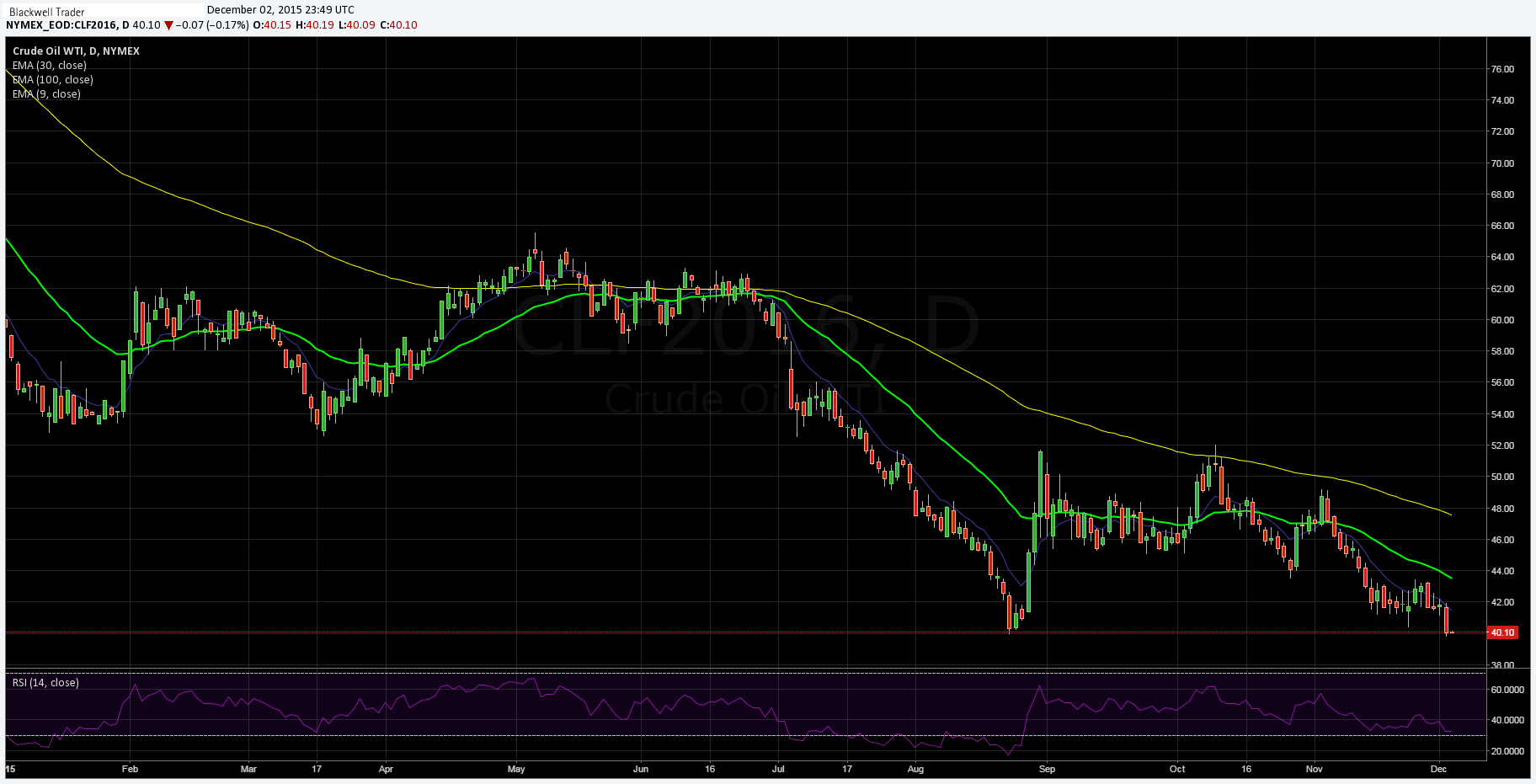

Crude oil prices continued to slide overnight, forming new lows not seen since early August, as concerns over a supply imbalance weighed upon the commodity. There continues to be mounting evidence that the oil glut is here for the long term as OPEC waivers on any consensus to cut production.

WTI Crude oil futures were hit relatively hard overnight as an EIA report demonstrated a further 1.18m barrel build in inventories. Despite significant declines m/m in the rig count, there seems to be no end in sight as oil analysts point to 2016 being a year of pain for the black gold. There is also mounting evidence that the oil industry will have to tolerate a savage over-supply that is likely to lead to a slump that exceeds anything seen during the GFC.

In addition, OPEC’s initial strategy of driving down production costs to damage the fledgling US shale industry has reached a critical point where a pivot is now required. In fact, it would appear that Middle Eastern producers are now facing the prospect of maintaining supply to defend their current market share against the innovative US sector.

However, the outcome of any such strategy is likely to end up further enlarging the current supply glut. Subsequently, 2016 is likely to be a year of severely depressed oil prices and continued production in an attempt to defend their respective market shares. The full effect of the lower prices is yet to be felt through much of the oil producing world but as supply continues to increase so will the impact further down the supply chain.

The next few months are going to be critical for oil prices and it is hard to see much in the way of upside for them. This is especially salient given the coming seasonal weakness as the US bids goodbye to the bullish summer months. This fact, coupled with the continuing global oversupply, provides plenty of fuel to the case for weaker crude prices.

Subsequently, I reiterate my medium term forecast for WTI futures to trade within the $35.00 - $39.00 a barrel range during the early part of 2016.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.