Morning View:

Will we get a hung Parliament in the UK?

That really is the question on traders lips as the UK goes to the polls today in what is shaping up as an election that could dramatically change their relationship with the European Union. However, it is the word ‘could’ that is key in that statement, with the uncertainty of no clear winner or direction sure to wreak havoc on financial markets across Europe and beyond.

Prime Minister David Cameron is leading the charge toward uncertainty, pledging to hold a referendum on the UK’s membership in the EU. Being part of the EU has never quite struck a cord with the general public but businesses enjoy the conditions under which they can more easily trade throughout the continent.

Read into pre-election polling at your own peril but throughout the election campaign, things have stayed pretty much the same. It’s almost even thirds between David Cameron’s Conservatives, Ed Miliband’s Labour Party, and then the rest. With no party occupying a clear majority, everything is pointing to the dreaded hung parliament and the possible weeks of re-negotiations and deals being done to form any sort of functioning government.

So what does this mean for the Pound?:

With all this talk of uncertainty weighing on the Pound, you would have expected to see more damage being done on a chart than what we have got. Markets have taken more notice of the Hawkish BoE combined with a weak USD and given Cable some strength over the last few weeks.

But it’s once the election results are clear that the real moves will come.

A Conservative majority or Conservative-led coalition is seen as being a positive for the UK economy. It will offer the certainty of the current government serving for another term, keeping the BoE on it’s current path of beginning a fresh rate hiking cycle and therefore GBP positive.

A Labour majority or similar Labour led coalition on the other hand is seen as having policies that are less beneficial for the economy as a whole. If a new Labour government is elected, economic growth uncertainty that comes with a new government will potentially be seen as GBP negative.

Any type of hung parliament will of course also be GBP negative.

The Charts:

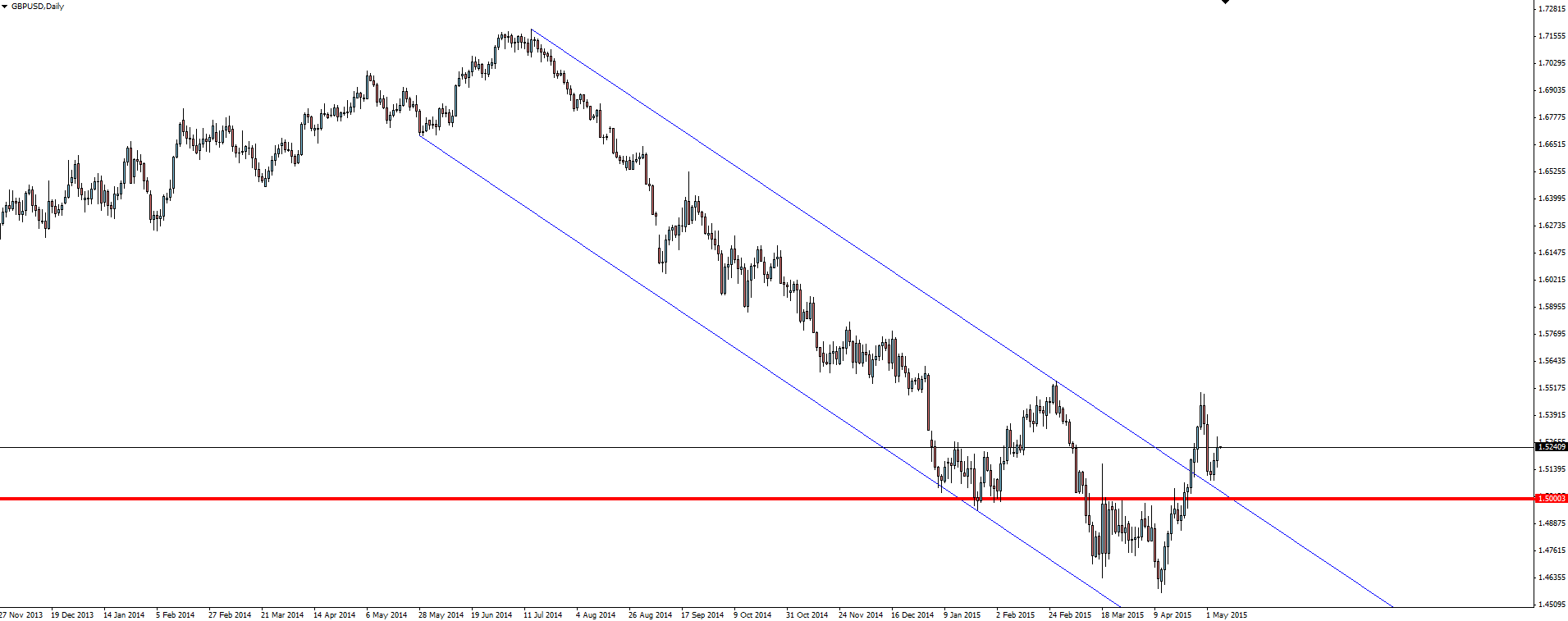

GBP/USD Daily:

EUR/GBP Weekly:

GBP/JPY Weekly:

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.