![]()

WTI crude oil managed to bounce off its worst levels following the publication of the latest crude stockpiles report from the US Energy Information Admiration (EIA), but remained in the red and was on course to end lower for a fifth day. Prior to the release of the EIA report, traders were evidently expecting to see a “bad” number because the American Petroleum Institute’s (API) data last night had indicated that inventories had climbed by 1.3 million barrels last week. The consensus expectations for the EIA number were not overly optimistic either, calling for a decrease of only 1.5 million barrels. However the actual number surprised as it showed, first and foremost, a drawdown, and a relatively sharp one at that: 2.8 million barrels. This was thus the fourth consecutive decline in as many weeks. During this period, oil stocks have been reduced by 11.6 million barrels. The drawdown of 3.3 million barrels in gasoline stocks also surprised but this was somewhat less than the decline reported by the API (3.6 million barrels). So overall it was a bit of a mixed-bag to slightly positive oil report. But for WTI to recover meaningfully, we will need to see further sharp decreases in stockpiles for they still remain near historic high levels.

Preventing oil from staging a more profound recovery was undoubtedly the stronger dollar, which continues to weigh on commodities across the board. The US currency remained in demand after pending home sales jumped by 3.4% in April – much better than 0.8% expected – although it pared its gains as the session wore on. The greenback is beginning to look a little bit overstretched in the short term, so a pullback could be on the cards. If seen, this could provide a respite for buck-denominated commodities in the short term. In the long term however, the dollar could appreciate significantly as the US Federal Reserve looks set to embark on a rate hiking cycle from as early as September.

Despite the sharper than expected drawdown in US oil stocks, the Brent-WTI spread rose back to above $5, having collapsed to a mid-April low of about $4.50 yesterday. Still, this is considerably lower than just a few months ago when the gap was about double this figure. Evidently, traders are surprised by the resilience of US oil, while at the same time they have grown bearish on Brent because of the continued rise in OPEC output. Saudi and Iraq are already producing more oil than is needed and soon Iran could join them if its sanctions are eased further or removed completely. On top of this, oil demand from China could ease if its economy cools down even more. Thus, there is a chance that the price gap may get eliminated completely or even reverse. That said, it is highly unlikely for WTI to trade at a premium over Brent for a sustainable period of time. After all, if US oil stabilises around the current levels then there will be no incentive for shale producers to scale back operations more than they already have. This may mean therefore that the excessive US oil surplus will remain in place for the foreseeable future and thus absorb any small positive demand shocks.

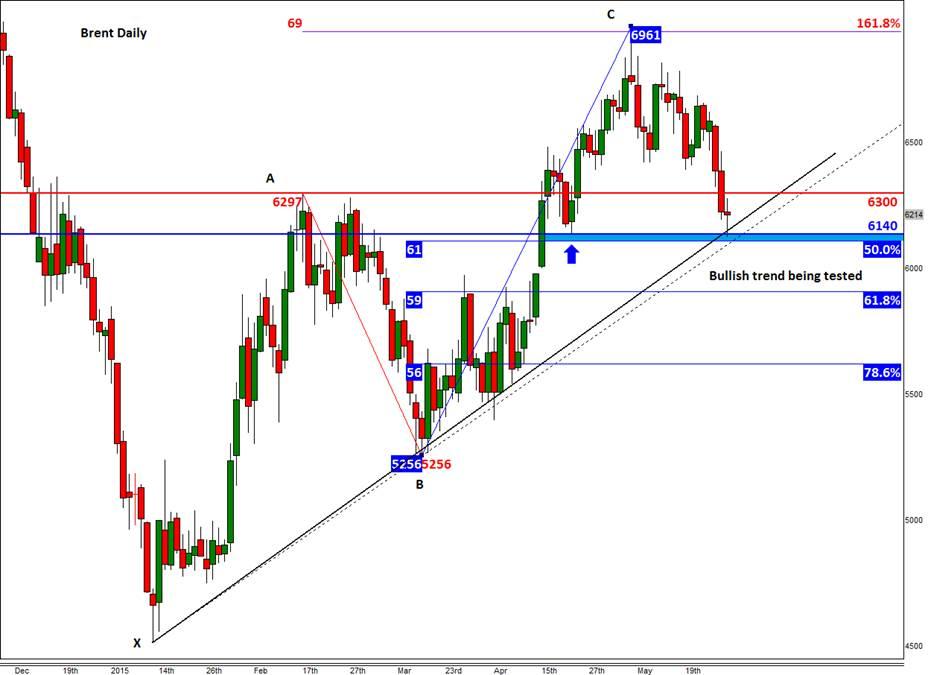

From a technical point of view, WTI remains in danger of collapsing towards support levels at $56 or $54.00, now that $58.00 is taken out decisively. The latter is the key resistance level to watch going forward; our short term bias remains bearish while below here. Brent is now testing its bullish trend line around $61 – it has already bounced off this area. A potential break below the trend line could expose the 61.8% Fibonacci level at $59 for a test.

Figure 1:

Source: FOREX.com. Please note, this product is not available to US clients

Figure 2:

Source: FOREX.com. Please note, this product is not available to US clients

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.