Market Brief

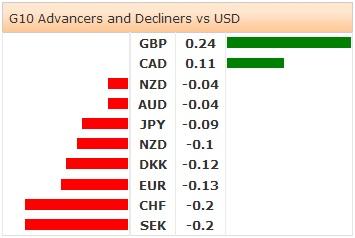

In the Asian session, risk appetite mildly crept back into FX markets. Yet volumes were low and direction unconvincing. In the equity space, the Nikkei was up slightly at 0.03%, Shanghai up 0.35% but the Hang Seng was down -0.32%. Geopolitical tensions still dominate price action as reports indicate that German and French ministers are participating in emergency talks with Ukraine and Russian in order to diffuse immediate tensions (reported results have been mixed). The Ukraine is still expressing considerable concern over a potential escalation, which is weighting on investors sentiment. EURUSD was range-bound, trading between 1.3380 and 1.3400. USDJPY caught a late afternoon bid trading up to 102.40 yet remained well within its daily range. Risks to JPY are balanced between the currencies role as a safe-haven trade verse evidence that the Japanese economy is falling backwards (Q2 P read of -6.8%). AUDUSD quickly dropped from its high at 0.9328 as China’s new housing price data printed on the softer side. However, with the RBA minutes out on Tuesday and RBA Governor Stevens speaking to a parliamentary economic committee on Wednesday, traders didn’t push the AUD lower. In broad terms, EM FX gained against the USD, but moves were minor as Asian rates were little changed. Oil continues to trade softly as concerns over supply disruptions from Russian and Iraq have been neutralized by increased oil output in Libya.

China new-house price Fall

In China, new-house prices fell in July in almost all cities, as tighter mortgage lending hurt buyers. The National Bureau of Statistics stated that prices fell in 64 of the 70 cities last month from June. This was the biggest price fall since January 2011 which was then a result of the government adjusting how it complies data. In other news, China’s foreign direct investment dropped 17.0% y/y in July verse the market expection of 0.8% and prior growth of 0.2%. Elsewhere, Thailand’s GDP recovered in Q2 expanding 0.9% q/q after a contraction of -1.9% q/q. This suggest that the Thai economy has expand 0.4% in Q2 after a contraction of 0.5% in Q1.

Carney might not wait for wage growth

In the UK, it was reported that BoE Governor Mark Carney stated that the central bank might now wait for real wages to actually increase before hiking policy rates. Then Carney went on to say that the underlying trend of the economic data was more important to the decision making process. As with the US, the UK economy has been producing jobs at a rapid pace, yet wage growth has been weak and even declined last week. The ability for the UK economy to grow without producing lasting inflation gives the BoE more time to maneuver. We suspect that the lag between a tight labor market and wage growth will catch up with the UK (and US) shortly, pressuring policy-makers to act. Based on this premise, we remain constructive on the GBP. Elsewhere, UK’s Rightmove house prices dropped 2.9%m/m in August verse -0.8% in July, the largest fall since December 2012. Todays light economic calendar will keep FX trading subdued barring any unexpected events from Ukraine/Russia.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.