AUD/USD

The dollar traded unchanged or lower against its major G10 peers during the European morning on Monday . It was lower against SEK, CAD, AUD and NZD, in that order, while it was higher only against JPY. The greenback was stable vs NOK, EUR, GBP and CHF.

The Swedish krona appreciated against the dollar after the country’s retail sales rose 1.9% mom in August, a rebound from -1.1% mom previously. The better-than-expected figure pushed USD/SEK down approximately 0.20%. This was the first major indicator to come strong from Sweden and beat market consensus so far this month. However, I believe that Sweden’s continued deflation risk and the positive sentiment towards the greenback could give USD/SEK back its losses in the near future.

The euro was resilient during the European morning ahead of the preliminary German CPI for September. All of the regional CPIs were unchanged or 0.1 ppt higher on a yoy basis, indicating that the national inflation rate is also likely to be unchanged or higher too. However, the outcome of the mixed US data due out later in the day are likely to give a better picture on the direction of EUR/USD, even though the overall sentiment lean towards a stronger dollar.

The New Zealand dollar tumbled during the Asian morning, after the country’s central bank revealed currency intervention during August. Despite Kiwi’s approximately 1 cent drop, it remains above its “Goldilocks” fair value, said the country’s Prime Minister. Having this in mind, we could see NZD/USD even lower.

Reserve Bank of Australia Governor Glenn Stevens said last week that regulators are considering imposing lending rules to limit mortgages in order to confront the overheating housing market. These specific measures may take some pressure off the RBA to raise interest rates in early 2016 as expected. Coming on top of falling commodity prices due to low Chinese demand, the change in interest rate view suggests AUD could weaken further.

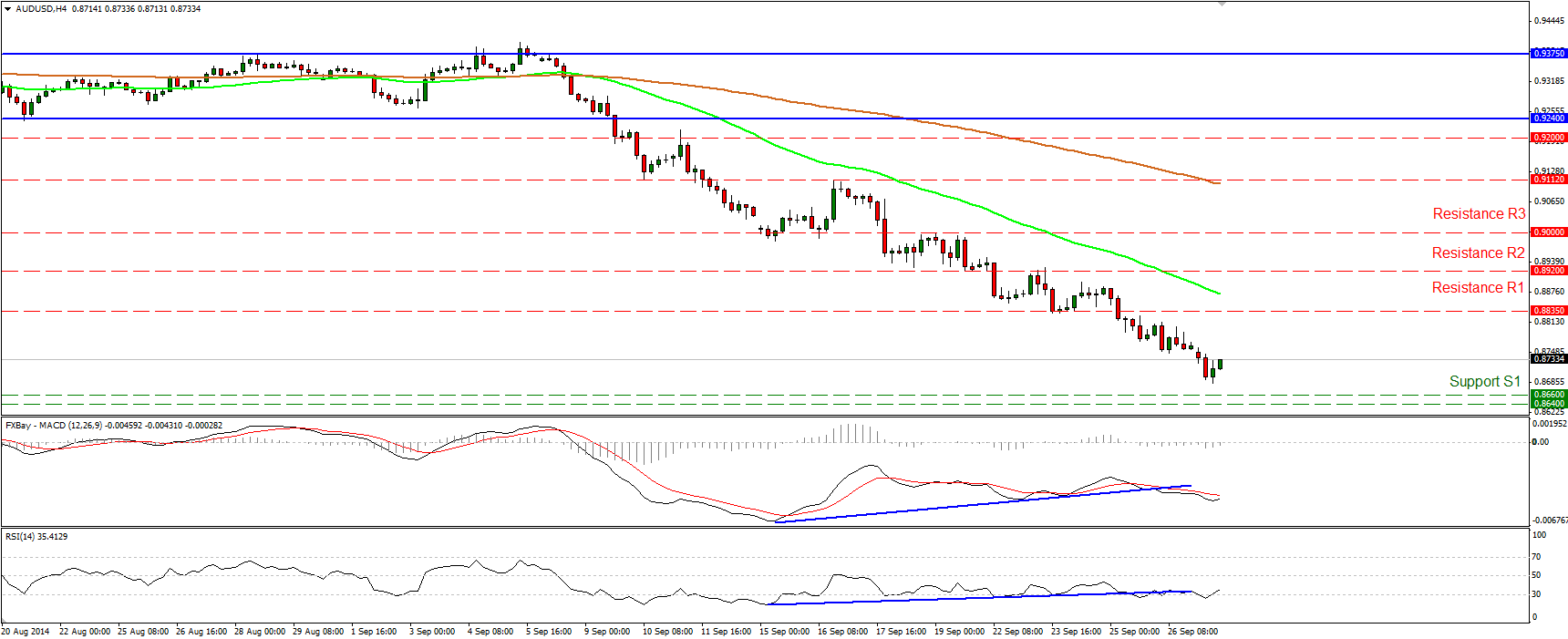

AUD/USD fell during the European morning Monday, breaking below the support barrier (turned into resistance) of 0.8730. That move confirms a forthcoming lower trough and I would expect the bears to pull the trigger for extensions towards our next support area of 0.8660 (S1), defined by the low of the 4th of February. As long as the price structure remains lower lows and lower highs below both the 50- and the 200-period exponential moving averages, I believe the overall picture is negative. My only concern is that I still see positive divergence between the price action and both of our momentum indicators, something that designates decelerating downside momentum.

Support: 0.8660 (S1), 0.8640 (S2) , 0.8600 (S3)

Resistance: 0.8730 (R1), 0.8835 (R2), 0.8920 (R3)

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.