The AUDUSD has recovered some lost ground over the past two trading sessions. On Monday it opened at the day’s low of 0.72476 and rose up to a high of 0.73659 yesterday. The Reserve Bank of Australia cut interest rates on May 3rd, to all-time lows of 1.75%. Despite the monetary easing, the Aussie has been able to recover some lost ground mostly thanks to a strong performance from Crude Oil and Gold.

The Australian dollar is considered a commodity currency, especially as it is one of the world’s largest producers of Gold. The currency, therefore, benefits when commodity prices rise as it can sell US dollars for more local currency. This allows producers to sell US dollars cheaper and still receive the same amount in local currency, which has the effect of pushing the US dollar lower.

Some of the Aussie’s strength may also come from some analysts’ views that another interest rate cut is not imminent, as the central bank waits to see the effects of this latest cut. We can also couple that to the view more recently, that the Federal Reserve will also take a hold on raising interest rates in the US. Consensus for a hike is conditional on better economic data in the coming months, in particular employment and consumer price increases.

Tomorrow at 01:30 GMT, we will see unemployment data released for Australia. Full time employment las month declined by 8,8k and the unemployment rate was 5.7%, with expectations of an increase to 5.8%. If the figures released are substantially better than forecast we may see the AUDUSD extend its rally.

There will also be jobs data from the US tomorrow at 1.30pm, weekly jobless claims are forecast at 297K after last week’s surprise number came in at 294K. Better figures than expected here may give the US dollar a boost.

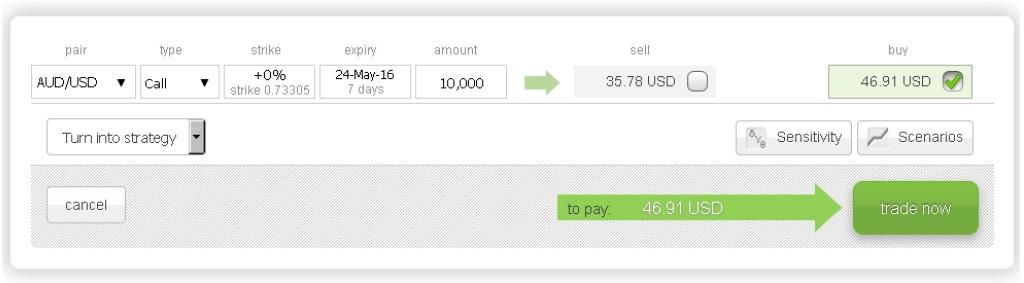

If you think that the AUDUSD will increase in price over the next week then you may buy a Call option, which gives you the right to buy AUDUSD at a preset price (strike), on a set date (expiry) and for an amount of your choice.

The screenshot bellows shows a AUDUSD Call option with a 0.73305 strike, 7 day expiry and for A$10,000 would cost $46.91, which would also be the maximum risk.

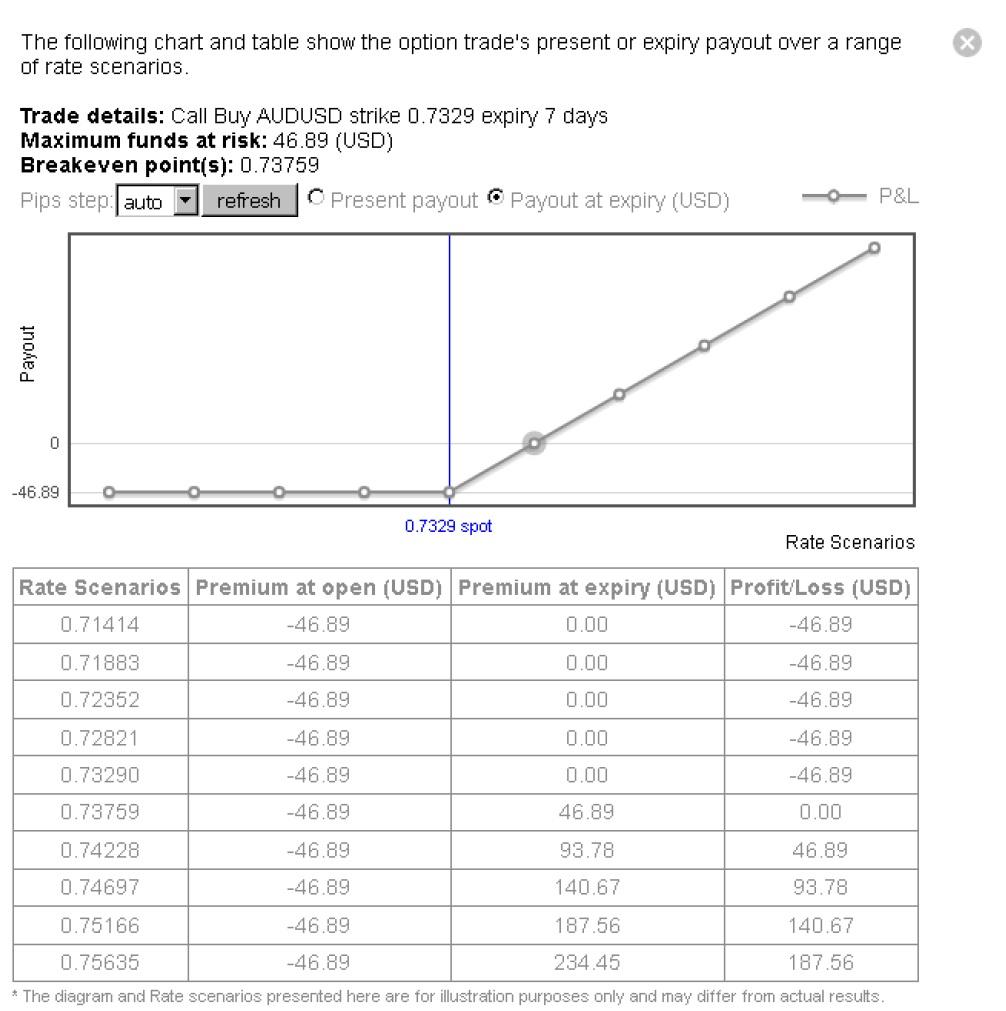

This screenshot shows the profit and loss profile of the above Call option, just click the Scenarios button.

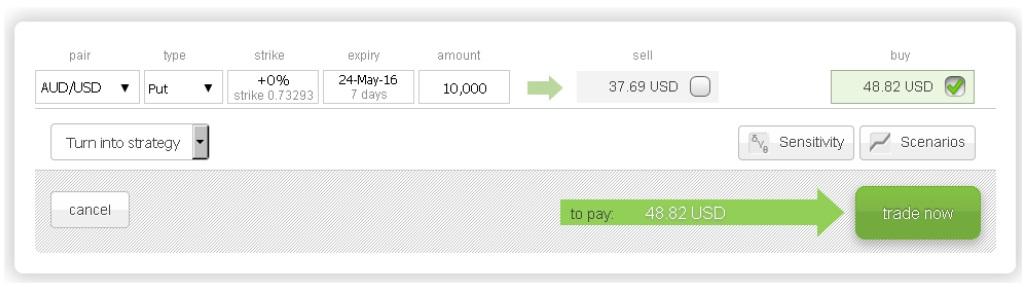

On the other hand, if you feel that AUDUSD will decline over the next week then you may buy a Put option, which gives you the right to sell AUDUSD at a set strike, on a specific date and for an amount of your choice.

The screenshot below shows an AUDUSD Put option with a 0.73293 strike, 7 day expiry and for $10,000 would cost $48.82, which would also be the maximum risk.

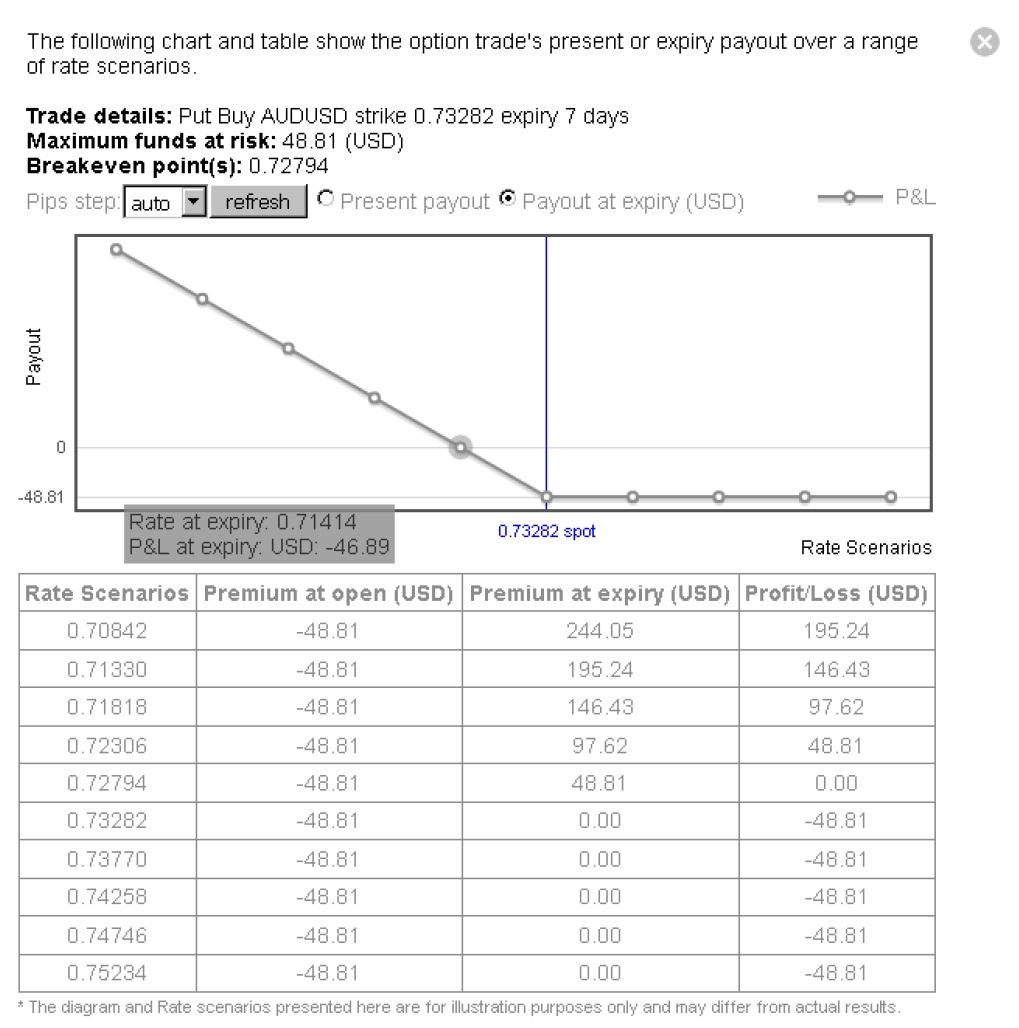

This screenshot shows the profit and loss profile of the above Put option.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.