![]()

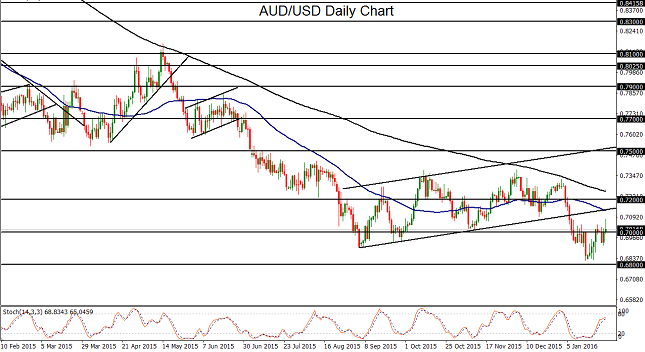

AUD/USD made a tentative breakout above a small, inverted head-and-shoulders pattern on Wednesday, but pared most of its gains by the afternoon. During the Asian session early Wednesday, Australia released its Consumer Price Index (CPI) inflation reading that showed a greater-than-expected increase in consumer prices, prompting AUD/USD to rise to a three-week high.

After the currency pair’s early Wednesday surge, however, it gave back much of its gains in the afternoon when the US FOMC statement was released.

The bullish head-and-shoulders pattern that has been forming since the beginning of the year had given AUD/USD bulls cause for some optimism that a bottom may have been forming for the embattled currency pair as it consolidated near recent multi-year lows. Less than two weeks ago in mid-January, AUD/USD dropped to more than a six-year low at 0.6825, just above its 0.6800 downside support target, forming the “head” of the chart pattern.

Despite the late retreat from its highs on Wednesday, AUD/USD could still potentially complete the bullish head-and-shoulders pattern, especially with the Reserve Bank of Australia’s (RBA) rate statement scheduled to be released on Tuesday of next week. With the slightly higher inflation readings in Australia that may reduce the chances of a near-future interest rate cut, the RBA may strike a more hawkish tone that could boost the Australian dollar further from its long-term lows.

In the event of a sustained breakout above the inverted head-and-shoulders pattern, the first major upside target is around the 0.7200 resistance level. Of course, the chart pattern would be invalidated on any return back down towards the key bearish trend target at the noted 0.6800 support level, in which case a continuation of the longstanding downtrend will have been confirmed.

-------

Who were the best experts in 2015? Have your say and vote for FXStreet's Forex Best Awards 2016! Cast your vote now!

-------

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.