DAX futures

The dollar traded higher against almost all of its G10 peers during the European morning Monday. It was unchanged only against GBP.

The German Ifo Business climate index rose for the fourth consecutive month in February, driven probably by the low oil prices. The expectations index also rose, in line with the strong ZEW survey released last week. The figures fell short of expectations and the increases were only moderate, however, probably because of the Greek and Ukrainian problems. Nonetheless, the overall improvement in the Ifo indices suggest that German business investment could pick up in Q1 and lift optimism about an economic recovery. As the Greek risk resolves, temporarily, and if the ceasefire agreement is respected by the pro-Russian rebels and Ukraine, we could see a stronger German growth rate that could support EUR somewhat, in our view.

Regardless of the moderate improvement in the Ifo, EUR weakened as the market reconsidered the implications of the Greek settlement, which leaves a number of points unresolved.

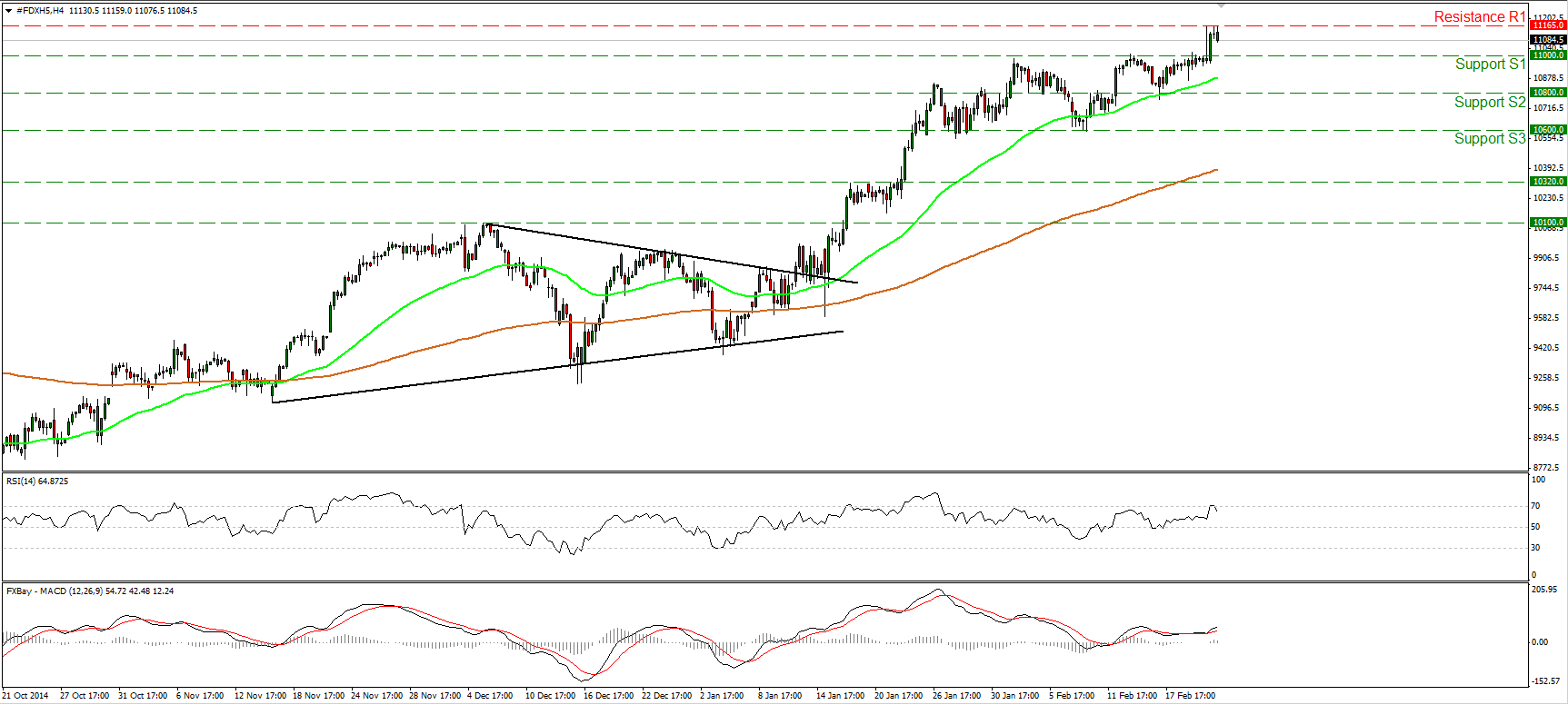

DAX futures initially firmed up on Friday after the Greek deal on its bailout program. The index breached the psychological resistance (now turned into support) zone of 11000 (S1), to print a new record high at around 11165 (R1). However, DAX retreated from its new high after the German Ifo survey fell short of expectations. After the exit of a symmetrical triangle on the 13th of January, the price structure has been higher highs and higher lows above both the 50- and the 200-period moving averages. Therefore, I would consider the overall picture to be positive. Nevertheless, I would be careful that the corrective move may continue for a while. Perhaps to test the 11000 (S1) key barrier as a support this time, or ever lower. My concerns stem from the RSI, which hit resistance near its 70 line and turned down. Moreover, on the daily chart I see negative divergence between both the daily oscillators and the price action, magnifying the case for the continuation of the pull back.

Support: 11000 (S1), 10800 (S2), 10600 (S3)

Resistance: 11165 (R1) (all-time high)

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.