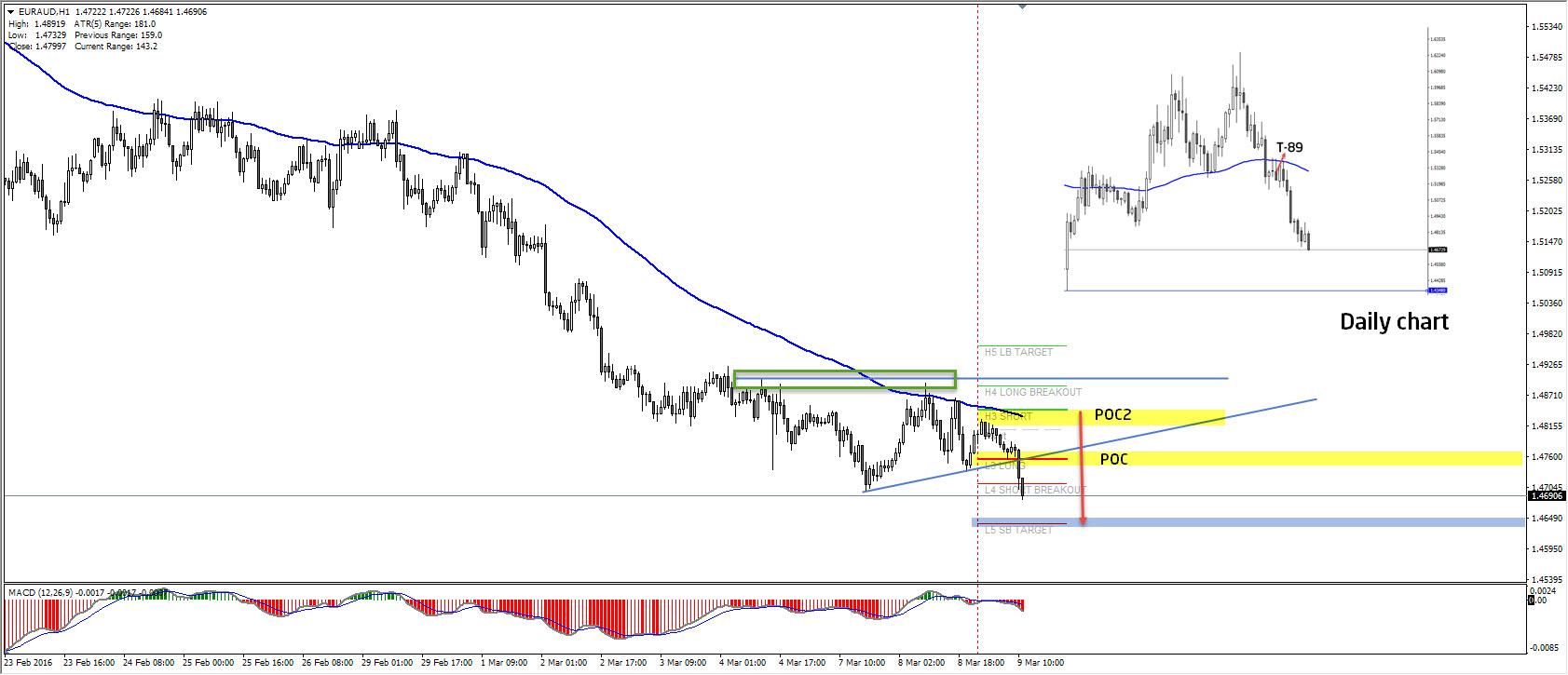

This week we have the ECB meeting, with analysts predicting further forms of QE by reducing deposit rates, which should weaken the EUR. Of recent, we've seen Commodities prices rebound, in particular Iron Ore, Copper, Gold, OIl (and coupled pricing on LNG), all key exports of Australia, causing AUD to appreciate. On this basis, should commodities prices continue to recover and ECB introduces further QE then EURAUD will proceed below our daily target that is 1.4650 and might extend to 1.4350 that is clearly seen on daily chart with a strong T-89 pattern rejection.

On intraday charts we have 2 POCs. 1.4750 zone (trend line and L3 X cross breakout) and 1.4810-30 (DPP, H3, EMA89) should reject the price if we see a retracement but currently we see a possible momentum break of L4 level. The price is currently 1.4690 and it is targeting 1.4640.

Pay attention to this pair as both technical and fundamentals are aligned and that provides great trading opportunities.

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.