![]()

After an extremely volatile week, traders are no doubt feeling a bit apprehensive about the future. After all, global stocks have now entered a “bear market†(20% decline in the MSCCI World index), USD/JPY briefly traded down over 1000 pips in less than two weeks, and US 10-year treasury yields are approaching all-time lows, a threshold that many global bonds have already reached. Surely all this risk-off trading is can be chalked up to declining economic growth? Based on the recent data out of the world’s largest economy at least, the answer is “no.â€

Over the last couple weeks, traders have seen top-tier US economic reports come out relatively mixed. On the worse-than-anticipated side of the ledger, both ISM PMI reports came out below economists’ expectations, as did the headline number of jobs in January’s Non-Farm Payrolls report and the Q4 advance GDP reading. That said, we also saw strong readings on wage growth and average hourly earnings, the ADP employment report, and just today, a better-than-anticipated retail sales report.

According to the census bureau, US retail sales rose 0.2% m/m, better than the 0.1% reading eyed by analysts; the “core†retail sales report, which filters out volatile automobile purchases, also beat expectations at 0.1% m/m growth vs. 0.0% expected. Excluding the decline in gasoline prices, retail purchases rose at a healthy 0.4% m/m rate. The gains were paced by rapid increases in online purchases (up 1.6%), at general merchadise outlets (0.8%), and on autmobiles (up 0.6% after a 0.5% gain in December).

With today’s retail sales report representing just the most recent evidence that the US economy is, at worst, continued to muddle through, it’s hard to square the decent economic data with the sharp declines in investor sentiment. Traditional economists view the current market conditions as one of the all-to-frequent tantrums that traders throw, but argue that the present volatility will blow over soon, leading to a rapid return of risk sentiment. More pessimistic investors note that market sentiment tends to be a leading indicator for the economy (though perhaps one that’s too sensitive; as the saying goes, “the stock market has predicted 9 of the last 4 US recessions), and just because the US economy appears to be on reasonable footing doesn’t rule out the possibility of bear market.

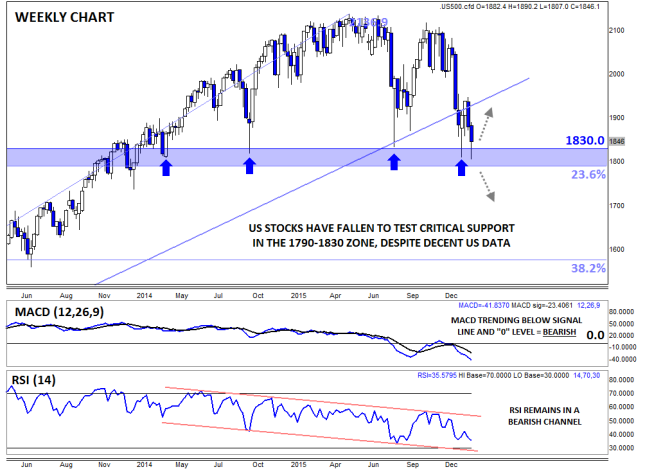

We tend to fall somewhere in the middle: we’re not calling for a global economic recession at this point, but anticipate that we haven’t seen the end of the current spate of market volatility. When it comes to actionable levels to watch, we remain hyperfocused on the critical 1790-1830 support zone in the S&P 500. If that level gives way, fears about slowing economic growth may start to become a self-fulfilling prophecy and a deeper drop would become likely. On the other hand, a bounce through off that floor and back toward the 2000 area would suggest that the stock market is catching back up to the decent economic figures of late.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.