The Oil markets are known for their swings up and down, especially in times of crises and times of recession. The most frequent market mover though, is the oil inventory data released by the Energy Information Administration (EIA), more commonly referred to as the data-gathering arm of the Department of Energy in the USA. This price mover has the ability to push oil prices by a few dollars, however, last night it didn’t.

The general consensus for oil movements is that a surplus leads to a drop in prices for oil when it comes to the US crude oil reserves and vice versa when there is a deficit in reserves. It’s basic at the most simple understanding level, but markets operate on a supply and demand basis when it comes to extremely liquid commodities such as oil.

What happened last night though, defied many expectations and a little bit of belief.

US crude inventories come in positive at 10 million barrels compared to a forecast of just 2 million - a very strong reading for oil, as domestic production hit its highest point in 26 years.

Obviously, many would expect a decline in oil prices, with such a surge in supply and an increase in oil inventories. However, the market reaction was the opposite. Instead, we saw oil prices lift surprisingly, as front page news played a bigger impact.

What we saw was the power of information on oil markets and in this case, the risk of Ukraine, which seems to occupy the oil market's minds, and rightfully so. Russia is currently a major supplier of oil in the global market, supplying roughly 12% of global production according to the International Energy Agency.

Its military action with Ukraine has oil markets on the edge of their seats, even in times of surplus. What markets fear is an invasion of Ukraine and the forcing of the US and NATO into the conflict, or some form of economic sanctions, like the ones used in Iraq and Iran, where the West bans using oil from the specific country. This would lead to a sharp increase in the price of oil, as oil-hungry nations like the US would end up paying the cost at the pump.

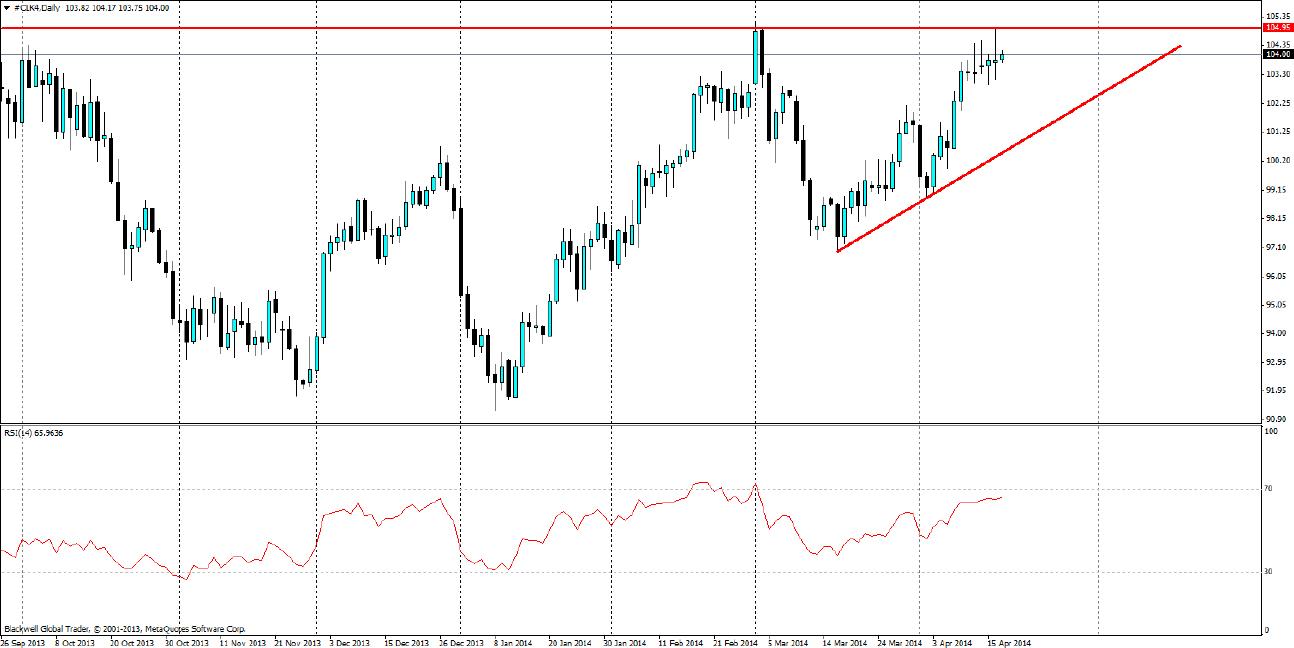

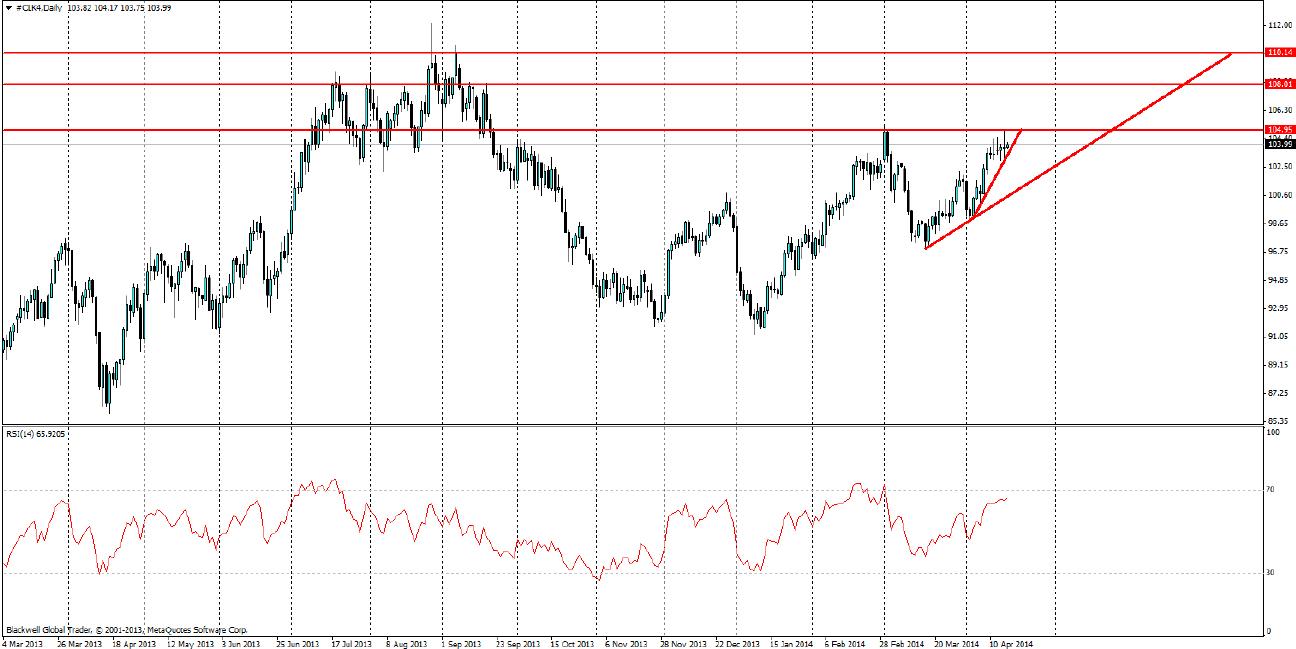

While it certainly seems that oil is destined to rise, a key point for traders would be by how much. Current resistance is key at 104.95-105.00, after that it becomes a little uncertain, even though we are in a bullish market currently. The next level would most likely be 108.00, after that we would need to see aggressive action from Russia to see further rises higher, or a restriction of oil supply globally – which seems unlikely due to the recent massive increases in output by the US alone in the last few years.

The technical are also worth pointing out for oil as the RSI has shown pullbacks when markets feel oil is overbought, so it is certainly worth paying attention to this. But make no mistake, the current market climate is certainly bullish, and tie-in fundamentals and technical is key to taking advantage of oil.

Overall, oil markets are expected to feel the pressure more than any other market, and I would not expect any differently in the current market climate. With a Russian build up on the border of Ukraine creating tension, this tension in turn gets passed over to the markets and oil markets are certainly feeling it. Markets are bullish on this tension and going forward, it’s not clear when Russia will ease off or if it will go even further. For now though, it certainly seems that the best bet would be to long oil, but it's risky given the recent surpluses, especially if Russia eases off.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.