USD/NOK

The dollar traded lower against most of its G10 counterparts during the European morning Wednesday, ahead of the FOMC meeting later in the day. The greenback remained stable vs AUD and CAD.

The Norwegian krone gained the most after the country’s AKU unemployment rate declined in November, in line with the earlier decline of the official unemployment figure for the same month. The country’s economics are overall in a very good condition compared to its peers. The unemployment rate seems to have stabilized near 3%, while consumer price inflation is just below Norges Bank’s 2.5% target and is definitely higher than its major peers in Europe. Nevertheless, Norway is Europe’s largest oil producer and its revenues are declining as well as investments in that sector as oil prices fall. This is likely to keep NOK under selling pressure and may prompt the Norges Bank to cut rates again at some point in the future. Therefore, the recent USD/NOK decline could be a renewed buying opportunity.

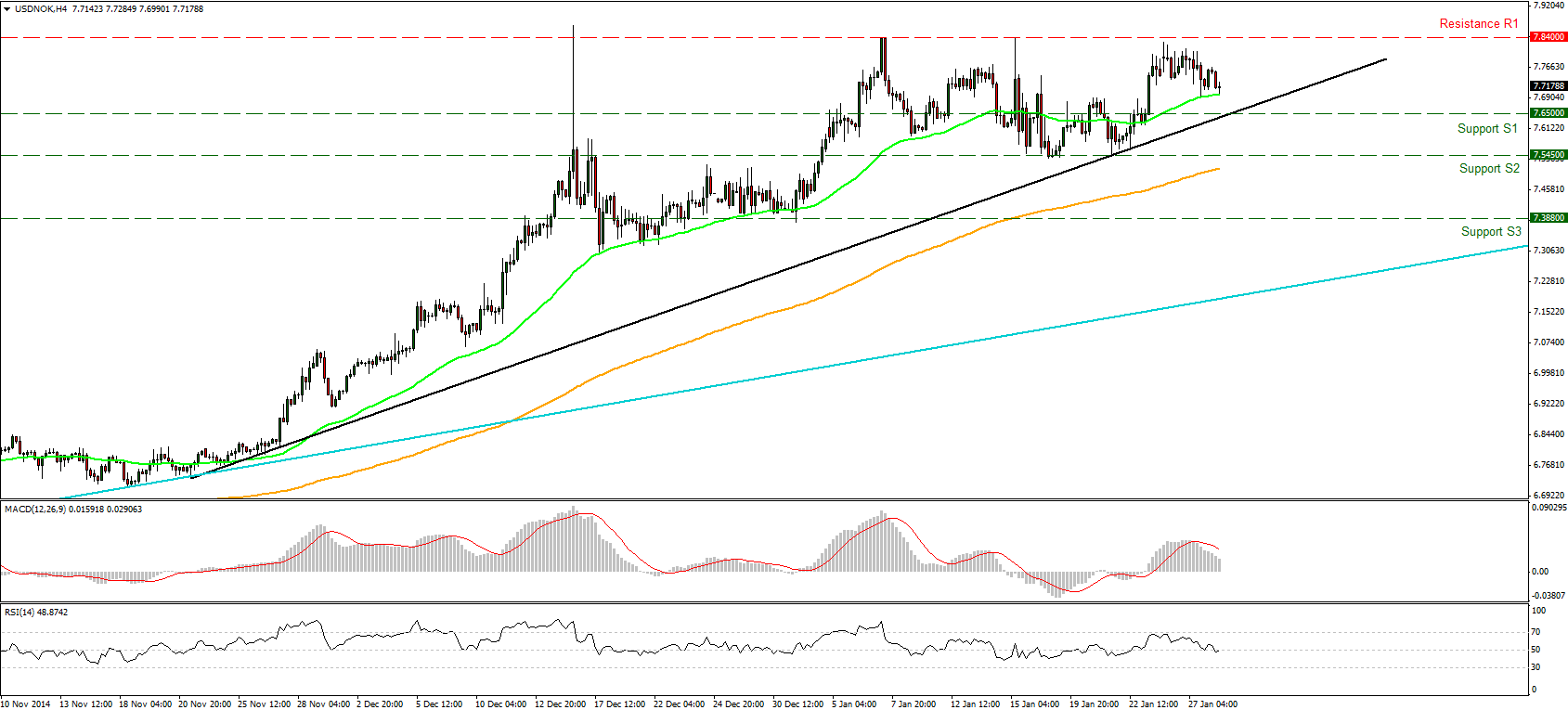

USD/NOK moved lower during the European morning Wednesday following the decline in Norway’s AKU unemployment rate. The move was halted at the 50-period moving average. A break of the moving average could see further downward extensions towards our 7.6500 (S1) support line. A break below the crossroad of that support line and the black uptrend line is necessary for further declines. Our short-term momentum studies support the notion of another leg down, at least to that crossroad. The RSI crossed below the 50-line and points down, while the MACD, already below its signal line, moves towards the zero level. However, the pair is still trading above the black uptrend line taken from the low of the 21st of November, which keeps the near-term bias positive, in my view. On the daily chart we have higher highs and higher lows above both the 50- and the 200-day moving averages, and also above the light blue uptrend line drawn from back at the low of the 3rd of September. This keeps the overall path of the rate to the upside.

Support: 7.6500 (S1), 7.5450 (S2), 7.3880 (S3).

Resistance: 7.8400 (R1), 8.0000 (R2), 8.2200 (R3).

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.