All good things eventually must come to an end, and after last week’s price action, USD/CAD bulls are wondering whether the seemingly never-ending gravy train of higher rates is finally done. The currency pair had surged a staggering 1500 pips in less than three months to hit a high above 1.4600 before rolling over in the second half of last week.

As with just about every major market nowadays, USD/CAD’s most important driver is oil. Oil prices did manage to stage an oversold bounce late last week (coinciding with the bearish reversal in USD/CAD), but as my colleague Fawad Razaqzada noted on Friday, talk of a bottom in crude may be premature at this stage. While there’s nothing in the way of traditional market-moving economic data scheduled for today, there is a report on the wires that Qatar has requested an emergency OPEC meeting; depending on whether the request is approved, it could serve as a near-term catalyst for oil and by extension, USD/CAD.

Technical View: USD/CAD

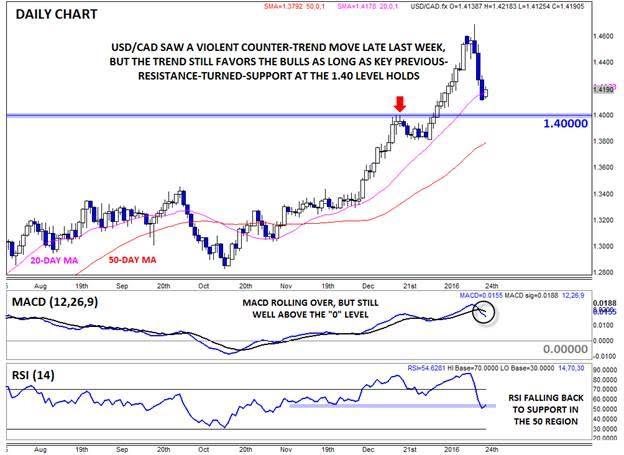

Turning our focus to the USD/CAD chart, we’re still inclined to give the established uptrend the benefit of the doubt. Despite the precipitous 3-day, nearly 600-pip peak-to-trough drop late last week, the unit is still holding above the last notable previous resistance level at 1.40, and that level may provide support if we see any more downside this week. Meanwhile, both the 20- and 50-day moving averages are still trending sharply higher, indicating that the short- and medium-term trends are still in favor of the bulls.

The secondary indicators are presenting a slightly more nuanced picture, with the MACD rolling over back below its signal line (but still well in positive territory) and the RSI indicator dropping from overbought territory back toward the 50 level. At this point, neither indicator has seen any structural damage that would suggest the recent uptrend is coming to an end.

Predicting the near-term movement of a given currency pair or market is fraught with difficulty, especially when there are external geopolitical bodies in play (OPEC), but much like with oil, it seems likely that last week’s reversal was merely a brief counter-trend move, and we would expect the medium-term uptrend in USD/CAD to resume this week. As long as support at the 1.40 level holds, bulls could look at last week’s pullback as an opportunity to join the established uptrend at a more favorable price.

-------

Who were the best experts in 2015? Have your say and vote for FXStreet's Forex Best Awards 2016! Cast your vote now!

-------

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.