The latest economic numbers in Australia point to a stunted economy but there are also signs this could be the bottom. In FX trading on the US Thanksgiving holiday, the dollar didn't get any love as it was the laggard on the day as the yen led the way. Japan's Oct CPI rose 0.3% y/y, beating expectations of 0.2% and previous 0.0%.

Click To Enlarge

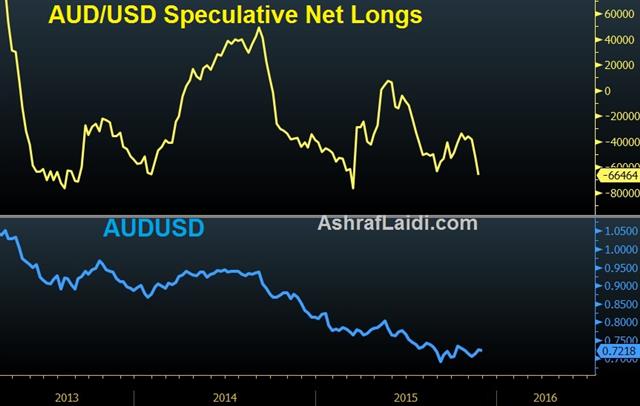

Yesterday's Australian capex numbers were the worst in 30 years of records. Private capital expenditures fell a whopping 9.2% compared to the -2.9% consensus. The immediate reaction was a 40-pip decline in AUD/USD but it's stabilized since.

That's two poor readings for Q3 ahead of the RBA decision on Tuesday and GDP on Wednesday. What's impressive is that the market hasn't shuddered despite such scary numbers. If the Aussie can make it past the RBA and GDP without another push lower, it's a good sign that the worst is behind for the Aussie.

China and commodity prices will continue to be factors to watch but barring surprisingly weak news, the soft hands have probably already exited Australia. Once Q3 is in the rearview mirror, the RBA may look towards the middle of next year and an improvement in the non-mining sector of the economy.

Note that that in Sept/Oct/Nov there has been a series of higher lows in AUD/USD. The employment report was probably a mirage but AUD has been hit by some terrible news including 6-year lows in copper prices and the never ending decline in iron ore. We often ask: If something can't fall on bad news, why should it fall at all?

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.