Market Brief

In the wake of Janet Yellen’s testimony before the House Financial Services Committee in Washington; FX traders kept on selling the US dollar during the Asian session as the Fed Chairwoman released a cautious speech. According to Yellen, the Federal Reserve is still on track to raise gradually short-term rates, however the recent market turmoil and the uncertainty about china’s growth prospect could weigh on US growth if proven persistent. A few days ago, Stanley Fisher, Fed Vice Chairman, delivered also a cautious speech by recalling that the Fed’s policy will remain data dependent and that it was too soon to tell if the current market conditions will prevent the Fed to move on with its rate cycle.

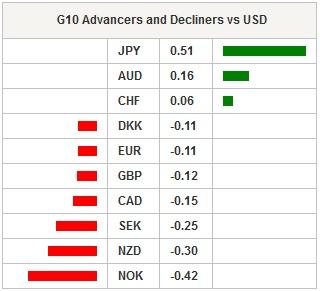

Yesterday investors rushed into US treasuries and sent sovereign rates lower, especially on the short end of the yield curve. The 30-year yields settled down 10bps to 2.49%, while the 10-year yields fell also 10bps to 1.67%, suggesting that investors are turning more pessimistic about the long-term outlook. The US dollar printed a fresh 16-month low against the Japanese yen, suggesting that traders believe the BoJ will be unable to weaken further the yen, while betting the Fed will have to remain sidelined for a longer period of time. USD/JPY is currently trading at around 112.75, down 0.50% in overnight trading. On the downside, a first support can be found at around 110 (psychological level and previous high), however the main support lies at 105.23 (low from October 15, 2014).

AUD/USD continued to push higher, remaining in its medium-term uptrend channel. The Aussie has been boosted by the potential delay of the next rate hike by the Federal Reserve, together with the solid performance of the Aussie economy against the backdrop of falling commodity prices.

The New Zealand dollar failed once again in an attempt to break the $0.6750 resistance and is now reversing the trend toward the next support at around $0.66.

Equities were broadly trading in negative territory as most Asian markets re-opened for trading. Hong Kong’s Hang Seng fell 3.88% after being closed for the last three days. South Korea’s Kospi settled down 2.93%, while in Singapore the STI fell 0.77%. Mainland Chinese markets will re-open next Monday. Be ready for the gap. In Europe equity futures are blinking green across the screen as concerns about the global economy weighs on traders’ mind. The German DAX was down 1.35%, the SMI -1.33%, the CAC -1.31% and the Euro Stoxx 600 -1.40%. US futures were also trading lower with contracts op the S&P 500 down 0.47%.

Today traders will be watching current account balance from Turkey; CPI from Switzerland; Riksbank interest rate decision (expect a cut); manufacturing production from South Africa; trade balance and gold and Forex reserve from Russia; Yellen’s speech before the Senate, initial jobless claims from the US; RBA governor’s testimony in front of the parliament committee.

| Global Indexes | Current Level | % Change |

| Hang Seng Index | 18539.7 | -3.88 |

| FTSE futures | 5571 | -0.81 |

| DAX futures | 8902.5 | -1.35 |

| CAC futures | 4007.5 | -1.31 |

| SMI Futures | 7556 | -1.33 |

| S&P future | 1838 | -0.47 |

| DJIA futures | 15845 | -1.68 |

| Global Indexes | Current Level | % Change |

| Gold | 1207.14 | 0.84 |

| Silver | 15.35 | 0.52 |

| VIX | 26.29 | -0.94 |

| Crude wti | 27.09 | -1.31 |

| USD Index | 95.79 | -0.11 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| TU Dec Current Account Balance | -5.00b | -2.11b | TRY/08:00 |

| SZ Jan CPI MoM | -0,40% | -0,40% | CHF/08:15 |

| SZ Jan CPI YoY | -1,30% | -1,30% | CHF/08:15 |

| SW Feb 11 Riksbank Interest Rate | -0,45% | -0,35% | SEK/08:30 |

| SW Jan Average House Prices | - | 2.677m | SEK/08:30 |

| SA Dec Mining Production MoM | 0,00% | 2,40% | ZAR/09:30 |

| SA Dec Gold Production YoY | - | 2,20% | ZAR/09:30 |

| SA Dec Platinum Production YoY | - | 24,90% | ZAR/09:30 |

| SA Dec Mining Production YoY | -0,90% | -0,80% | ZAR/09:30 |

| BZ Feb 10 FGV CPI IPC-S | 1,73% | 1,78% | BRL/10:00 |

| SA Dec Manufacturing Prod SA MoM | 0,10% | -1,20% | ZAR/11:00 |

| SA Dec Manufacturing Prod NSA YoY | -1,50% | -1,00% | ZAR/11:00 |

| UK BOE Deputy Governors Cunliffe, Bailey Speak in London | - | - | GBP/11:30 |

| RU Feb 5 Gold and Forex Reserve | - | 371.3b | RUB/13:00 |

| RU Dec Exports | 27.0b | 25.5b | RUB/13:00 |

| RU Dec Imports | 16.9b | 16.4b | RUB/13:00 |

| RU Dec Trade Balance | 10.0b | 9.1b | RUB/13:00 |

| US Feb 6 Initial Jobless Claims | 280k | 285k | USD/13:30 |

| CA Dec New Housing Price Index MoM | 0,20% | 0,20% | CAD/13:30 |

| US janv..30 Continuing Claims | 2245k | 2255k | USD/13:30 |

| CA Dec New Housing Price Index YoY | - | 1,60% | CAD/13:30 |

| US Bloomberg Feb. United States Economic Survey | - | - | USD/13:45 |

| BZ Currency Flows Weekly | - | - | BRL/14:30 |

| US Feb 7 Bloomberg Consumer Comfort | - | 44,2 | USD/14:45 |

| US Fed's Yellen to Appear Before Senate Banking Committee | - | - | USD/15:00 |

| BZ Feb 7 Trade Balance Weekly | - | - | BRL/17:00 |

| NZ Jan Food Prices MoM | - | -0,80% | NZD/21:45 |

| AU RBA Governor's Testimony to Parliament Committee | - | - | AUD/22:30 |

| RU Jan Budget Balance YTD | -210.0b | -1945.1b | RUB/23:00 |

| CH Jan New Yuan Loans CNY | 1900.0b | 597.8b | CNY/23:00 |

| CH Jan Aggregate Financing CNY | 2200.0b | 1820.0b | CNY/23:00 |

| CH Jan Money Supply M0 YoY | 10,60% | 4,90% | CNY/23:00 |

| CH Jan Money Supply M1 YoY | 14,70% | 15,20% | CNY/23:00 |

| CH Jan Money Supply M2 YoY | 13,50% | 13,30% | CNY/23:00 |

| BZ ABPO Jan. Cardboard Sales | - | - | BRL/23:00 |

| IN Jan Local Car Sales | - | 172671 | INR/23:00 |

| CH Jan Foreign Direct Investment YoY CNY | -5,90% | -5,80% | CNY/23:00 |

Currency Tech

EURUSD

R 2: 1.1495

R 1: 1.1387

CURRENT: 1.1313

S 1: 1.0711

S 2: 1.0524

GBPUSD

R 2: 1.5242

R 1: 1.4969

CURRENT: 1.4459

S 1: 1.4081

S 2: 1.3657

USDJPY

R 2: 125.86

R 1: 123.76

CURRENT: 112.01

S 1: 105.23

S 2: 100.78

USDCHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 0.9700

S 1: 0.9476

S 2: 0.9072

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.