USD/SEK

The dollar traded unchanged or higher against most of the other G10 currencies. It was lower only against NOK and CAD. The greenback outperformed NZD, CHF, and EUR in that order, while it was virtually unchanged against JPY, SEK, AUD and GBP.

Although virtually unchanged, SEK did not trade quietly. The krona surged during the European morning after Sweden’s industrial production expanded by more than anticipated in January. Meanwhile, December’s rate was revised higher. Nevertheless, the Swedish currency pared the gains as Riksbank Governor Stefan Ingves said at the parliament finance committee hearing that SEK strength would not be welcome. He also said that Riksbank wants to raise inflation towards 2% and if more is needed, they will do more. We are now turning our attention to next week’s CPI data for February. If deflation accelerated in February, this will make the Riksbank more willing to act again at its next policy meeting on April 29th. The divergence in monetary policy between the Fed and Riksbank is one of the factors that will eventually trigger the resumption of the USD/SEK uptrend.

Yesterday, Handelszeitung, a German-language Swiss newspaper, reported that the Swiss finance minister said in a confidential discussion paper that a new minimum exchange rate should be “considered”. Swiss government spokeman Andre Simonazzi denied the report. CHF weakened against both USD and EUR on the rumor, but regained the lost ground after the denial. Nonetheless USD/CHF resumed climbing today.

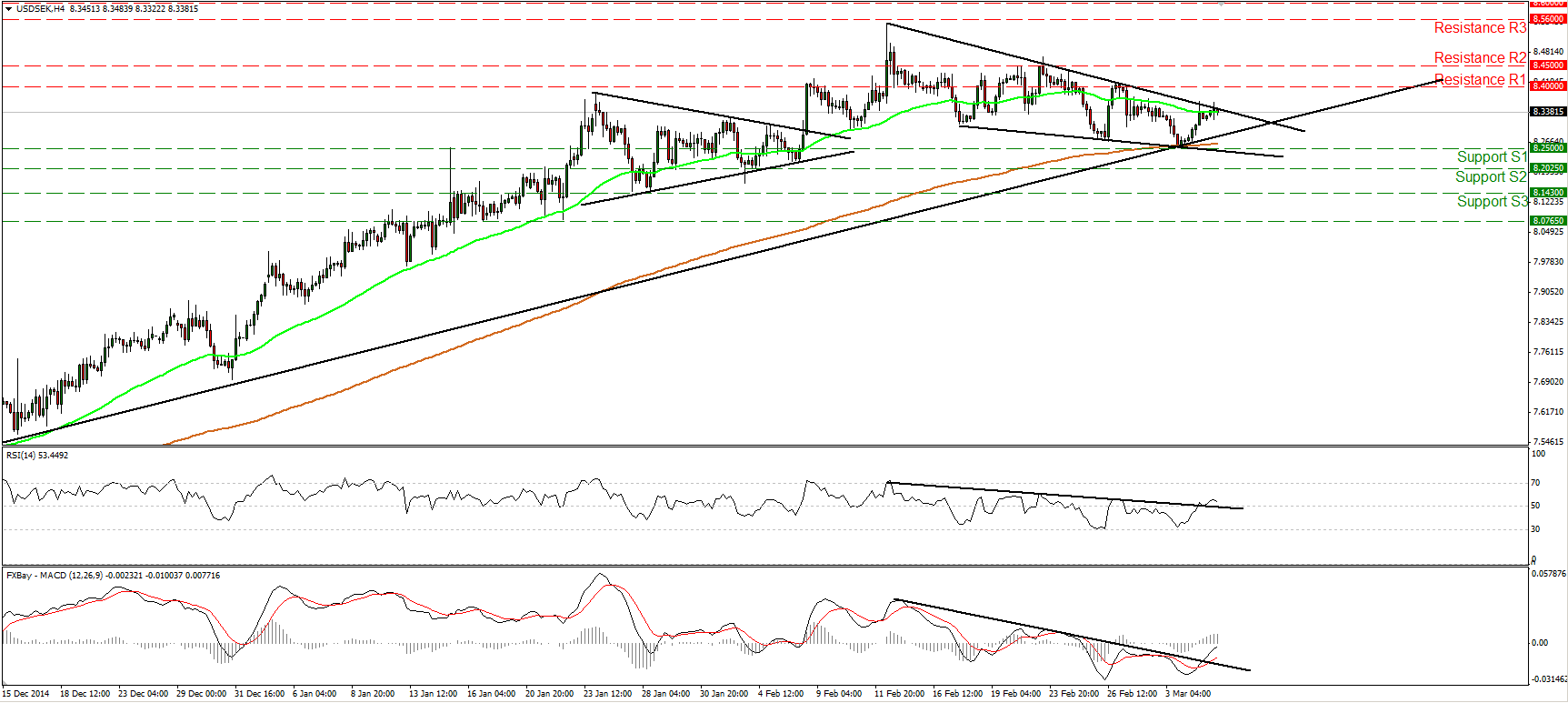

USD/SEK traded near the lower bound of a falling wedge formation that has been containing the price action since the 12th of February. A clear move above the upper line of the pattern could give an early hint that the larger uptrend is resuming and perhaps target our resistance of 8.4000 (R1). Nevertheless, the move that could have larger bullish implications is a break above the 8.4500 (R2) hurdle. This could pull the trigger for the high of the 12th of February, near the resistance barrier of 8.5600 (R3).Our near-term momentum studies add to the possibility that USD/SEK could extend higher. Both of them emerged above their downward sloping resistance lines, with the RSI also crossing above its 50 line.

Support: 8.2500 (S1), 8.2025 (S2), 8.1430 (S3).

Resistance: 8.4000 (R1), 8.4500 (R2), 8.5600 (R3).

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.