outcome and then how to go about managing your risk from that point. The RBA didn’t play ball with market expectations and AUD/USD shot up from lows as spoken about.

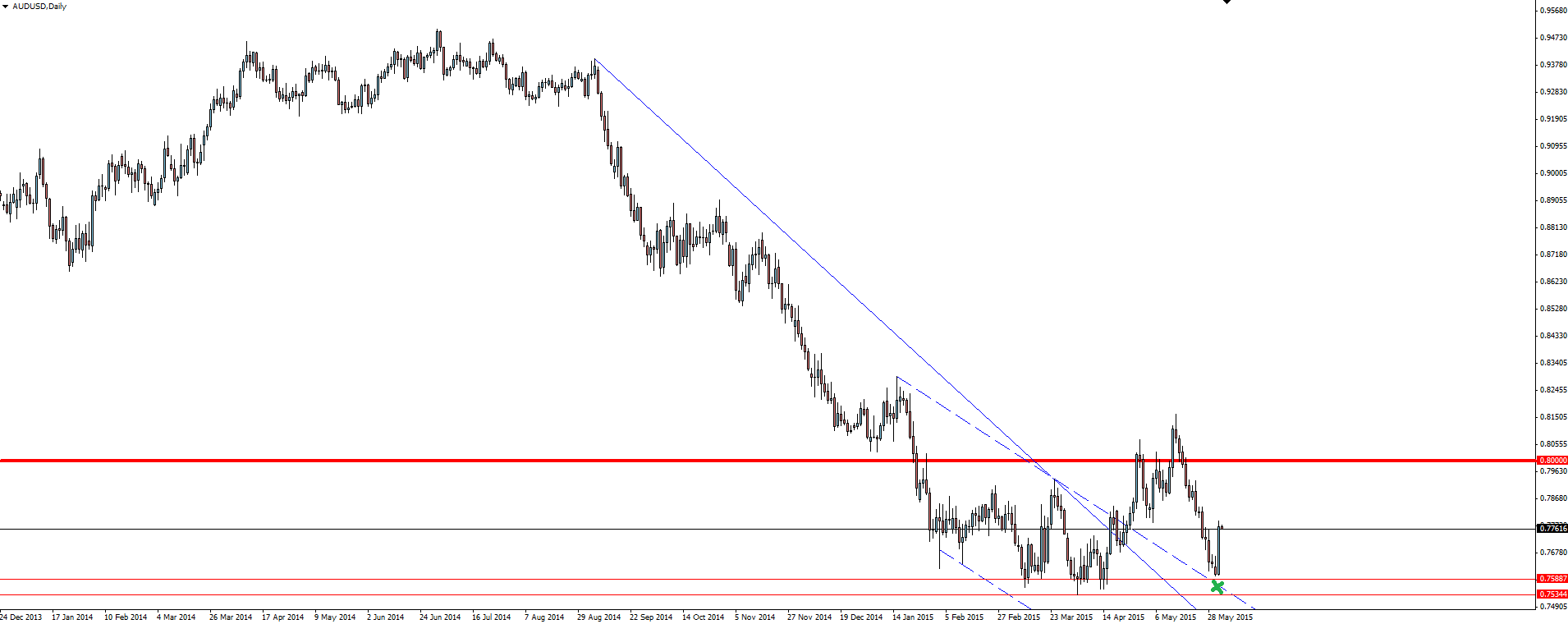

AUD/USD Daily:

This was the start of the big moves and I hope that this blog helped a little with the risk management side of things.

Europe:

It was during Europe where things really kicked off, with traders sensing the prospect of a deal between Greece and its creditors being announced as early as Wednesday. Eurozone CPI was also higher than expected, but Greek optimism in the market was what pushed EUR/USD up before USD traders started to get squeezed and by then, the move had exploded.

The story was that the Eurogroup and the IMF look to have come to an initial agreement that would allow Greece access to the additional bailout funds that are needed to keep their head above water. The USD side of this EUR/USD move is a key part, but I’m not convinced as to why the market viewed this agreement as a lock. The document needs to be reviewed on Wednesday followed by the final sign off from Greece who we know won’t be happy with the austerity measures that are being forced upon them.

There is no deal. Stay on your toes.

US:

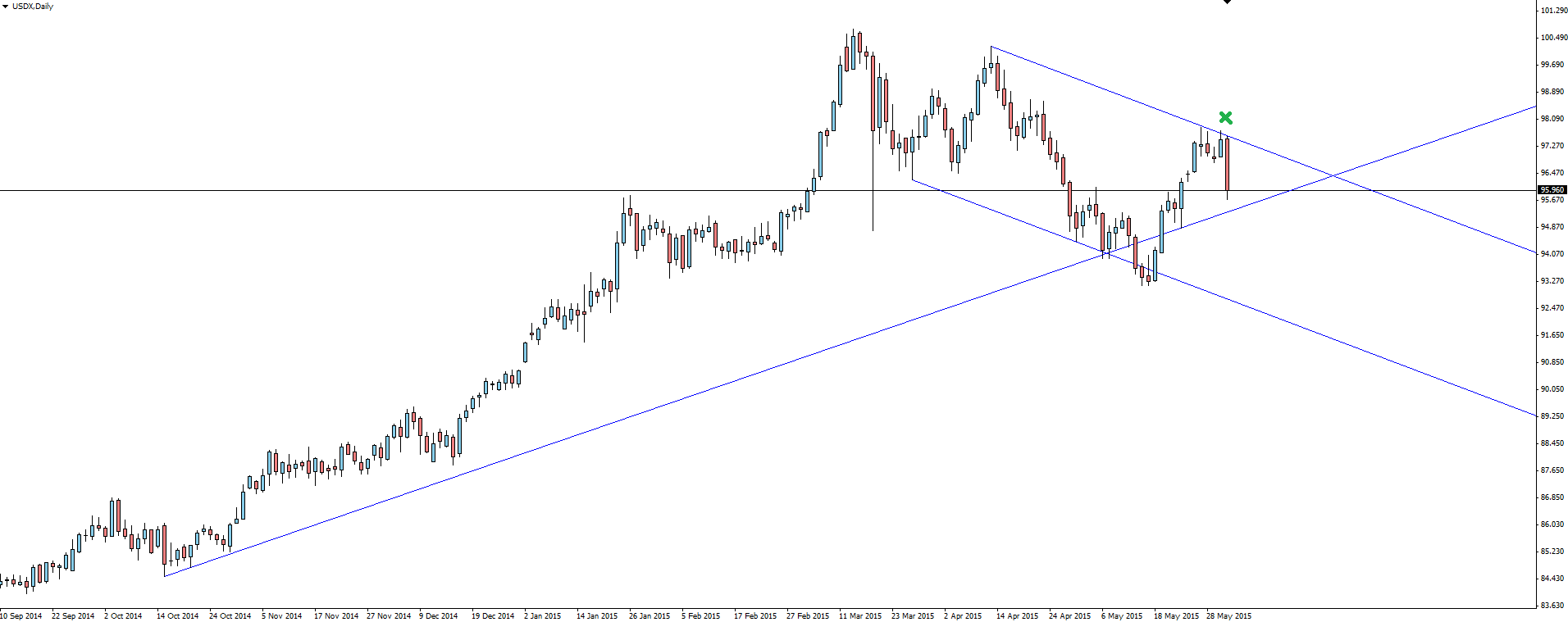

USDX Daily:

All you need to do is take a look at the technicals on the USDX chart that we have been playing with on Twitter over the last few months. Simple parallel lines tell the above fundamental story with a lot less subjectivity.

On the Calendar Today:

The data releases just keep flowing all the way through today highlighted by the Australian GDP release during Asia and the polarising ADP Employment number during the US session.

Wednesday:

AUD GDP

CNY HSBC Services PMI

EUR Services PMI’s

GBP Services PMI

EUR Minimum Bid Rate

USD ADP Non-Farm Employment Change

CAD Trade Balance

EUR ECB Press Conference

USD Trade Balance

USD ISM Non-Manufacturing PMI

Chart of the Day:

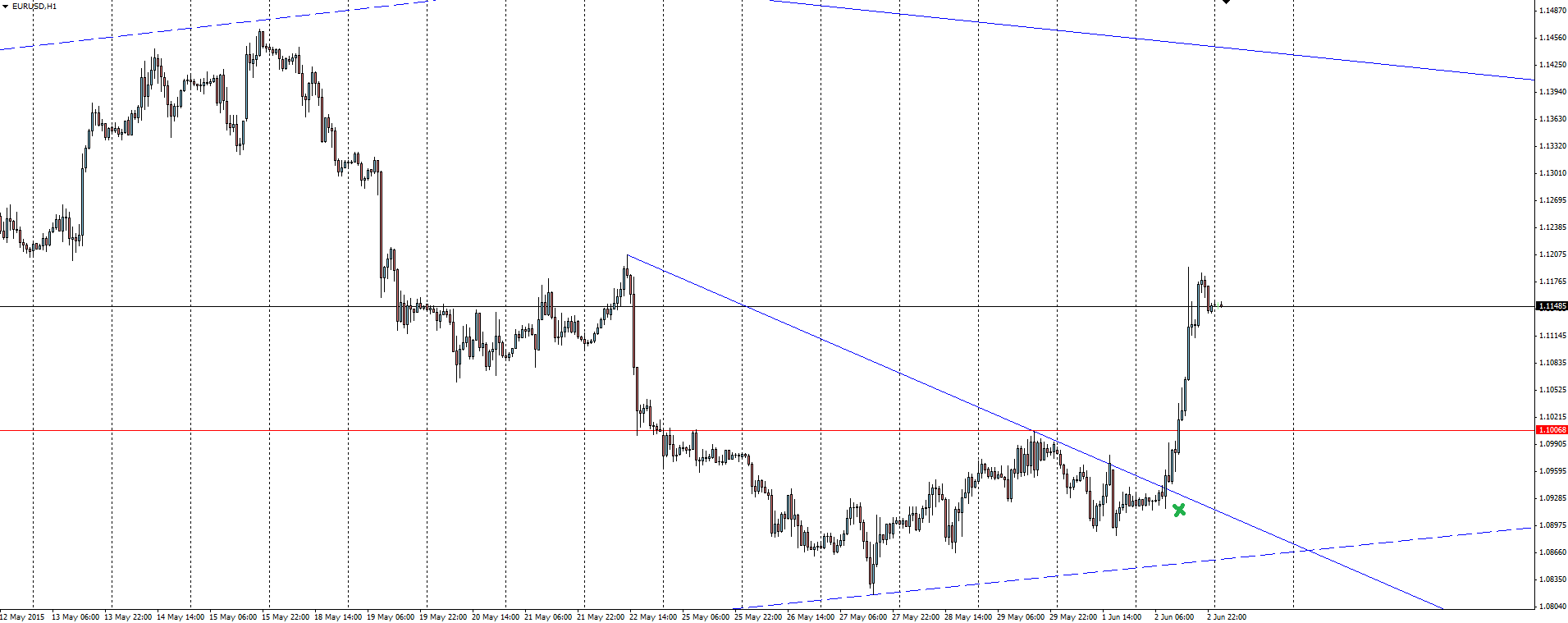

In Yesterday’s Asian Session Morning blog, I posted a EUR/USD hourly chart after negotiations seemingly had come to another road block. I said that the the market had become de-sensitised to failure and that I was looking for a resumption of the down trend.

EUR/USD Hourly:

1 day and a 200 pip straight line rally later, I wasn’t quite on with that one for reasons we went through above.

EUR/USD Daily:

If we take a look on the daily chart, the short setup is still on the cards with price below it’s major trend line and still tucked neatly inside that flag.

Trying to get on board the train just before it leaves gives you massive potential to catch major moves. You just have to make sure you have your risk clearly defined and identify when you are wrong.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.