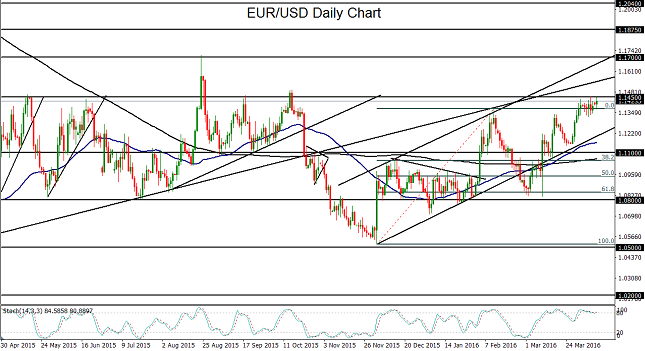

EUR/USD has consolidated within the past week just under a major resistance zone around the 1.1450-1.1500 area. In the process, the currency pair has formed a key bullish flag pattern that could be poised for a breakout if the dollar continues its recent weakening trend.

Within this consolidation, EUR/USD hit a new six-month high last week at 1.1453, a price level that has not been reached since mid-October. The current consolidation is the latest culmination of a rising trend characterized by higher highs and higher lows since December’s lows near 1.0500.

Much of EUR/USD’s rise in the past four months can be attributed to a falling US dollar that has been pressured by an increasingly dovish Federal Reserve and the resulting lowered expectations for a regular pace of interest rate hikes in the US. Last week’s release of minutes from March’s FOMC meeting revealed much debate within the ranks of Fed policymakers, as well as an overall sense of caution with regard to raising rates due to persistent global economic worries. The EUR/USD currency pair has stayed well-supported because of this dollar pressure, despite what one might expect should be a weakened euro due to the European Central Bank’s own extended easing program.

During the course of the current EUR/USD uptrend, the currency pair has broken out above several major resistance areas, including the key 1.1100 level. In mid-March, the 50-day moving average crossed above the 200-day moving average, suggesting a potentially bullish outlook for the near-term.

Currently just off the noted key resistance zone around 1.1450-1.1500, EUR/USD is at a critical technical juncture. Any sustained breakout above this resistance could go on to target the next major upside target at the 1.1700 level, which was the area of the high reached in August 2015.

This week’s upcoming economic calendar, especially with respect to US data, could help prompt such a breakout move. March’s Producer Price Index, a key inflation measure, will be released on Wednesday, along with the US retail sales report. This will be followed on Thursday by the Consumer Price Index, another major inflation measure, and weekly unemployment claims.

Investopedia does not provide individual or customized legal, tax, or investment services. Since each individual’s situation is unique, a qualified professional should be consulted before making financial decisions. Investopedia makes no guarantees as to the accuracy, thoroughness or quality of the information, which is provided on an “AS-IS” and “AS AVAILABLE” basis at User’s sole risk. The information and investment strategies provided by Investopedia are neither comprehensive nor appropriate for every individual. Some of the information is relevant only in Canada or the U.S., and may not be relevant to or compliant with the laws, regulations or other legal requirements of other countries. It is your responsibility to determine whether, how and to what extent your intended use of the information and services will be technically and legally possible in the areas of the world where you intend to use them. You are advised to verify any information before using it for any personal, financial or business purpose. In addition, the opinions and views expressed in any article on Investopedia are solely those of the author(s) of the article and do not reflect the opinions of Investopedia or its management. The website content and services may be modified at any time by us, without advance notice or reason, and Investopedia shall have no obligation to notify you of any corrections or changes to any website content. All content provided by Investopedia, including articles, charts, data, artwork, logos, graphics, photographs, animation, videos, website design and architecture, audio clips and environments (collectively the "Content"), is the property of Investopedia and is protected by national and international copyright laws. Apart from the licensed rights, website users may not reproduce, publish, translate, merge, sell, distribute, modify or create a derivative work of, the Content, or incorporate the Content in any database or other website, in whole or in part. Copyright © 2010 Investopedia US, a division of ValueClick, Inc. All Rights Reserved

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.